Half of Gen Zs and Millennials say they live paycheck to paycheck and are taking on side hustles to make ends meet. Jourdan Skirha from Arizona is one of them.

Recently, the 29-year-old woman uploaded a video to her social media about her three jobs not being enough to carry her out of financial hardship.

In it, Jourdan vents about her situation and asks others if it’s just her, or if they are struggling as well. The candid no-BS clip quickly spread all over the internet, igniting a discussion on the current cost of living and money management.

More info: jourdanskirha.com | Instagram | TikTok | X

After years of inflation, US consumers are shouldering a burden unlike anything seen in decades

Image credits: Ahsanjaya / Pexels (not the actual photo)

29-year-old Jourdan Skirha has grown sick and tired of it

“Does anyone else feel like they’re absolutely drowning financially?”

“As a single 29-year-old woman, I have three jobs and I’m still struggling. I’m just getting myself farther and farther into credit card debt because I don’t have enough after the first of the month to avoid using it.”

Image credits: jourdskir

“It just isn’t working. Full-time job – not doing it, got a second job, it’s barely doing it. The third job – hit or miss.”

“I feel like I’m drowning and I don’t know what to do. I don’t know if any industry is doing well right now.”

Image credits: jourdskir

“I used to be a server, I used to have all cash every night, whenever I would work, walk out with cash. And I don’t have that anymore, and I don’t even know if they’re doing okay.”

“I have seriously considered quitting my full-time good job to go back to serving because at least I can use my personality and try to get more money. Minimum wage or what an entry-level job pays people nowadays is sick.”

Image credits: jourdskir

“Do I just find a boyfriend so I can split everything with him? Sorry, I’m too stubborn and I just want what I want, and I just can’t do that or be that way.”

“So yeah, friends, I might say no to your weddings, I might say and I have said no to bachelorette parties, I just can’t.”

Image credits: jourdskir

“Is there anyone else? Or am I just dumb with money?”

“I used to not be, my credit used to be phenomenal. Credit card bill? Paid it all off every single time. It’s not like that, it can’t be like that anymore.”

Jourdan’s video has since gone viral

@jourdskir I just want to know if any other single millenials are in the same boat as me or if im the huge problem.♬ original sound – jourdan.skirha

Image credits: Felipe Cespedes / Pexels (not the actual photo)

And she’s definitely onto something; it’s often more expensive to live alone than in a two-person household

There currently are 117.6 million American adults who are unmarried, divorced, or widowed, and they account for 46% of the population, according to U.S. Census Bureau data.

That number has been growing slowly but steadily since the 1960s. But as more adults are finding themselves single for longer, many, just like Jourdan, are getting crushed by the total weight of living expenses, which have also continued to grow in recent years.

Yes, dollar for dollar, a one-person household is cheaper; there’s only one mouth to feed and the home only needs to have enough space for one body. But when you add it everything up, maintaining a single-person household doesn’t cost exactly half of a two-person household.

Take South Carolina, for example, which falls roughly in the middle of all states in terms of cost of living, according to the Missouri Economic Research and Information Center.

Here’s the cost of a year’s worth of typical expenses before taxes, including necessities such as food, housing, medical care, transportation, and more, in South Carolina, according to estimates from the Massachusetts Institute of Technology:

- Single-person household: $29,880 a year

- Two-person household: $47,483 a year

If the two-person household would split costs down the middle, each should contribute about $23,742 per year, whereas someone living on their own would need to cover that much plus an additional $6,138.

The biggest factor is housing. Single people often have to choose between getting a roommate or covering the entire cost of a house or apartment by themselves.

Image credits: Emma Bauso / Pexels (not the actual photo)

Marriage has financial benefits

But even if individuals earn a high income and keep their living costs low, according to Monique Morrissey, senior economist at the Economic Policy, financial advantages for married couples are written right into the law.

“It used to be that the tax brackets were structured in such a way that if two people were earning money and then they combine their incomes, they would pay more taxes after they were married,” Morrissey told CNBC, alluding to what’s known as the marriage tax penalty or bonus.

Before the Tax Cuts and Jobs Act of 2017, married couples were more likely to face what’s known as a “marriage tax penalty,” which is when a couple combined their incomes and entered a higher tax bracket. But except for some states and among ultra-high-income earners, the penalty was mostly eliminated under the 2017 reform.

It became easier for married couples — again, aside from those in the highest tax bracket — to get a tax bonus after the Tax Cuts and Jobs Act. (The “marriage tax bonus” occurs when couples pay less in income taxes when they file jointly than they would have as individuals.)

Image credits: Karolina Grabowska / Pexels (not the actual photo)

Jourdan isn’t alone

Young adults, burdened by financial struggles, are now living with their folks at a higher rate than people of their age did five decades ago.

The proportion of young adults who live in a parent’s home more than doubled between 1971 and 2021, from 8% to 17%, according to a recent Pew Research report.

That’s largely because young adults face rising student debt and housing costs.

After adjusting for inflation, the cost of college tuition, fees, room, and board has more than doubled since the 1971-72 school year, according to data from the College Board.

Because of this, millions have been saddled with student debt that they struggle to pay off after graduating, forcing many to postpone or abandon their hopes of purchasing a home or starting a family.

The median price of a home in the second quarter of 1972 was just $26,800, according to the U.S. Census Bureau, amounting to roughly $189,500 in current dollars. Since then, home prices have climbed 132%.

No wonder Jourdan’s confession has been viewed 2.9 million times and liked by 363.6K people. Her problem is a universal one.

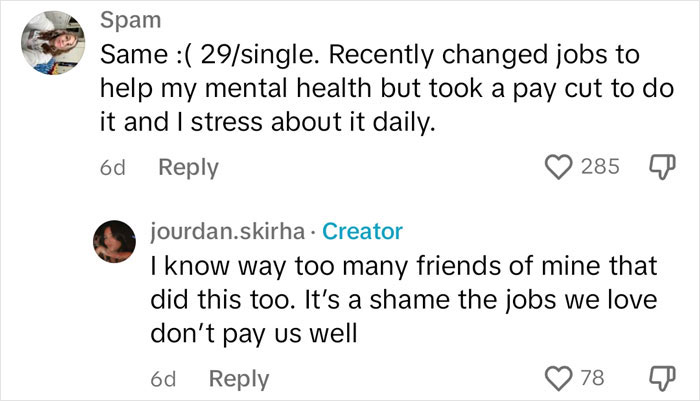

People have been responding to her video

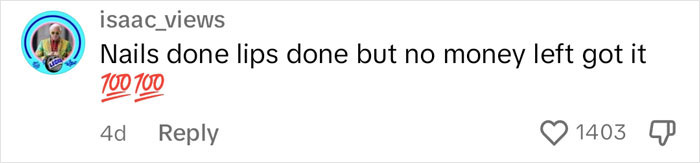

Some tried criticizing her

But their comments were buried under reactions from those who feel the same way as the woman