Multi-level marketing (MLM) is a business model that relies on direct selling and consultants recruiting friends and relatives to also become consultants, salespeople or distributors.

MLM salespeople sell products – such as beauty products, kitchenwares, essential oils or health supplements – directly to end-user retail consumers. These sales are made through relationship referrals, word-of-mouth marketing, and increasingly through social media.

Billed as entrepreneurial self-employment, many people (mostly women) join MLMs to supplement their income or make some money while caring for kids.

However, while MLMs promise financial independence, flexibility and work-life balance, it’s been widely reported by media and researchers that very few MLM sellers make any profit.

To find out more, we surveyed 287 current and former MLM consultants in Australia.

Many said they made less than A$5,000 a year from their MLM business. But even this figure is likely an overestimate for many; around half of those we surveyed said they didn’t include all costs in their profit calculations.

Around 40% of former MLM consultants told us they left for financial reasons.

How do MLMs work?

Under Australian Consumer Law, legal MLM enterprises are not classed as pyramid schemes because consultants’ income is predominantly derived from selling products or services rather than recruiting others into the scheme.

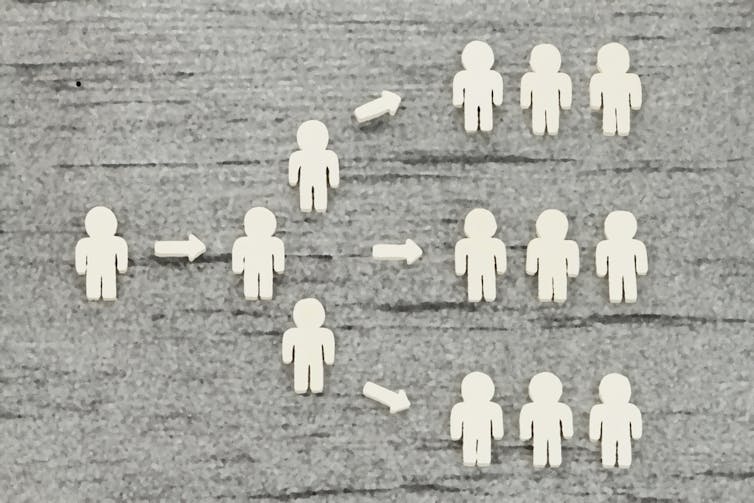

However, consultants are incentivised to recruit others because recruits become their “downline”. Most MLMs offer commissions based on downlines’ sales in addition to their own sales.

For example: Mary recruits Jane as a consultant and now Jane is in Mary’s downline. So now Mary gets to keep a portion of the money Jane makes from her sales. Jane goes on to recruit Angela to her downline; now both Mary and Jane get to keep a portion of the money Angela makes from her sales.

There are close to half a million independent MLM sellers in Australia selling products ranging from health and beauty products to craft supplies, home wares and fashion.

Critics say the MLM business model depends on exploiting women’s social circles as well as aspirations or obligations to generate income while managing caring responsibilities.

Is it really a side hustle if you end up losing money?

The most common reason for joining an MLM is to earn extra money. But a US survey of more than 1,000 MLM sellers found the majority made less than US 70c per hour in sales – before deducting expenses.

Fewer than half made US$500 over five years. Nearly a third acquired credit card debt to finance their MLM involvement.

A 2020 study by AARP (formerly known as the American Association of Retired Persons) found 1 in 13 US adults had tried MLM at some point, and nearly half had lost money.

In our study, we were interested in the financial literacy of MLM consultants in Australia. You can test your financial literacy using the questions we asked consultants.

We compared the actual and perceived financial literacy of MLM consultants, and found many were unable to answer questions assessing basic financial literacy.

We also asked MLM-specific financial literacy questions and found a sample of the general population (meaning people not involved in MLMs) were more likely to answer these questions correctly than most of the MLM sample.

We also found some respondents are particularly vulnerable to MLM recruitment as they have high levels of optimism and materialism and are overconfident of their financial knowledge.

Read more: Should I pay off the mortgage ASAP or top up my superannuation? 4 questions to ask yourself

Questions to ask yourself before joining an MLM

If you are considering joining an MLM, our research suggests you need to consider the following questions first.

1. Can I afford to join an MLM?

You may need to purchase a starter kit or demonstration products, or pay a joining fee. Two-thirds of consultants told us they spent more than $1,000 starting their MLM business.

But the majority told us it took more than a year to make any profit. So if you are going to take out a loan, consider the repayment terms, including interest.

Some MLM companies have annual membership fees. Others have monthly or quarterly sales targets and you may feel pressured to meet these by purchasing additional products yourself to meet your quota. In fact, 40% of consultants told us they did not make any profit in their MLM business.

2. Do I really have the financial knowledge and skills to run my own MLM business?

Most MLM recruits have little or no experience running a home-based business; only 20% seek ongoing advice from a financial professional.

This is concerning, as MLMs typically have complex commission and remuneration structures.

We also found many sellers overestimate their financial knowledge compared to their actual financial literacy.

3. Do I have all the information I need to make an informed decision to join?

It is important to collect as much information as possible before making this decision.

MLM consultants and the person trying to recruit you have a vested interest in highlighting success stories and downplaying how statistically improbable it is you’ll achieve them.

Do your homework, compare alternatives and ask current and former consultants about their experiences to get both sides of the story.

Deanna Grant-Smith received funding from Ecstra Foundation to undertake this research. She is a board member of the TJ Ryan Foundation, a progressive public policy think tank. This story is part of a series on financial and economic literacy funded by Ecstra Foundation.

Laura de Zwaan receives funding from Ecstra Foundation and the Financial Basics Foundation. She is affiliated with the Financial Planning Academic Forum and is an Academic Member of the Financial Planning Association.

This article was originally published on The Conversation. Read the original article.