A whale with a lot of money to spend has taken a noticeably bullish stance on NextEra Energy.

Looking at options history for NextEra Energy (NYSE:NEE) we detected 12 strange trades.

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $110,310 and 10, calls, for a total amount of $912,542.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $70.0 to $90.0 for NextEra Energy over the last 3 months.

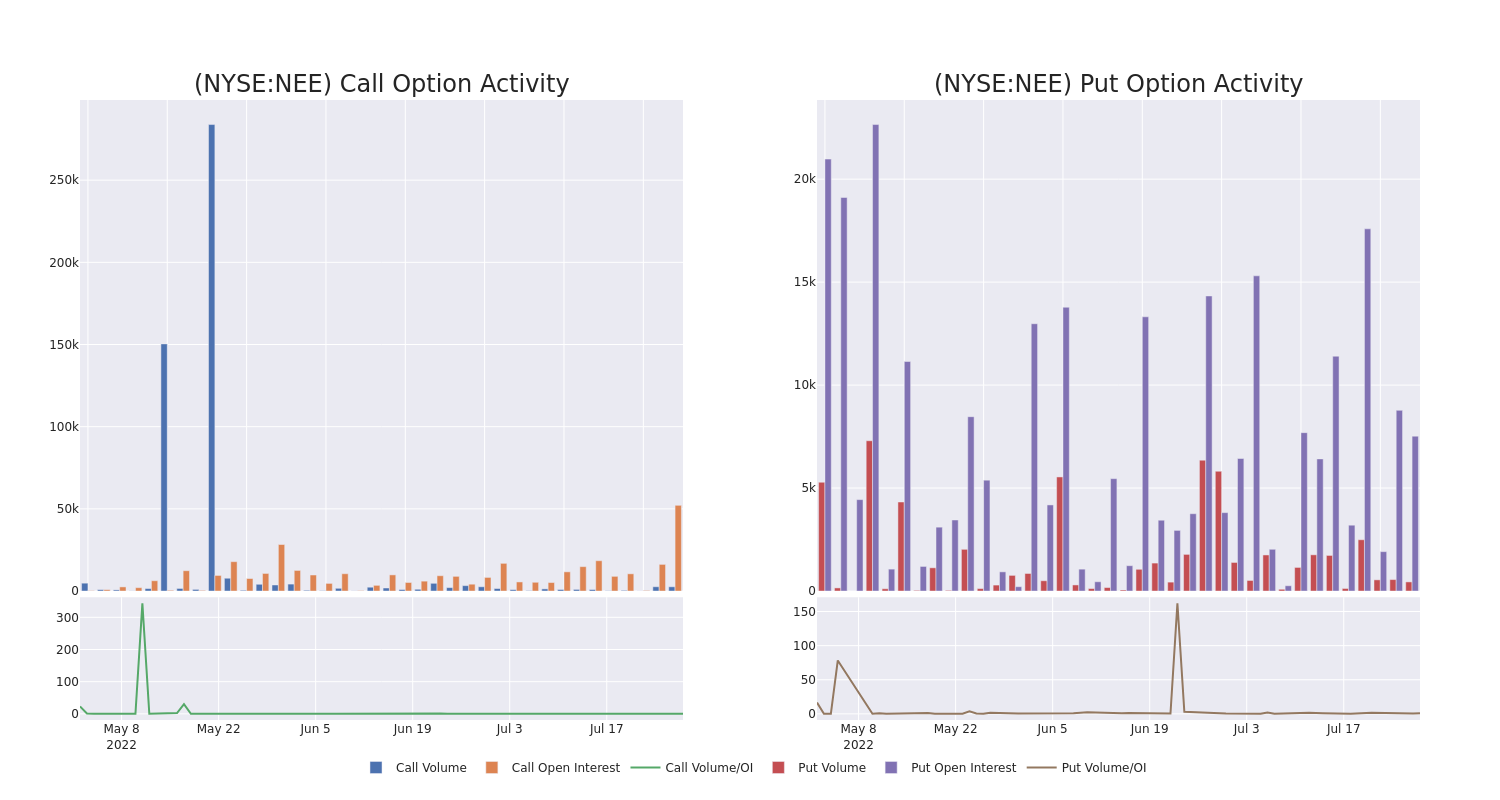

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for NextEra Energy's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of NextEra Energy's whale trades within a strike price range from $70.0 to $90.0 in the last 30 days.

NextEra Energy Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| NEE | CALL | SWEEP | NEUTRAL | 01/20/23 | $80.00 | $198.5K | 11.2K | 528 |

| NEE | CALL | SWEEP | BEARISH | 01/20/23 | $75.00 | $156.0K | 3.9K | 324 |

| NEE | CALL | SWEEP | NEUTRAL | 01/20/23 | $80.00 | $154.8K | 11.2K | 192 |

| NEE | PUT | SWEEP | BULLISH | 01/20/23 | $77.50 | $84.8K | 7.3K | 258 |

| NEE | CALL | SWEEP | BULLISH | 09/16/22 | $87.50 | $83.0K | 5.1K | 691 |

Where Is NextEra Energy Standing Right Now?

- With a volume of 4,205,813, the price of NEE is up 6.81% at $85.85.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 83 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for NextEra Energy, Benzinga Pro gives you real-time options trades alerts.