/Deere%20%26%20Co_%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $139.3 billion, Deere & Company (DE) is a global manufacturer and distributor of agricultural, turf, construction, and forestry equipment, operating through four segments: Production and Precision Agriculture, Small Agriculture and Turf, Construction and Forestry, and Financial Services. It also provides financing, leasing, and warranty services to support equipment sales worldwide.

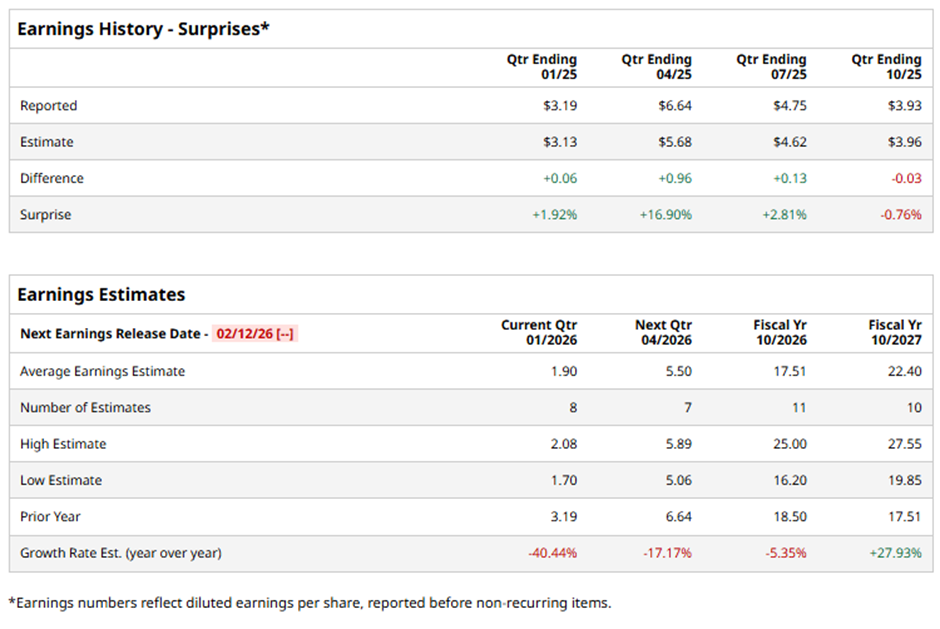

The Moline, Illinois-based company is expected to release its fiscal Q1 2026 results soon. Ahead of this event, analysts project DE to report an adjusted EPS of $1.90, a decrease of 40.4% from $3.19 in the year-ago quarter. It has exceeded Wall Street's bottom-line estimates in three of the last four quarterly reports while missing on another occasion.

For fiscal 2026, analysts forecast the agricultural equipment manufacturer to report adjusted EPS of $17.51, down 5.4% from $18.50 in fiscal 2025. However, adjusted EPS is expected to surge 27.9% year-over-year to $22.40 in fiscal 2027.

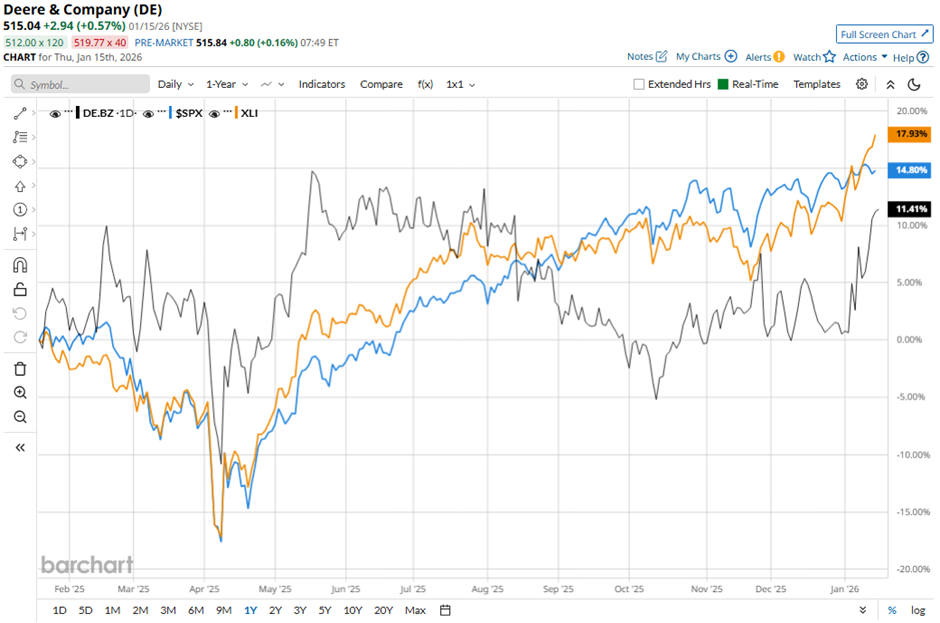

Shares of Deere & Company have risen 16.8% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) nearly 17% gain and the State Street Industrial Select Sector SPDR ETF's (XLI) 21.5% return over the same time frame.

Despite reporting better-than-expected Q4 2025 net sales of $10.58 billion, Deere’s shares fell 5.7% on Nov. 26 as the company posted EPS of $3.93, which fell short of Wall Street expectations. The stock was further pressured by Deere’s warning of a $1.2 billion pre-tax tariff hit in fiscal 2026 and its forecast of $4 billion - $4.75 billion in annual net income, well below analysts’ estimates. The selloff was also driven by weaker margins on large tractors, soft demand due to lower crop prices and higher production costs.

Analysts' consensus view on DE stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 24 analysts covering the stock, 11 suggest a "Strong Buy," two give a "Moderate Buy," and 11 recommend a "Hold." The average analyst price target for Deere & Company is $526.48, suggesting a potential upside of 2.2% from current levels.