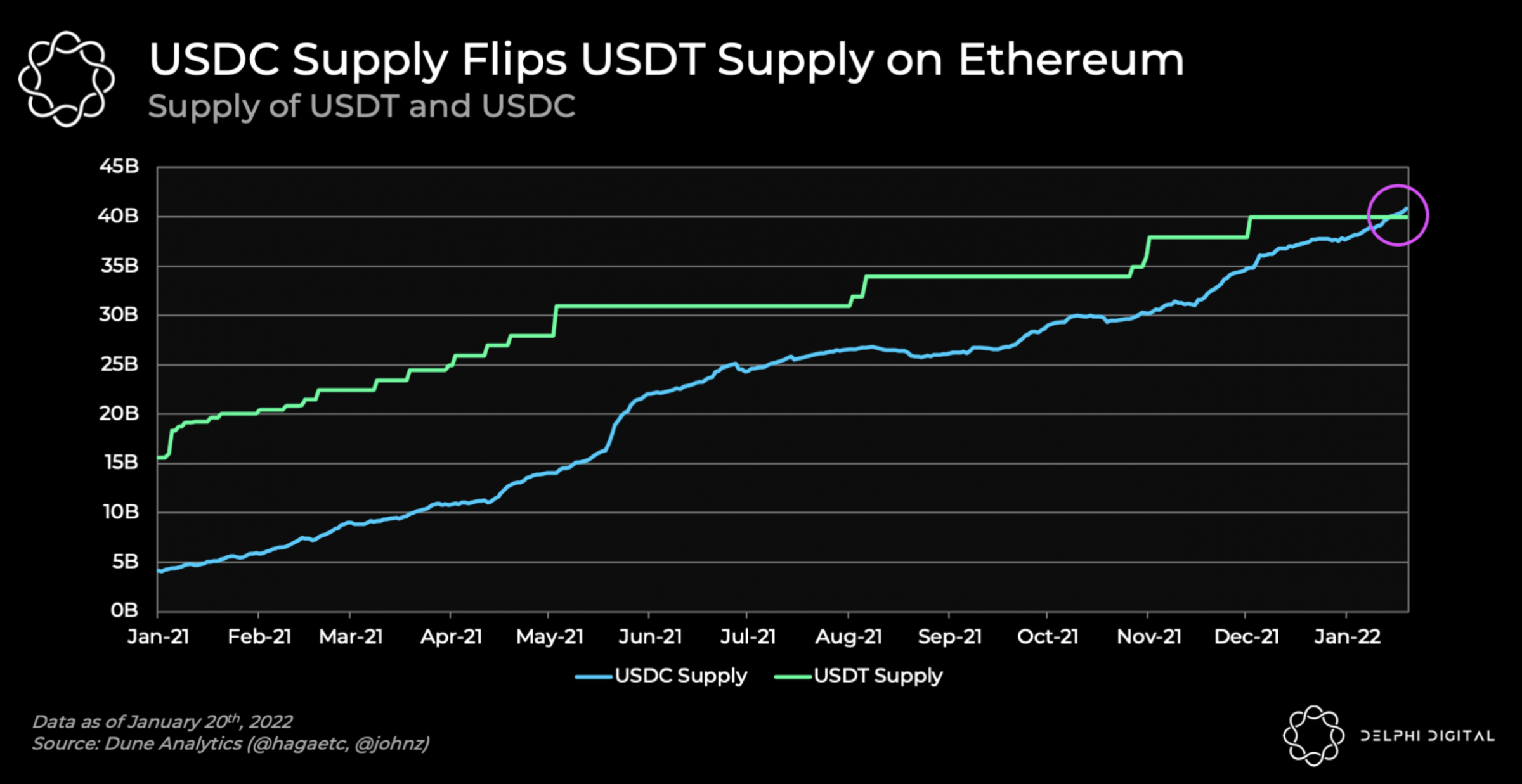

USD Coin (USDC) has emerged as the most popular stablecoin on the Ethereum (CRYPTO: ETH) ecosystem.

What Happened: USD Coin, managed by the Centre consortium — which was founded by Circle and includes members such as Binance and Coinbase Global Inc (NYSE:COIN) — has risen in popularity compared with Tether (USDT), according to Delphi Digital, an independent research firm.

Tether’s tokens are issued by Tether Limited, which is controlled by the owners of Bitfinex.

“For the most part, USDC’s goodwill in the Ethereum ecosystem has been driven by uncertainty around Tether and how it holds its reserves,” wrote Delphi Digital, in a note seen by Benzinga.

See Also: How To Buy Ethereum (ETH)

Why It Matters: USD Coin says that its tokens are mostly backed by cash and cash equivalents as well as short-term treasury bills, while 44% of Tether tokens backing is held in commercial paper, according to Delphi Digital.

“On the surface, users might perceive USDC and USDT as susceptible to the same risks (e.g regulation, censorship), but USDT also bears a higher redemption risk than USDC due to the risk profile of its reserves,” noted Delphi Digital.

Last month, the Financial Times ran a scathing story on Tether CEO Jean-Louis van der Velde which tracked his career spanning IT sales in Hong Kong and an “ailing Chinese electronics manufacturer.”

The United Kingdom-based publication also touched on Tether and how it had been fined “tens of millions” of dollars by U.S. regulators this year due to its past disclosures about its reserves.

Tether responded to the story by issuing a statement that read: “rather than focusing on the importance of stablecoins, more specifically Tether and its role within the crypto ecosystem, the questions seem fixed on the hopes of uncovering non-secrets from the past of a successful entrepreneur.”

Read Next: 'New NFT Profile Pic' Trends On Twitter And Takes The Social Media Platform 'Down' With It