/Snap-on%2C%20Inc_%20logo%20on%20building%20by-Michael%20Vi%20via%20Shutterstock.jpg)

With a market cap of $18.4 billion, Snap-on Incorporated (SNA) is a prominent manufacturer and distributor of premium tools, equipment, diagnostics, and repair information solutions primarily for professional users in the automotive, aerospace, aviation, and industrial markets. Founded in 1920 and headquartered in Kenosha, Wisconsin, the company is known for its high-quality, mission-critical products and strong brand loyalty among technicians.

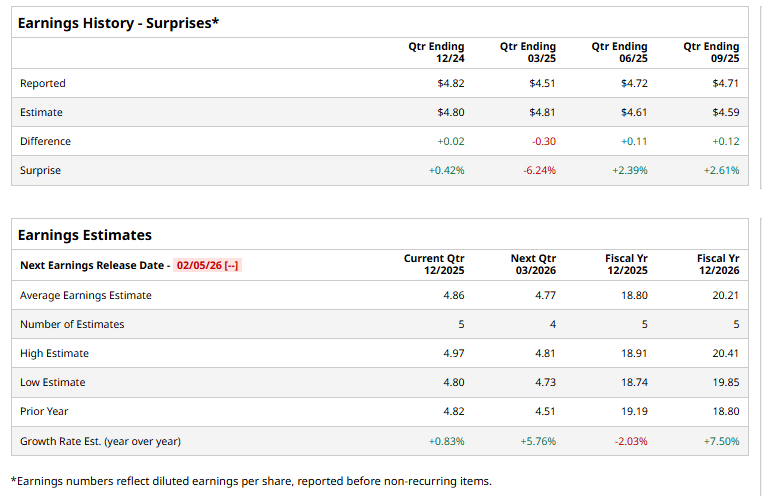

The industrial giant is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts expect Snap-on to report an EPS of $4.86, a marginal rise from $4.82 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts predict SNA to report an EPS of $18.80, a 2% decrease from $19.19 in fiscal 2024. However, EPS is anticipated to grow 7.5% year over year to $20.21 in fiscal 2026.

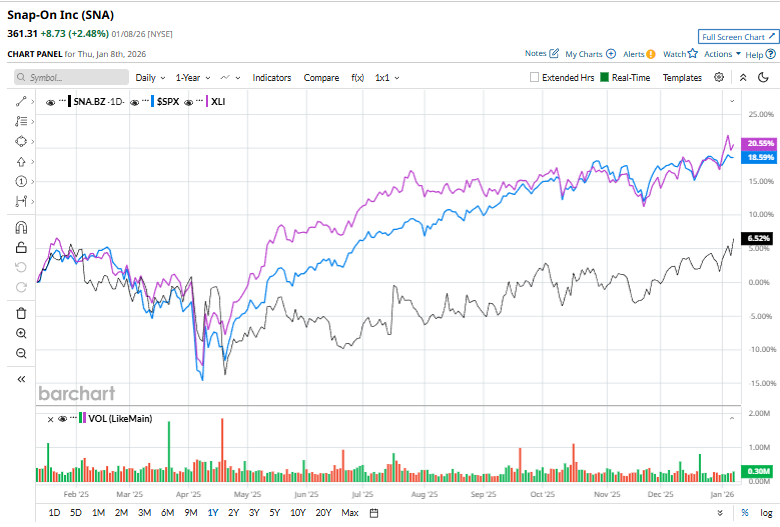

Shares of Snap-on have returned 7.3% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 17% gain and the Industrial Select Sector SPDR Fund's (XLI) 20.6% rise over the same period.

Snap-on has lagged the broader market over the past year primarily due to slower end-market demand and cyclical pressures in key end markets, such as automotive repair and industrial activity. Elevated inventory levels in parts of its dealer and distribution channels weighed on sales momentum, and customers have been cautious in tool and equipment purchases amid economic uncertainty. Additionally, investor concerns around decelerating revenue growth, margin compression from cost pressures, and less visibility on near-term earnings have dampened sentiment relative to broader market indexes.

Nevertheless, analysts' consensus view on SNA stock is moderately optimistic, with a "Moderate Buy" rating overall. Among 10 analysts covering the stock, three suggest a "Strong Buy," one gives a "Moderate Buy," five recommend a "Hold," and one has a "Moderate Sell." The average analyst price target for Snap-on is $365.29, which implies a premium of 1.1% from the current levels.