America's tax code is notoriously convoluted, but the complexity really sparkles when it comes to the federal government's approach to alcohol taxation. Wine, beer, and liquor are all subject to varying tax rates based on intricate calculations, but the so-called "bubble tax" for hard cider is the star of this regulatory circus.

Unbeknownst to most Americans, the tax rate for alcoholic cider is based on, among other things, the amount of carbonation the drink contains. Yes, America technically already has a carbon tax and the feds have literally found a way to tax air. Craft cider makers are being flattened by an arbitrary system that is strangling the industry's long-term potential.

Under the federal code, alcoholic cider is taxed as either hard cider, still wine, or sparkling wine, and the implications of which category applies are not insignificant. Hard cider is taxed at a modest $0.226 per gallon, while sparkling wine is taxed at a whopping $3.40 per gallon—a staggering 1,400 percent increase. For every 100 gallons of cider produced, Uncle Sam either takes $22 in taxes or $340 in taxes.

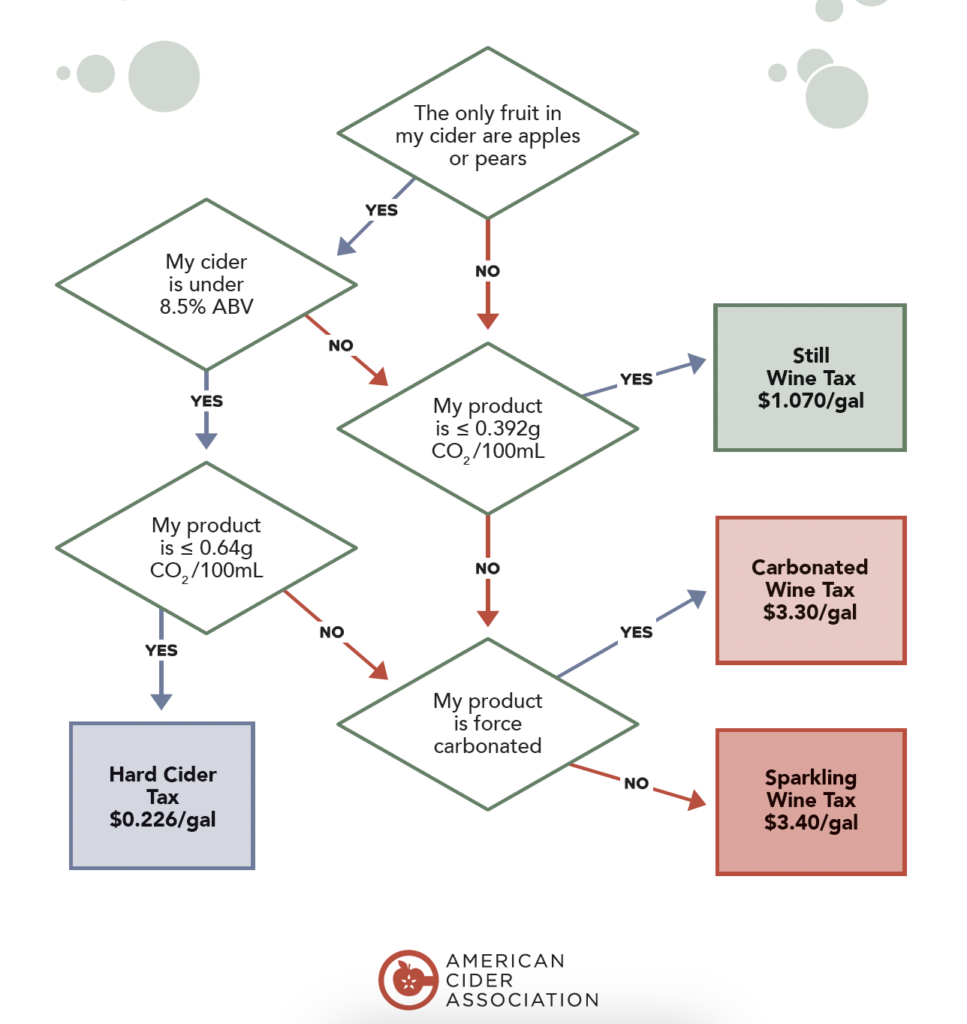

What determines how cider is categorized and taxed? A ridiculous three-part formula based on a) what type of fruit is used to make the cider, b) the alcohol content of the cider, and c) what carbonation level the cider contains.

Imagine you're a cider maker aiming for the lower tax rate to apply to your product. You need to produce a cider that is made from apples or pears (with no other fruit additions), is less than 8.5 percent alcohol by volume (ABV), and has less than or equal to 0.64 grams of carbon dioxide (CO2) per 100mL. However, if you decide to add some blackberries or grapes, it's considered a still wine and taxed at $1.07 per gallon—but only if it has less than 0.392 grams of CO2 per 100mL. If you go over that carbonation threshold, you've unlocked sparkling wine status and with that the $3.40 per gallon tax rate.

Confused? It gets worse.

If your pear or apple cider is over 0.64 grams of CO2, it gets the sparkling wine rate. But it's knocked back down to the still wine rate if it's less than 0.392 grams of CO2 and the ABV level is 8.5 percent or higher. Whether the bubbles are added via "force carbonated" or "bottle conditioned" carbonation creates another tax delineation for the sparkling wine category. A flow chart is needed just to unpack all the potential permutations and combinations:

The implications of this tax labyrinth extend to consumers. A report from Wine Enthusiast notes that modern drinkers have grown to expect beer-like carbonation levels in their alcoholic beverages, thereby creating pressure for cider makers to add more carbonation to their products.

One cider maker from Oregon reported that he receives frequent emails from consumers complaining about flat cider, which they incorrectly blame on him rather than the government. If adding more carbonation could financially cripple a small business, it's little wonder many cider makers feel that their hands are tied.

The disparity is glaring when compared to beverages like beer, hard seltzer, and regular soda, which face no such carbonation-based tax penalties. It's a clear disconnect from market realities and consumer demands, which increasingly favor diverse flavors and more carbonation in ciders.

Craft cider makers are doing their best to diversify the carbonation levels and fruits in their ciders to respond to consumer demand, but it's clear the industry has a hard ceiling on its growth due to these tax rules. This is why many cider makers state that their ability to expand—and the ability of the industry as a whole to thrive—is being pointlessly inhibited.

The bubble tax is now getting more attention due to a recent bipartisan bill introduced in Congress, which aims to level the playing field between apple and pear ciders and those made with other fruits. While promising, the best reform would be to convert the entire system of alcohol taxation to one based simply on a drink's ABV level rather than arbitrary classifications.

Craft cider, a beverage steeped in American history, deserves better. Another Michigan cider maker made it even simpler: "It's not expressing the free market. The government needs to get out of the way."

The post The Federal Government is Literally Taxing Air appeared first on Reason.com.