During the last three months, 10 analysts shared their evaluations of FTAI Aviation (NASDAQ:FTAI), revealing diverse outlooks from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 5 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 3 | 3 | 0 | 0 | 0 |

| 3M Ago | 2 | 1 | 0 | 0 | 0 |

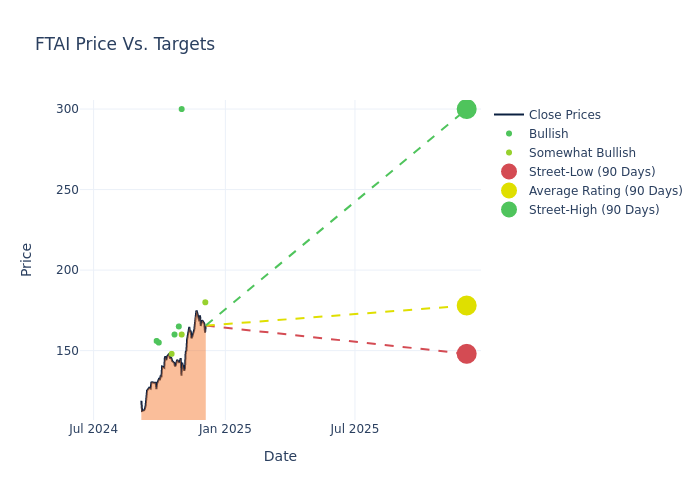

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $170.2, along with a high estimate of $300.00 and a low estimate of $135.00. This upward trend is apparent, with the current average reflecting a 27.78% increase from the previous average price target of $133.20.

Understanding Analyst Ratings: A Comprehensive Breakdown

In examining recent analyst actions, we gain insights into how financial experts perceive FTAI Aviation. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brandon Oglenski | Barclays | Raises | Overweight | $180.00 | $135.00 |

| Josh Sullivan | Benchmark | Raises | Buy | $300.00 | $150.00 |

| Ken Herbert | RBC Capital | Maintains | Outperform | $160.00 | $160.00 |

| Brandon Oglenski | Barclays | Raises | Overweight | $135.00 | $110.00 |

| Christian Wetherbee | Citigroup | Raises | Buy | $165.00 | $134.00 |

| Hillary Cacanando | Deutsche Bank | Raises | Buy | $160.00 | $125.00 |

| Kristine Liwag | Morgan Stanley | Raises | Overweight | $148.00 | $140.00 |

| Devin Ryan | Jefferies | Raises | Buy | $155.00 | $140.00 |

| Giuliano Bologna | Compass Point | Raises | Buy | $156.00 | $118.00 |

| Ken Herbert | RBC Capital | Raises | Outperform | $143.00 | $120.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to FTAI Aviation. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of FTAI Aviation compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of FTAI Aviation's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into FTAI Aviation's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on FTAI Aviation analyst ratings.

Discovering FTAI Aviation: A Closer Look

FTAI Aviation Ltd is a aerospace company .It owns and maintains commercial jet engines with a focus on CFM56 engines. FTAI owns and leases jet aircraft which often facilitates the acquisition of engines at attractive prices. It invests in aviation assets and aerospace products that generate strong and stable cash flows with the potential for earnings growth and asset appreciation.

Key Indicators: FTAI Aviation's Financial Health

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Positive Revenue Trend: Examining FTAI Aviation's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 60.01% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: FTAI Aviation's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 16.78% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 83.23%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): FTAI Aviation's ROA stands out, surpassing industry averages. With an impressive ROA of 2.17%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: FTAI Aviation's debt-to-equity ratio is notably higher than the industry average. With a ratio of 27.19, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: What Are They?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.