Portsmouth, New Hampshire-based Iron Mountain Incorporated (IRM) is an information management services company that helps organizations store, protect, and manage physical and digital information throughout its lifecycle. Valued at a market cap of $27.1 billion, the company is ready to announce its fiscal Q4 earnings for 2025 in the near future.

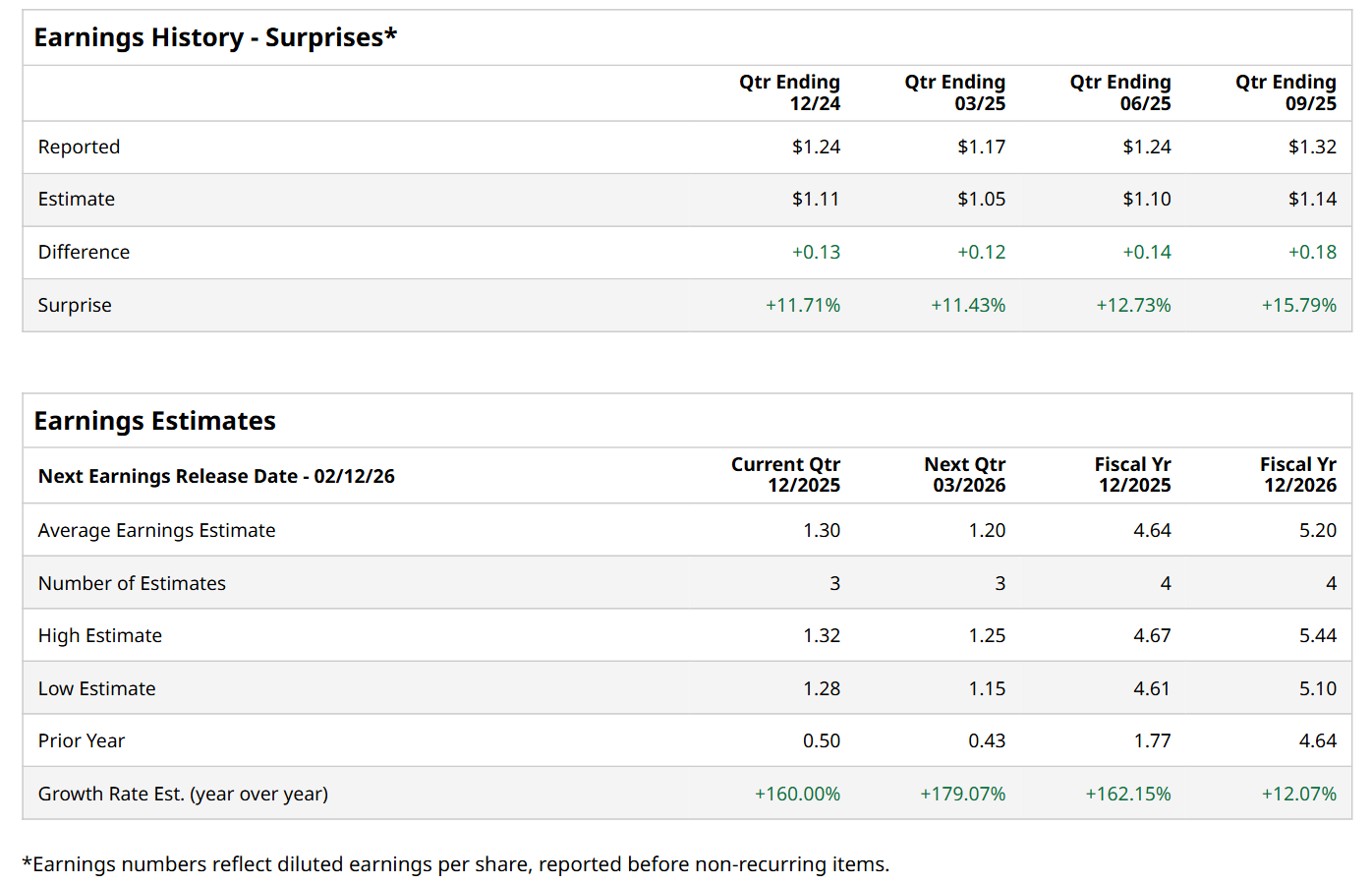

Before this event, analysts expect this specialty REIT to report a profit of $1.30 per share, up 160% from $0.50 per share in the year-ago quarter. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. Its FFO of $1.32 per share in the previous quarter exceeded the consensus estimates by 15.8%.

For the current fiscal year, ending in December, analysts expect IRM to report an FFO of $4.64 per share, up 162.2% from $1.77 per share in fiscal 2024. Its FFO is expected to further grow 12.1% year-over-year to $5.20 in fiscal 2026.

IRM has declined 12% over the past 52 weeks, considerably lagging behind both the S&P 500 Index's ($SPX) 18.6% return and the State Street Real Estate Select Sector SPDR ETF’s (XLRE) 3.4% uptick over the same time period.

On Nov. 19, shares of IRM declined 2.9%, followed by a further 4.3% drop in the next trading session after short-seller Gotham City Research revealed a short position and published a bearish report on the company. Gotham argued that IRM’s stock is materially overvalued relative to its underlying fundamentals, estimating fair value at just $22–$40 per share, well below prevailing levels. The report also challenged the durability of Iron Mountain’s growth strategy and highlighted concerns around leverage and cash-flow quality, increasing investor caution and weighing on the stock.

Wall Street analysts are moderately optimistic about IRM’s stock, with an overall "Moderate Buy" rating. Among 11 analysts covering the stock, eight recommend "Strong Buy," one indicates a "Moderate Buy,” one suggests a "Hold,” and one advises a “Strong Sell” rating. The mean price target for IRM is $116.40, indicating a 27.2% potential upside from the current levels.