/W_R_%20Berkley%20Corp_%20phone%20and%20site-by%20T_Schnedier%20via%20Shutterstock.jpg)

Greenwich, Connecticut-based W. R. Berkley Corporation (WRB) is a commercial property and casualty insurance company. Valued at a market cap of $26.7 billion, the company is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

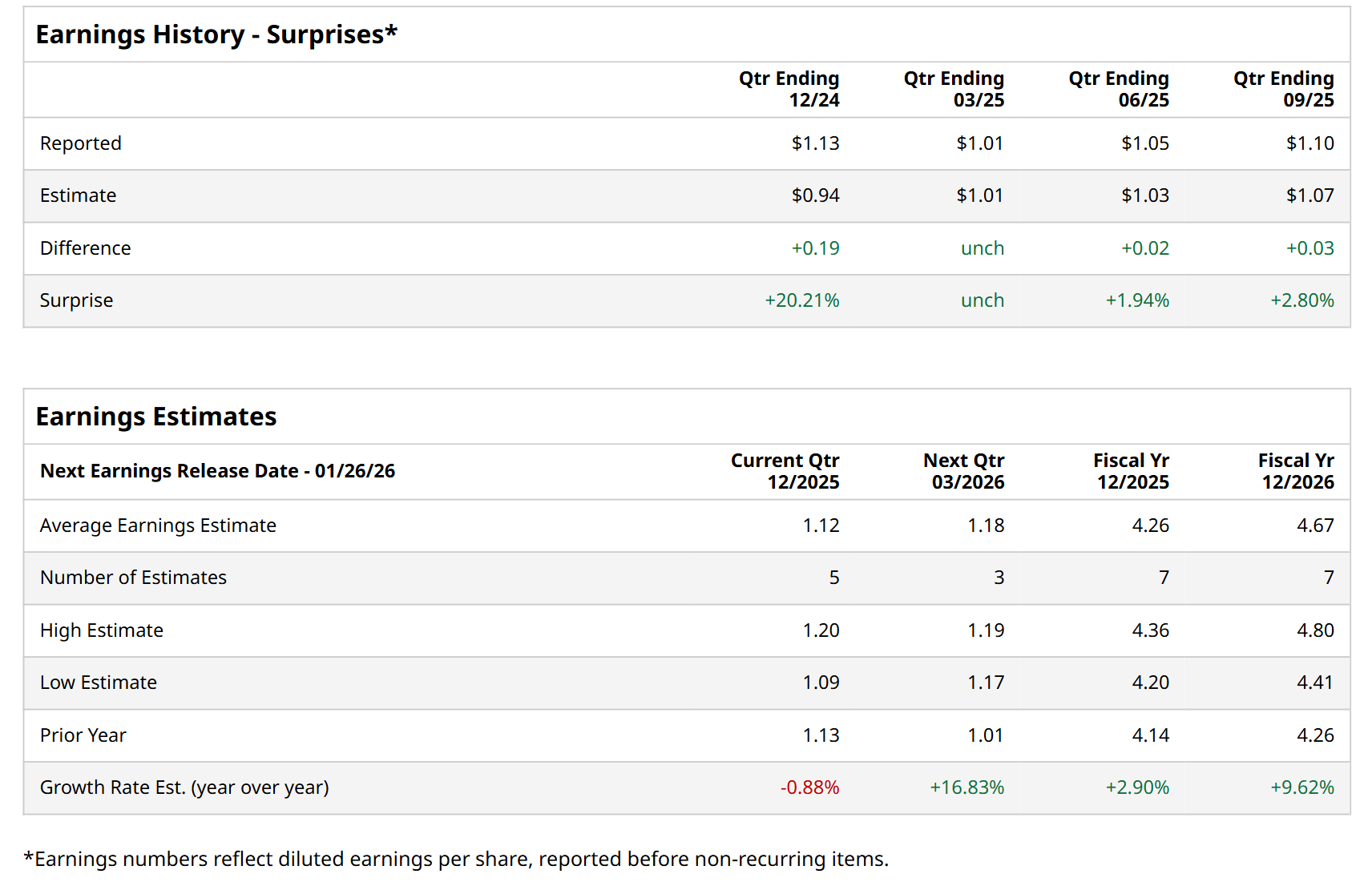

Before this event, analysts expect this insurance company to report a profit of $1.12 per share, down marginally from $1.13 per share in the year-ago quarter. The company has met or surpassed Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $1.10 per share in the previous quarter exceeded the forecasted figure by 2.8%.

For the current fiscal year, ending in December, analysts expect WRB to report a profit of $4.26 per share, up 2.9% from $4.14 per share in fiscal 2024. Its EPS is expected to further grow 9.6% year-over-year to $4.67 in fiscal 2026.

Shares of WRB have surged 19.7% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 14.4% return and the State Street Financial Select Sector SPDR ETF’s (XLF) 13.2% uptick over the same time period.

On Oct. 20, shares of WRB closed down marginally after its Q3 earnings release. The company’s total revenue increased 10.8% year-over-year to $3.8 billion, topping analyst estimates by 1.6%. Meanwhile, its operating income per share came in at $1.10, up 12.2% from the year-ago quarter and in line with Wall Street expectations.

Wall Street analysts are cautious about WRB’s stock, with an overall “Hold" rating. Among 20 analysts covering the stock, five recommend "Strong Buy," 13 indicate "Hold,” and two suggest "Strong Sell.” The mean price target for WRB is $74.59, indicating a 5.8% potential upside from the current levels