/Abbott%20Laboratories%20logo-by%20360b%20via%20Shutterstock.jpg)

Valued at a market cap of $217 billion, Abbott Laboratories (ABT) is a healthcare company that develops, manufactures, and sells a broad range of medical devices, diagnostics, nutrition products, and branded generic pharmaceuticals. The North Chicago, Illinois-based company is expected to announce its fiscal Q4 earnings for 2025 in the near future.

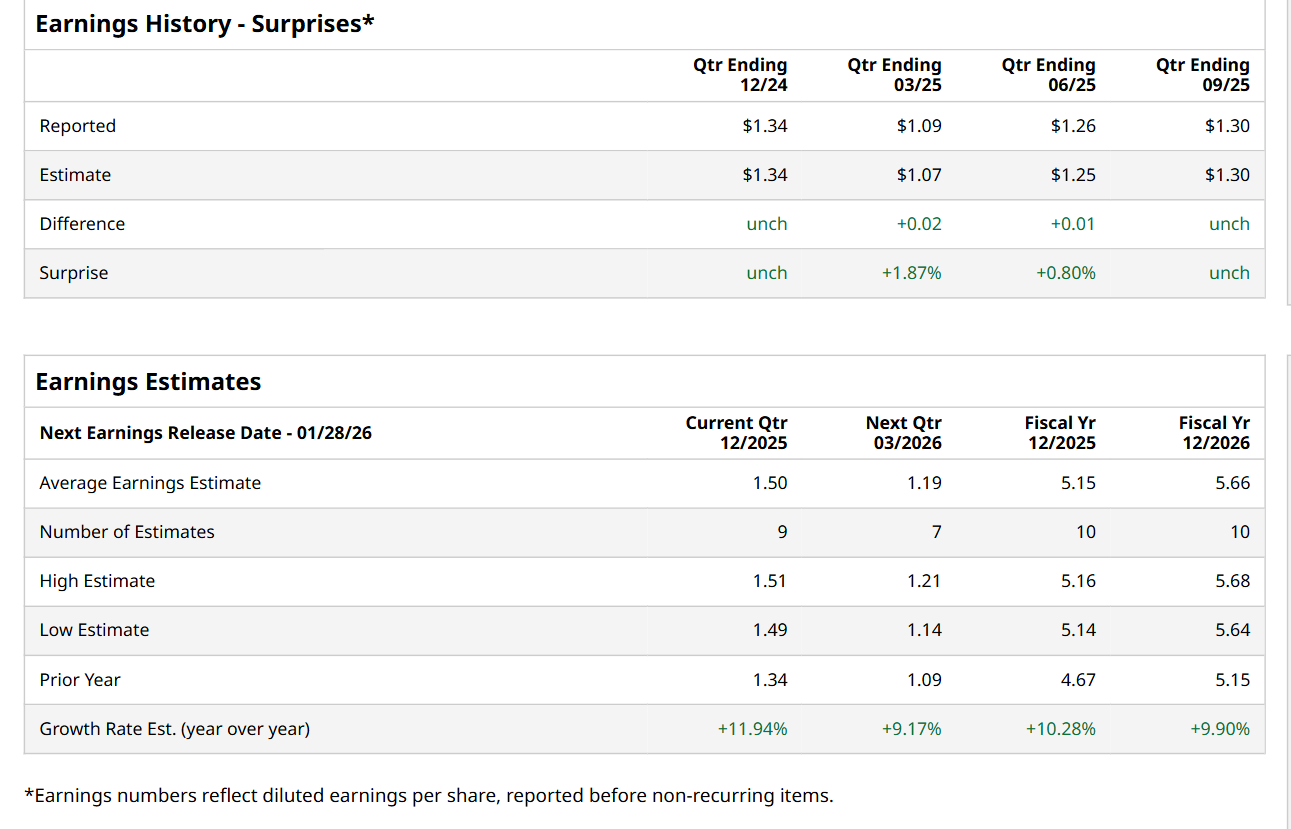

Ahead of this event, analysts expect this healthcare company to report a profit of $1.50 per share, up 11.9% from $1.34 per share in the year-ago quarter. The company has met or surpassed Wall Street’s bottom-line estimates in each of the last four quarters. In Q3, ABT’s EPS of $1.30 came in line with the forecasted figure.

For the current fiscal year, ending in December, analysts expect ABT to report a profit of $5.15 per share, up 10.3% from $4.67 per share in fiscal 2024. Furthermore, its EPS is expected to grow 9.9% year-over-year to $5.66 in fiscal 2026.

Shares of ABT have gained 8.8% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 14.8% return and the State Street Health Care Select Sector SPDR ETF’s (XLV) 11.8% uptick over the same time period.

On Oct. 15, shares of ABT plunged 2.9% after posting mixed Q3 earnings results. The company’s net sales improved 6.9% year-over-year to $11.4 billion, but missed the consensus estimates by a slight margin, mainly due to a decline in the diagnostic products segment revenue. Nonetheless, on the brighter side, its adjusted EPS of $1.30 increased 7.4% from the year-ago quarter and met analyst expectations.

Wall Street analysts are highly optimistic about ABT’s stock, with an overall "Strong Buy" rating. Among 27 analysts covering the stock, 19 recommend "Strong Buy," two indicate "Moderate Buy,” and six suggest "Hold.” The mean price target for ABT is $146.69, indicating a 17.5% potential upside from the current levels.