Houston, Texas-based Camden Property Trust (CPT) owns, manages, develops, repositions, redevelops, acquires, and constructs multifamily apartment communities. Valued at $11.5 billion by market cap, it owns and operates 172 properties containing 58,250 apartment homes across the U.S.

Shares of this leading apartment REIT have underperformed the broader market considerably over the past year. CPT has declined 9.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.6%. In 2026, CPT stock is down 2%, compared to the SPX’s 1.7% rise on a YTD basis.

Narrowing the focus, CPT has also lagged behind the Residential REIT ETF (HAUS). The exchange-traded fund has declined about 3.5% over the past year. Moreover, the ETF’s 2.2% returns on a YTD basis outshine the stock’s losses over the same time frame.

On Feb. 5, CPT shares closed down by 2% after reporting its Q4 results. Its FFO of$1.76 per share surpassing Wall Street expectations of $1.73 per share. The company’s revenue was $390.8 million, missing Wall Street forecasts of $394.6 million. CPT expects full-year FFO in the range of $6.60 to $6.90 per share.

For the current fiscal year, ending in December, analysts expect CPT’s FFO per share to decline marginally to $6.84 on a diluted basis. The company’s FFO surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

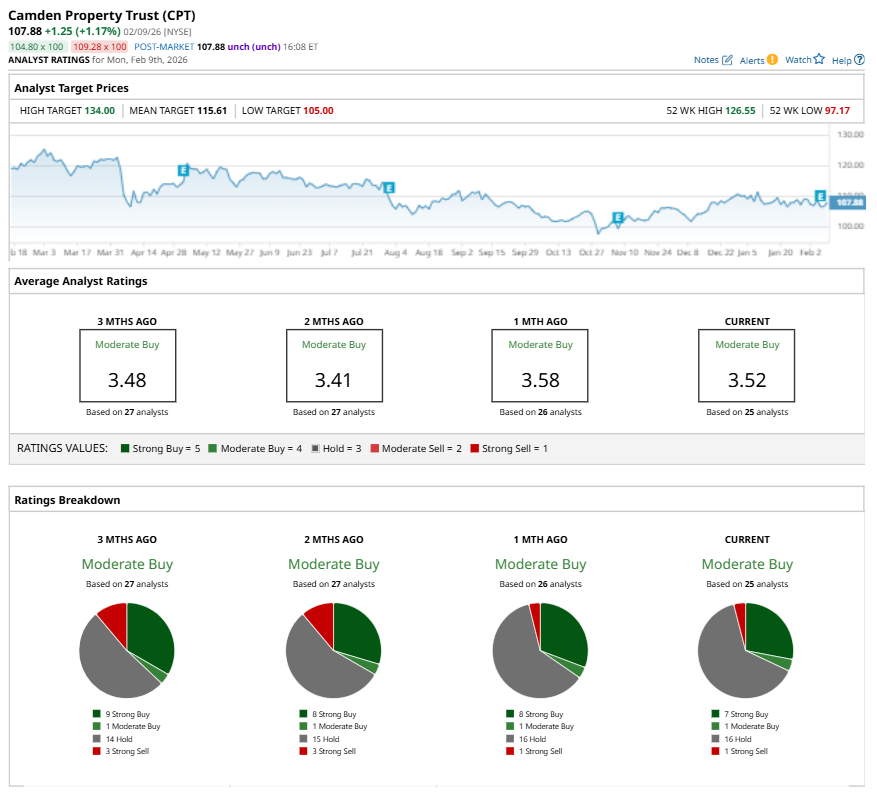

Among the 25 analysts covering CPT stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, one “Moderate Buy,” 16 “Holds,” and one “Strong Sell.”

This configuration is less bullish than a month ago, with eight analysts suggesting a “Strong Buy.”

On Feb. 6, Colliers Securities analyst Barry Oxford maintained a “Buy” rating on CPT and set a price target of $125, implying a potential upside of 15.9% from current levels.

The mean price target of $115.61 represents a 7.2% premium to CPT’s current price levels. The Street-high price target of $134 suggests an upside potential of 24.2%.