Having seen firsthand how the research sausage gets made, Next TV has a lot of respect for Samba TV and the data it pulls from "tens of millions" of smart TV users who have voluntarily, it claims, "opted in" to its data collection panel.

And having been decidedly underwhelmed by the myriad "research" reports that tell us which programming genres are hot in streaming right now, we approached Samba TV's second-half of 2023 "The State of Viewership" report with a bit of shock and awe. (You can access the whole 43-page kitchen sink here, which we encourage.)

In the interest of brevity -- and our own cerebral processing limitation -- here are five pages from the report that stood out for us:

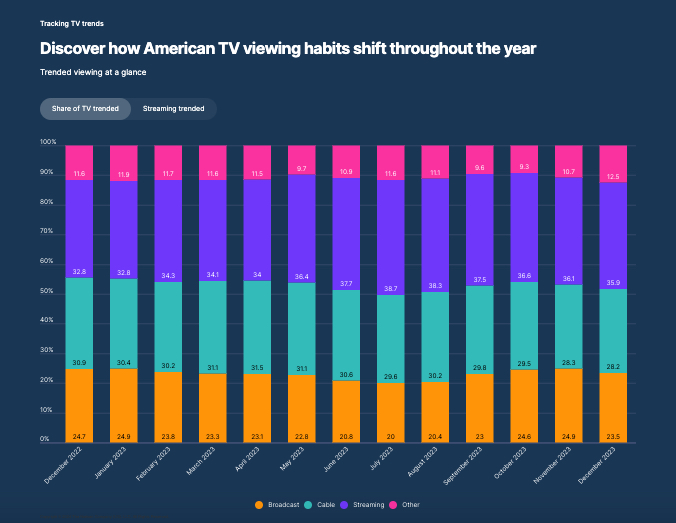

The Hollywood Strikes Really Did a Number on Broadcast and Cable TV Usage

It's interesting that Netflix can acquire the umteenth SVOD window for a 10-year-old Brad Pitt war movie, Fury, from Sony Pictures Entertainment and merchandise the film to deliver 7.3 million streaming hours last week.

Netflix's top executives were a pivotal negotiators amid the paralyzing, summer-long Hollywood talent guild strikes. But as Fury showed, Netflix can make its tank go, regardless of the supply chain adversity.

The linear broadcast and cable networks? Not so much.

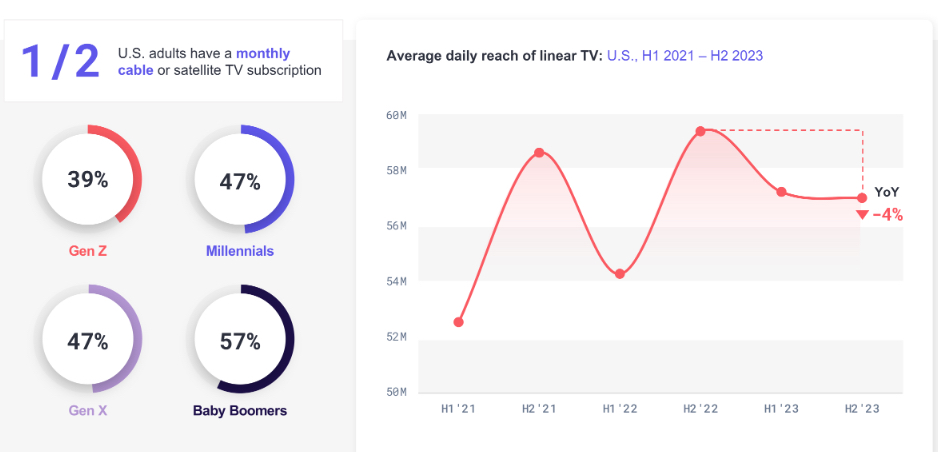

As this Samba TV graphic shows, broadcasters and "cablers" typically get a nice reach bump in the second half of the year, with viewers not only tuning in for football, but the new fall shows.

In the second half of 2023, not only was part of football streaming on Amazon Prime Video on Thursday nights, as well as on YouTube on Sunday, but there were no "fall season" to check out.

Data from Nielsen seems to corroborate Samba TV's findings. Linear market share didn't expand like it normally would in the second half of the year.

Also notable to us: Less than 60% Baby Boomers, linear TV's biggest audience, have a cable or satellite TV subscription right now.

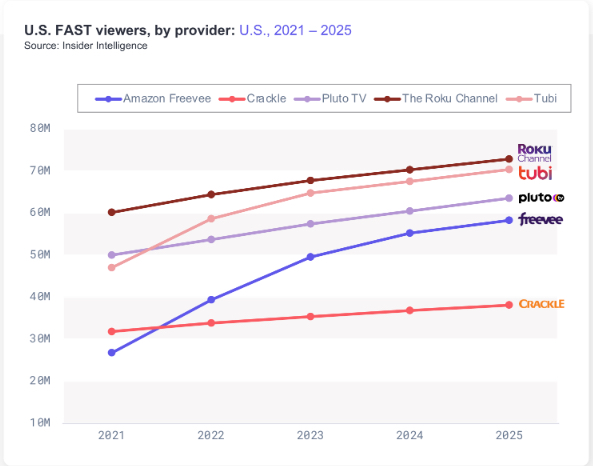

Roku Channel is the No. FAST

Based on Insider Intelligence data, Samba TV ranks Roku Channel as the most popular FAST platform, ahead of Tubi, Pluto TV, Amazon Freevee and Crackle.

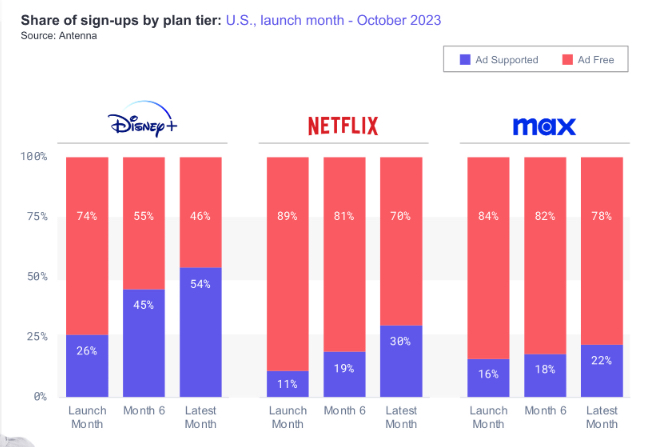

Disney Plus Is Now Mostly an Ad-Supported Service

As of October, 53% of signups for Disney Plus were for the service's ad-supported plan. That figure compares to 39% for Netflix and 22% for Max.

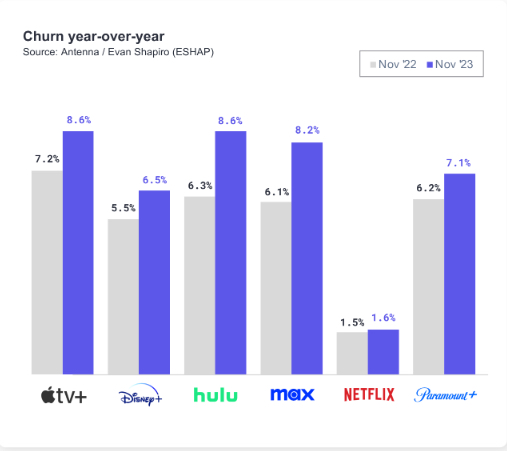

Hulu and Max Experienced the Highest YoY Churn Increase

Amid a competitive market or U.S. subscription streaming, in which every provider raised prices in 2023, Hulu and Max experienced the largest increases in churn.

"Audiences continue to limit the number of services they will subscribe to in order to keep costs down," Samba TV said in its report. "In fact, about half (46%) of U.S. households watched tow or less services throughout the second half of 2023. Subscription cycling is a way of live, as every platform saw churn increase year-over-year and about half of Gen Z indicating that they plan to cycle through subcriptions with the next six months."

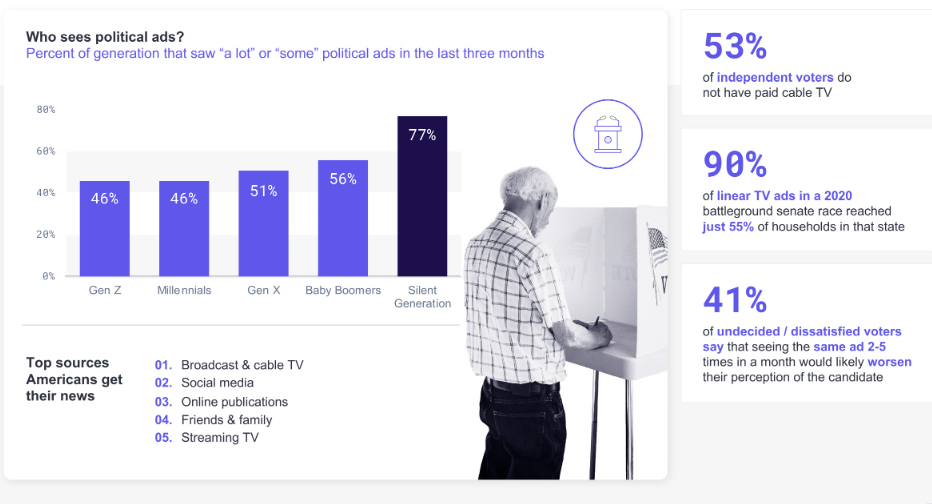

Political Ads Aren't Reaching Their Targets

While political ads are reaching 77% of the "Silent Generation," younger folks, who consumer more connected TV and less linear, aren't getting the same exposure, Samba TV notes.

Advertising 101 suggests that younger demographic groups are targeted because, well, they are more impressionable and haven't made their minds up as much.

Understanding these consumption dynamics might be key in an election year, no?