Valued at a market cap of $28.2 billion, Extra Space Storage Inc. (EXR) is a real estate investment trust (REIT) that specialises in self-storage facilities. The Salt Lake City, Utah-based company offers a wide range of storage solutions, including climate-controlled units, drive-up access units, lockers, as well as vehicle, boat and RV storage.

This industrial REIT has considerably underperformed the broader market over the past 52 weeks. Shares of EXR have declined 20.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 13.7%. Moreover, on a YTD basis, the stock is down 12.7%, compared to SPX’s 13.4% uptick.

Narrowing the focus, EXR has also lagged behind the Real Estate Select Sector SPDR Fund’s (XLRE) 5.4% drop over the past 52 weeks and marginal YTD rise.

On Oct. 29, EXR delivered mixed Q3 results, and its shares plunged 4.9% in the following trading session. On the upside, the company’s core FFO of $2.08 increased marginally from the year-ago quarter and surpassed the consensus estimates of $2.06. However, its total revenue improved 4.1% year-over-year to $858.5 million, but missed analyst expectations by a slight margin, dampening investor confidence.

For the current fiscal year, ending in December, analysts expect EXR’s FFO to decline 10.5% year over year to $8.16. The company’s FFO surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

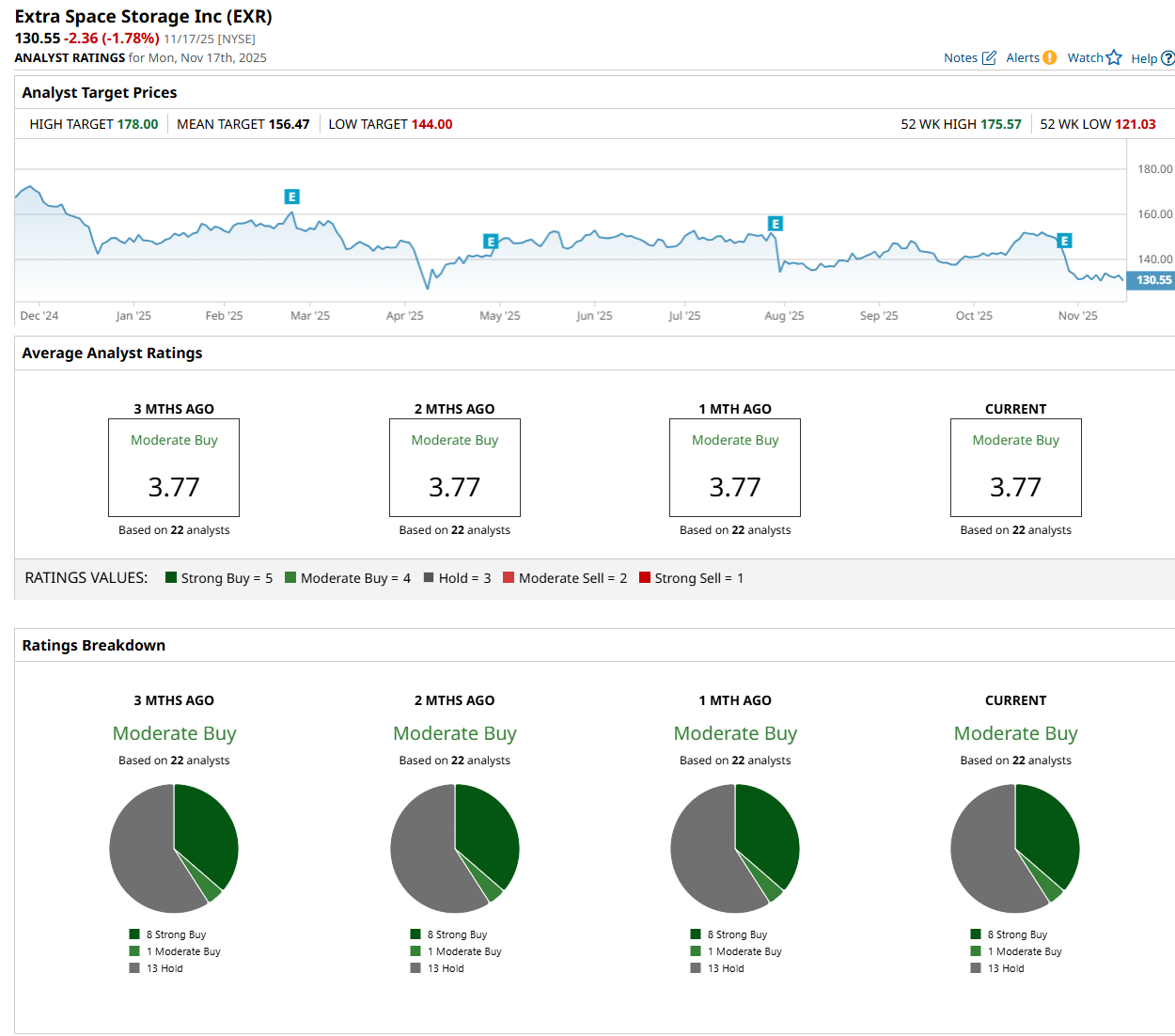

Among the 22 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on eight “Strong Buy,” one "Moderate Buy,” and 13 "Hold” ratings.

This configuration has remained consistent over the past three months.

On Nov. 11, Barclays PLC (BCS) analyst Brendan Lynch maintained a "Buy" rating on EXR and set a price target of $169, indicating a 29.5% potential upside from the current levels.

The mean price target of $156.47 represents a 19.9% premium from EXR’s current price levels, while the Street-high price target of $178 suggests a 36.3% potential upside from the current levels.