The Bank of England has voted against a further cut to interest rates, after the latest UK inflation figures remained stubbornly high.

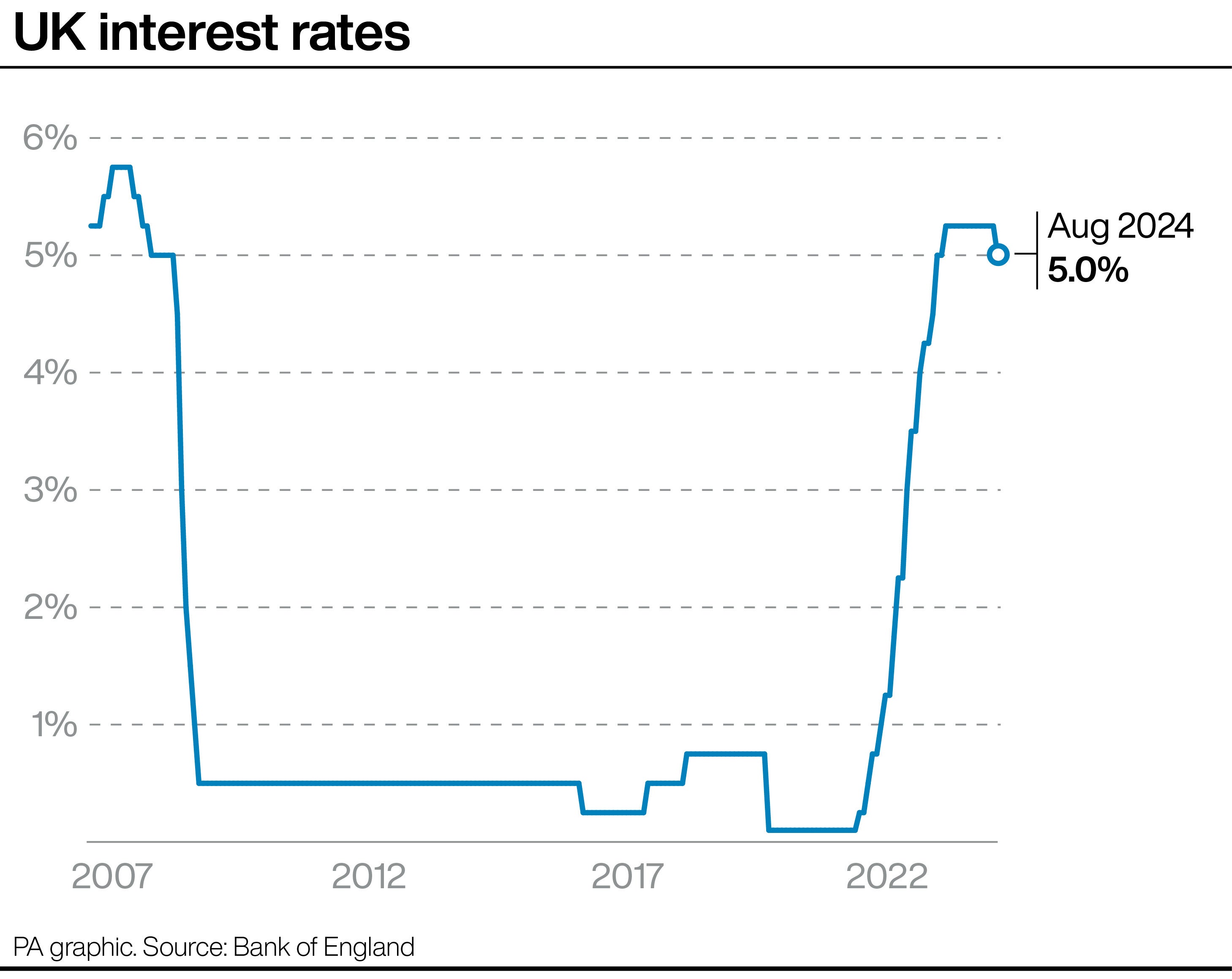

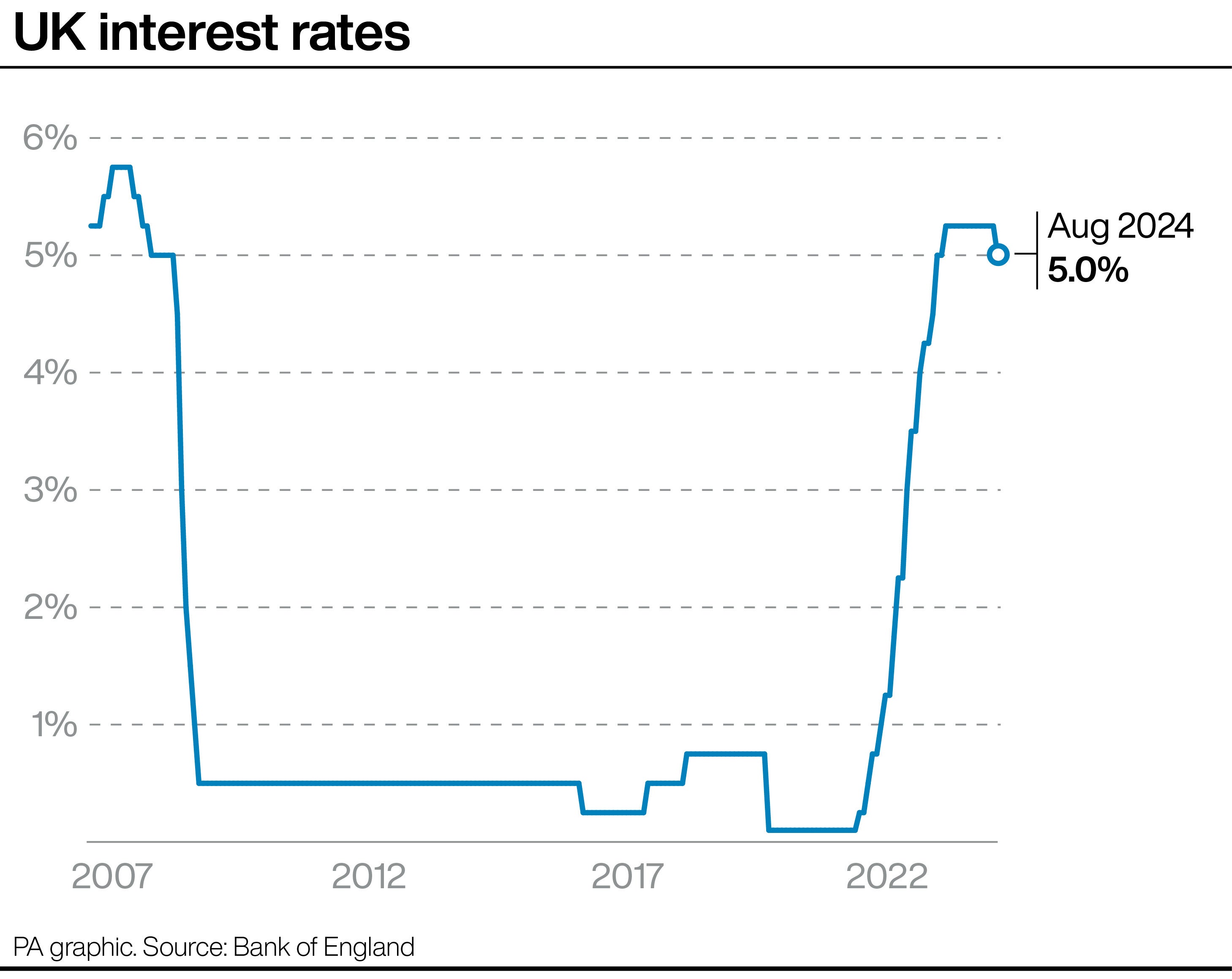

The nine rate-setters on the Bank’s Monetary Policy Committee (MPC) voted 8-1 to keep the base rate unchanged at 5 per cent, a level which – prior to last year – had last been seen in 2008 during the global financial crisis.

The Bank cut rates from 5.25 per cent last month – the first reduction since 2020, in a move welcomed by squeezed borrowers still suffering from the cost-of-living crisis. The move disappointed savers, however.

August’s inflation was unchanged at 2.2 per cent, which was higher than the Bank of England’s 2 per cent target but was below the 2.4 per cent the Bank itself had predicted at this stage.

Keeping the base rate on hold means mortgage repayments are unlikely to change.

The decision comes a day after the US Federal Reserve voted for a shock 0.5 per cent cut to US interest rates, marking the first drop in four years.

Key Points

- Breaking: Bank of England holds base rate at 5%

- How have interest rates changed since the financial crisis?

- US Federal Reserve and ECB both opt for interest rate cuts

Welcome to our live coverage of the Bank of England’s interest-rate decision due to be announced on Thursday.

Bank poised to hold rates at 5%, economists think

Wednesday 18 September 2024 21:45 , Jane DaltonRead more:

Bank of England poised to hold interest rates at 5%, economists say

Glimmer of hope for borrowers

Wednesday 18 September 2024 22:50 , Jane DaltonThe crumb of comfort for hard-pressed borrowers is that there will by ample scope for a cut in November if inflation remains below the Bank’s predicted path, writes James Moore:

How UK interest rates have changed since 2007:

MPC set to put interest rate cuts on hold

Thursday 19 September 2024 01:30 , Jane DaltonThe Bank of England is expected hit the pause button on interest rate cuts after warning it needs to be “careful” not to rush the decision as pressures on inflation linger:

Bank of England set to pause interest rate cuts as ‘cautious tone’ sticks

How inflation has accelerated or eased for everyday items

Thursday 19 September 2024 03:00 , Jane DaltonAugust’s inflation was unchanged at 2.2 per cent, higher than the Bank of England’s 2 per cent target but there was a wide variation in the rate across everyday goods and services.

Examples of how everyday costs changed:

Examples of how inflation has accelerated or eased for everyday items

Savers £4bn better off thanks to higher easy-access rates

Thursday 19 September 2024 04:15 , Jane DaltonSavers are an estimated £4billion better off following improvements to easy-access rates in recent months, according to the City regulator.

The Financial Conduct Authority (FCA) said the average interest paid on easy-access savings accounts increased to 2.11% in June, up from 1.66% in July 2023, just before it published a review.

It said: “We estimate savers are £4 billion a year better off from higher interest rates as a result.”

A new consumer duty was introduced by the regulator last year, requiring financial firms to put consumers at the heart of what they do, including when designing products and communicating with customers.

In July 2023, the FCA also set out a 14-point action plan to ensure banks and building societies were passing on interest rate rises to savers appropriately, that they were communicating with customers more effectively and that they were offering them better savings rate deals.

The FCA said that while interest rates on savings accounts had been rising, this had been happening more slowly for easy-access accounts.

How inflation news spelled blow for borrowers

Thursday 19 September 2024 05:45 , Jane Dalton

Inflation rises to 2.2% for first time this year in blow to interest rate cut hopes

House price growth slows but rents climb at near-record rate

Thursday 19 September 2024 07:00 , Jane DaltonAnnual house price growth has slowed, but private rents continue to climb at a “near-record rate”, according to an Office for National Statistics (ONS) report – as many hard-pressed borrowers know:

Annual house price growth slows but rents climb at near-record rate, says ONS

Good morning

Thursday 19 September 2024 07:08 , Joe MiddletonHi and welcome to our blog covering the Bank of England’s latest decision on interest rates that will happen at midday. We will bring you all the latest on the decision as well as reaction from top economists and policymakers.

How UK interest rates have changed since 2007

Thursday 19 September 2024 07:18 , Joe Middleton

Back-to-back cuts unlikely, analyst says

Thursday 19 September 2024 07:44 , Andy GregoryMatt Swannell, chief economic adviser at the EY Item Club, said the Bank of England had“sent a clear message that back-to-back rate cuts were unlikely” after last month’s reduction, unless subsequent economic data was weaker than expected.

He said the latest official data, which showed Consumer Prices Index (CPI) inflation remained at 2.2 per cent in August, would not be enough to prompt the Bank to start cutting rates more quickly.

Inflation figures won’t be enough to trigger rate cut, economist forecasts

Thursday 19 September 2024 07:57 , Andy GregorySanjay Raja, chief UK economist for Deutsche Bank, has predicted that the recent inflation figures of 2.2 per cent “won’t be enough to trigger a surprise rate cut” today.

“Instead, the MPC will likely take this as a positive sign that underlying price pressures are easing, and could warrant a further dial down of restrictive policy in November, when it conducts its next forecast update,” he said.

“The MPC will also have more information on the fiscal outlook, with the autumn Budget slated for 30 October.”

European Central Bank opt for consecutive rate cuts

Thursday 19 September 2024 08:14 , Andy GregoryThe Bank of England’s rate-setters could take note of the European Central Bank’s (ECB) decision to cut interest rates in the Eurozone last week, marking the second reduction in a row.

The ECB’s rate-setting council lowered the main deposit rate from 3.75 per cent to 3.5 per cent at the meeting last week.

James Moore | What do this week’s inflation figures show?

Thursday 19 September 2024 08:30 , Andy GregoryIn his latest column, The Independent’s chief business commentator James Moore writes:

Let’s start with the good news: August’s inflation number came in unchanged at 2.2 per cent. While that is higher than the Bank of England’s 2 per cent target, it is in line with City forecasts and beneath the 2.4 per cent the Bank itself had predicted at this stage. Compared to the double-figure price rises Britain was experiencing in the painful summer of 2023, it looks very good.

Food prices, a persistent bugbear, rose by just 1.3 per cent – down from 1.5 per cent. At the factory gate, an increase of just 0.2 per cent was recorded while the cost of raw materials actually fell, as did that of fuel.

There are a few buts coming. One thing to watch is the cost of services – from haircuts to handymen and everything in between; service prices rose by a headline rate of 5.6 per cent compared with this time last year, quite a bit worse than the previous month (5.2 per cent). The City had pencilled in 5.5 per cent.

The real villain of the piece was aviation. Air fares traditionally rise in summer, but they rose by an extraordinary 22 per cent between July and August alone. Falling restaurant and hotel bills helped offset that to some degree.

The Bank of England’s rate-setting Monetary Policy Committee has long been concerned about the cost of services, which represent by far the biggest part of the UK economy. This price tends to be closely linked to the cost of paying the staff who provide them. Wage settlements have been declining, to a two-year low 5.1 per cent in the three months to July compared with 5.4 per cent in the three months to May.

But the price consumers pay for services still represents an inflationary troll lurking under the bridge.

US Federal Reserve cuts interest rates by half point for first time in four years

Thursday 19 September 2024 08:46 , Andy GregoryThe US Federal Reserve has broken a four-year run and cut its benchmark interest rate by half a percentage point to 4.75-5.0 per cent.

This significant move signals that the US central bank believes it is winning the war on inflation and will now focus on preventing the job market from weakening.

One immediate effect should be lower borrowing costs for both consumers and businesses in the run-up to November’s presidential election.

Oliver O’Connell reports from New York:

Fed slashes interest rates for first time in years. Here’s what that means for you

What has US Fed said after first interest rate cut in four years?

Thursday 19 September 2024 09:00 , Andy GregoryIn a statement after cutting interest rates for the first time in four years, the US Federal Reserve’s Open Market Committee said: “The Committee seeks to achieve maximum employment and inflation at the rate of two percent over the longer run.

“The Committee has gained greater confidence that inflation is moving sustainably toward two percent, and judges that the risks to achieving its employment and inflation goals are roughly in balance. The economic outlook is uncertain, and the Committee is attentive to the risks to both sides of its dual mandate.”

Norway keeps interest rates at 16-year high

Thursday 19 September 2024 09:43 , Andy GregoryHours after of the Bank of England’s interest rate decision, Norway’s central bank opted to keep its policy interest rate unchanged at a 16-year high of 4.5 per cent.

“The committee judges that a restrictive monetary policy is still needed to bring inflation down to target within a reasonable time horizon,” the central bank said in a statement.

It added: “The policy rate forecast in this report implies that the policy rate will remain at 4.5% to the end of 2024 before being gradually reduced from the first quarter of 2025.”

Markets suggest 21 per cent chance of rate cut

Thursday 19 September 2024 09:44 , Andy GregoryTrader bets suggest the markets believe there is a 21 per cent chance that the Bank of England will cut its base interest rate again today, Sky News reports.

Direct debit failure rate on mortgage payments rises 11% in a year, ONS says

Thursday 19 September 2024 10:34 , Andy GregoryAs the Bank of England mulls whether to cut interest rates while seeking to keep inflation at bay, the Office for National Statistics has revealed that the rate of consumers defaulting on direct debits rose by 1 per cent in August – marking an increase of 12 per cent over the past year.

Compared with August 2023, the direct debit failure rate for electricity and gas payments rose by 43 per cent, while water payments rose 20 per cent and mortgages by 11 per cent.

Total Direct Debit failure rate (seasonally adjusted) in August 2024 increased by 1% (compared with July 2024).

— Office for National Statistics (ONS) (@ONS) September 19, 2024

The rate was 12% higher when compared with August 2023. Categories with the largest increases (compared with August 2023):

· Electricity & gas (43%)

· Water (20%) pic.twitter.com/Wg4b3xEyPP

US Fed improves rate forecasts

Thursday 19 September 2024 11:08 , Andy GregoryAs well as cutting rates by a bumper 0.5 per cent to a range of 4.75-5 per cent, the US Federal Reserve also dramatically lowered its forecasts of where the rate will sit in the future.

As well as a further drop of 0.5 per cent anticipated this year, a majority the Fed’s rate-setters forecasee rates reaching 3.4 per cent next year, lower than the 4.1 per cent previously predicted. The rate is then expected to fall to 2.9 per cent in 2026.

However Fed chief Jerome Powell suggested that officials would be prudent in incrementally lowering rates, after the surprise half-point cut.

“I do not think that anyone should look at this and say, oh, this is the new pace,” Mr Powell said. “We’re recalibrating policy down over time to a more neutral level. And we’re moving at the pace that we think is appropriate, given developments in the economy.”

Value of sterling rises after inflation data published

Thursday 19 September 2024 11:32 , Andy GregoryThe value of sterling rose on Wednesday as data showed that British inflation held steady in August but rose in the services sector – which is closely watched by the Bank of England – to 5.6 per cent from 5.2 in July.

Money markets priced in a 20 per cent chance of a 25 basis points rate cut from the Bank on Thursday, down from roughly 28 per cent right after the inflation data.

Economists forecast rate cut in November

Thursday 19 September 2024 11:44 , Andy GregoryThe Bank of England will keep its main interest rate at 5 per cent, but reduce it in November despite inflation being expected to stay above the central bank’s 2 per cent target, a comfortable majority of economists predicted in a poll by Reuters.

Analysts noted that the Bank’s rate-setters would also have more information on the fiscal outlook by November, with chancellor Rachel Reeves’ Budget expected on 30 October.

Breaking: Bank of England votes to keep rates at 5%

Thursday 19 September 2024 12:02 , Andy GregoryThe Bank of England has voted to hold interest rates at 5 per cent, in line with economists’ expectations.

Bank’s rate-setters vote 8-1 to hold at 5%

Thursday 19 September 2024 12:05 , Andy GregoryThe rate-setting Monetary Policy Committee voted by a majority of eight members to one to hold interest rates at 5 per cent.

One member voted to reduce the base rate by 0.25 percentage points to 4.75 per cent.

‘Vital that inflation stays low,’ says Andrew Bailey

Thursday 19 September 2024 12:10 , Andy GregoryAfter the Bank of England voted to hold rates at 5 per cent, governor Andrew Bailey said: “Inflationary pressures have continued to ease since we cut interest rates in August.

“The economy has been evolving broadly as we expected. If that continues, we should be able to reduce rates gradually over time.

“But it’s vital that inflation stays low, so we need to be careful not to cut too fast or by too much.”

Which MPC member voted to cut rates?

Thursday 19 September 2024 12:19 , Andy GregoryEight of the nine Bank of England policymakers voted to keep interest rates unchanged on Thursday.

The eight policymakers who voted to keep the base rate unchanged were the Bank’s governor Andrew Bailey, Sarah Breeden, Megan Greene, Clare Lombardelli, Catherine Mann, Huw Pill, Dave Ramsden, and the committee’s new member Alan Taylor, of Columbia University.

Swati Dhingra, an associate professor at the London School of Economics, once again voted to reduce the base rate by 0.25 percentage points.

Pound strengthens after Bank holds rates

Thursday 19 September 2024 12:25 , Andy GregoryThe pound strengthened after the Bank’s decision to hold rates, while the FTSE 100 Index pared back gains after surging ahead of the vote.

Sterling lifted 0.7 per cent to $1.33, and was 0.3 per cent higher at €1.19.

The FTSE 100 stood 0.9 per cent higher, up nearly 74 points at 8326.9, just after the decision, having at one stage risen 1.3 per cent higher in late morning trading.

CBI forecasts rate cut in November

Thursday 19 September 2024 12:32 , Andy GregoryAlpesh Paleja of the Confederation of British Industry said he expects an interest rate cut in November.

He said: “Monetary policy will be walking a fine line for a little while yet: between balancing upside risks to inflation, but not being too tight so as to choke off activity. Developments in fiscal policy in October’s Budget will also be a key consideration for growth prospects.

“We still anticipate another rate cut in November, and a few more next year, in line with the MPC (Monetary Policy Committee) moving at a slow but steady pace. On their own, lower interest rates will be a welcome respite to households and businesses.”

Pace of rate cuts ‘likely to be painfully cautious’ despite Bank’s ‘dovish’ tone

Thursday 19 September 2024 12:37 , Andy GregorySuren Thiru, economics director at the Insitute of Chartered Accountants, warned that the Bank’s decision today “will be a notable setback to households contending with burdensome mortgage bills”.

Mr Thiru said: “While this decision doesn’t mean the end of the rate-cutting cycle, it does suggest that the pace of policy loosening is likely to be painfully cautious, with rate setters still concerned that underlying inflation remains too high.

“Although only one rate-setter voted to loosen policy, the relatively dovish tone of the minutes suggest that the Monetary Policy Committee is shifting towards cutting interest rates when it next meets in November.

“Continuing to keep interest rates elevated risks hampering the government’s ambition of significantly higher annual GDP growth by keeping borrowing costs too high for too long, limiting investment and growth opportunities for businesses.”

‘No need for homeowners to panic,’ mortgage broker says

Thursday 19 September 2024 12:53 , Andy GregoryJo Pocklington, of Purplebricks Mortgages said: “There’s absolutely no need for homeowners to panic about the base rate being held today.

“Mortgage rates are nothing like what they were two years ago and there’s no reason to believe they’ll return to the levels seen by the end of 2022 any time soon. Given it was a close call on whether the Bank of England would drop the base rate in August, it’s not a huge surprise to see rates held for September.”

Pound hits highest value against dollar since March 2022

Thursday 19 September 2024 13:07 , Andy GregoryThe value of the pound rose to its highest levels since March 2022, just above $1.33, having traded around $1.3266 ahead of the Bank of England’s decision.

It comes a day after the Federal Reserve opted to cut US interest rates for the first time in four years, by a shock 0.5 per cent.

Prospect of November cut has dimmed slightly, markets suggest

Thursday 19 September 2024 13:20 , Andy GregoryThe prospect of a base rate cut in November has fallen, with trading markets now suggesting there is a 60 per cent chance of rates to be cut at that meeting.

Traders will likely be pointing to the fact that eight out of nine members of the Bank’s Monetary Policy Committee opted to hold rates at 5 per cent, in addition to governor Andrew Bailey’s warnings that the Bank must take care “not to cut too fast or by too much”.

Ex-chancellor Hunt says last month’s cut was thanks to his government

Thursday 19 September 2024 13:37 , Andy GregoryTory former Jeremy Hunt has said the Bank of England’s base rate cut last month was “thanks to difficult decisions by the last government”.

Mr Hunt, now shadow chancellor, said: “Today’s announcement shows how important it is that the new government works hard to hold down inflation, which will pave the way for future interest rates cuts.

“New employment laws that put up costs for business will ultimately feed through into higher prices so they should think again before damaging UK competitiveness as they currently plan.”

Bank of England slightly pares back expectations of economic growth this quarter

Thursday 19 September 2024 13:54 , Andy GregoryThe Bank of England has said it now expects the British economy to grow 0.3 per cent this quarter, down slightly from the 0.4 per cent increase forecast in August.

The central bank said its analysts believe that improving real incomes, last month’s base rate reduction and anticipated further cuts in interest rates “had underpinned improved sentiment and expectations of increased activity across most sectors around the turn of the year”.

Why did Bank of England opt to hold rates?

Thursday 19 September 2024 14:11 , Andy GregoryThe Bank of England says members of its nine-strong Monetary Policy Committee “took different views on the probabilities and risks” facing the UK economy as they decided on the base rate at today’s meeting.

Noting that eight members preferred to hold the rate at 5 per cent, the Bank said: “Wage and price-setting had continued to normalise and UK activity growth had been broadly in line with expectations, although there was some greater uncertainty around the near-term global outlook.

“There was a range of views among these members on the degree to which the unwinding of past global shocks, the normalisation in inflation expectations and the current restrictive policy stance would lead underlying domestic inflationary pressures to continue to unwind, or whether these pressures could prove more entrenched, possibly as a result of more structural factors or greater momentum in demand.

“Despite these differences of view, the current policy stance was judged to be appropriate. For most members, in the absence of material developments, a gradual approach to removing policy restraint would be warranted.”

Bank of England ‘may have wiggle room for two cuts before end of the year’

Thursday 19 September 2024 14:42 , Andy GregorySimon Gammon, a managing partner at Knight Frank Finance, said: “Caution from the Bank will have little impact on the slow, downward trajectory of mortgage rates.”

He said a “brightening global picture” has been pushing down swap rates, which lenders use to price their loans, “giving the lenders leeway to keep cutting”.

Mr Gammon added: “Wednesday’s UK inflation data did little to change the narrative that the Bank of England has the wiggle room to cut the base rate once or twice before the end of the year.”

‘Dark clouds gathering once again,’ warns analyst

Thursday 19 September 2024 15:01 , Andy Gregory“Dark clouds are gathering once again” and the government may need to rely on the Bank of England to deliver economic growth with rate cuts larger than otherwise expected, an analyst has warned.

Lindsay James, investment strategist at Quilter Investors, said: “The general consensus is to expect more rate cuts this year and into next as the economic momentum that had built up slows and inflation remains close to target. Two more cuts are expected by financial markets, and with time running out in 2024, the next meeting is likely to see the BoE’s next cut delivered.”

Warning that chancellor Rachel Reeves’ first Budget is “the spectre hanging over all of this”, he added: “Taxes are guaranteed to rise, but by what extent we are not sure and thus the economic impact cannot be properly gauged. Businesses and consumers are likely to cut back on spending in anticipation of changes to their income and as such growth could slide further.

“Given Labour’s emphasis on wealth creation and economic growth in the run up to the election, it may in turn, have to rely on the Bank of England to deliver this in the short term by providing more regular or larger rate cuts than perhaps would have been expected otherwise.

“A rate cut would have been especially welcomed by consumers and businesses alike, given the economy remains close to stall speed. Having had a positive and rather buoyant first half of 2024, dark clouds are gathering once again and as such action from the BoE will be required sooner rather than later.”