The rout in software stocks may be grabbing most of the headlines lately, but the prolonged crypto winter has been equally compelling to watch. Holding the promise of upending the financial order, it seems that the different digital assets of the crypto world are themselves in a state of turmoil. In fact, the world's largest cryptocurrency, Bitcoin (BTCUSD), is down 31% over the past year.

However, while Bitcoin may be having a tough time navigating all the global uncertainties, the company with the world's largest Bitcoin reserve remains convinced of the crypto's utility and prospects. Let's take a closer look at what's going on with Strategy (MSTR) and MSTR stock.

Strategy Does It Again

Strategy, the Michael Saylor-led Bitcoin treasury company, purchased BTC worth $90 million for the week ended Feb. 8. This follows an earlier buying spree in the week before, when the company loaded up on BTC worth roughly $75 million. Overall, the company now holds 714,644 BTC, bought for an average price of about $76,000 per coin. This means that, at the current prevailing BTC price of under $70,000 per coin, the company is incurring a notional loss on its overall holdings.

This strategy is not a deviation from the company's preferred path of being the biggest owner of Bitcoin in the world. In fact, over the years, Strategy has sold Bitcoin just once. On Dec. 22, 2022, the firm sold 704 BTC for approximately $11.8 million. Bitcoin had crashed significantly from Strategy's earlier purchase prices, and selling at a loss allowed the company to generate federal income tax credits that could offset previous capital gains. Thus, rather than losing faith in Bitcoin, the sale was for the strategic reason of tax loss harvesting. This can be gauged from the fact that just two days later, on Dec. 24, the company turned around and bought 810 BTC.

Notably, Saylor continues to be one of the biggest cheerleaders of Bitcoin. On the company's latest earnings call, Saylor stated, “Bitcoin is digital capital. We believe in it.” In a more detailed statement in a previous earnings call, CEO Phong Le also tried to assuage investors by saying, “In the extreme downside, if we were to have a 90% decline in bitcoin price, and the price was $8,000, that is the point at which our bitcoin reserve equals our net debt.” Reportedly, Le elaborated that Bitcoin "would need to fall to $8,000 and remain there for five to six years before Strategy faced serious difficulty covering its convertible obligations."

So, what should investors make of Strategy right now? MSTR stock is down almost 61% over the past year, while Strategy's market capitalizaiton has dropped to about $38 billion from a peak above $120 billion. Does that mean it is best to part with the stock? Or is this just a blip on the radar and, under the guidance of Saylor, the company will sail into calm waters soon?

Strategy's Q4 Results Are Not as Bad as They Look

At first glance, Strategy's fourth-quarter results may come as a brutal jolt. The company reported a staggering loss of $42.93 per share, multiple times more than the prior year's loss of $3.03 per share. However, a deeper look paints a slightly different picture.

Firstly, the losses may look substantial, but they should be viewed in the proper context. Strategy's reported net loss or profit is overwhelmingly driven by mark-to-market accounting rules applied to its Bitcoin holdings. At the end of Q4, the company held 713,502 BTC, which must be carried at fair value each period. Bitcoin's decline from its October peak near $126,000 to the current range of approximately $65,000 to $70,000 made a significant unrealized loss unavoidable under these standards.

Also, it must be understood that the core proposition of investing in Strategy is to gain exposure to Bitcoin. Now, BTC in particular and cryptocurrencies in general are highly volatile investments, with beta much higher than the regular indices. That makes volatility a feature, not a bug, for the company. Having said that, in 2025, Strategy's BTC yield stood at 22.8%, which is within the targeted range of 22% to 26%. Although this may seem much lower than the previous year's figure of 74.3%, it must be noted that the company's Bitcoin pile is now more than 700,000 BTC versus 471,107 BTC in the previous year.

Encouragingly, the company's BTC holdings of about $50 billion mean that, with a market capitalization of about $40 billion, MSTR stock is trading at a discount to the market value of its BTC holdings.

On the other hand, the software side quietly reported revenue of $123 million. Not only was this 2% higher than the previous year, but it also came in higher than the consensus estimate of $118.8 million. The company's cash balance also surged to $2.3 billion at the end of 2025 from just $38.1 million at the start of the year. This marks a strategic move by the company to build a USD reserve to pay dividends to its preferred shareholders in a timely manner.

This sends a strong signal to investors that a crypto winter will not leave them high and dry, and that Strategy has the required support of cash reserves to look after its preferred shareholders. In fact, Strategy iterated in its Q4 report that its “current intention is to maintain the USD Reserve at an amount sufficient to fund two to three years of its Dividends.”

Therefore, despite the losses widening significantly, the whole picture presents a fairer picture of the company and what it's doing. Moreover, Strategy is moving forward diligently on its path to stack up as much Bitcoin as it can, but in a financially sustainable manner that keeps the balance sheet robust and shareholders secure.

What Do Analysts Think About MSTR Stock?

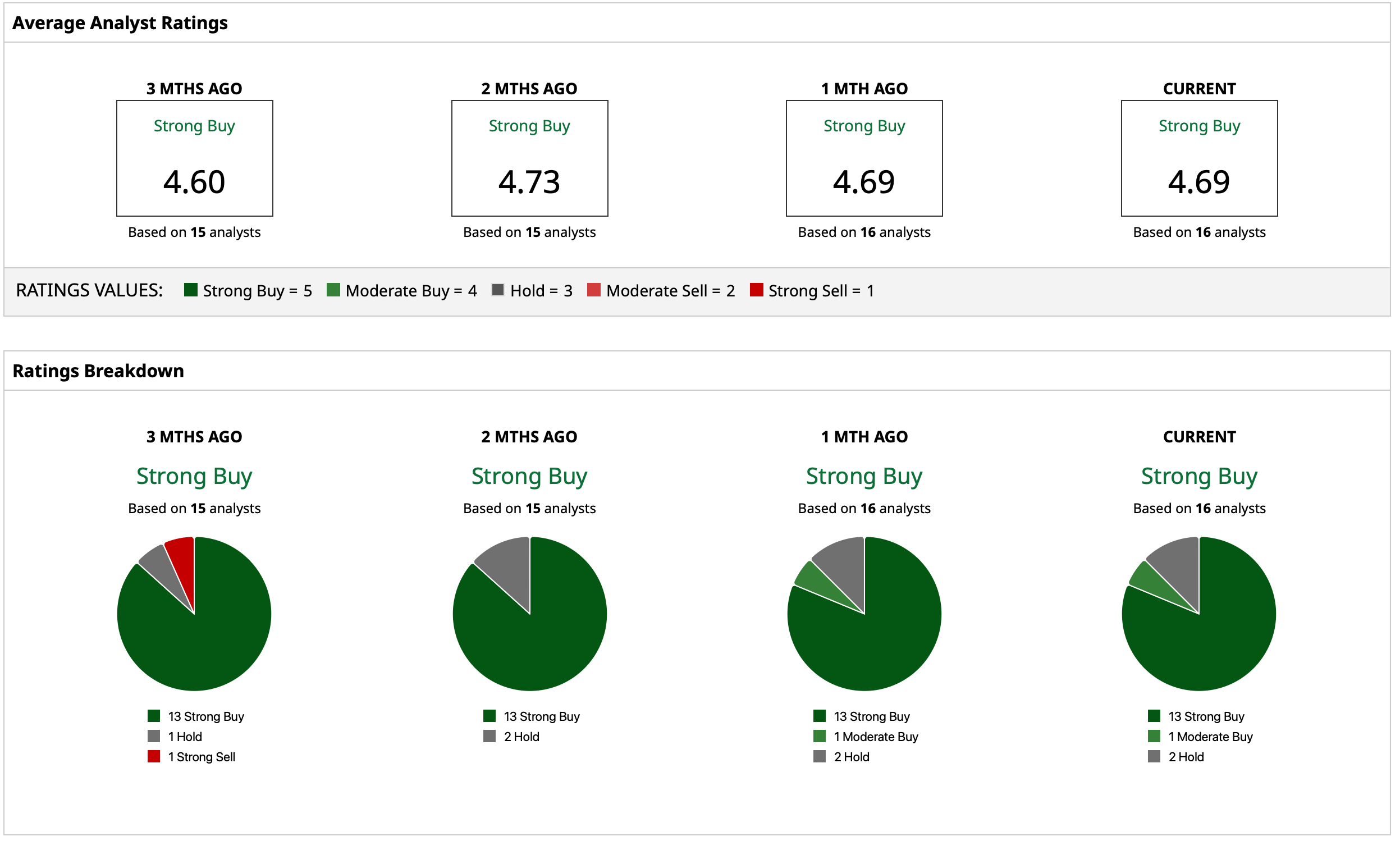

Overall, analysts give MSTR stock a “Strong Buy” conesensus rating with a mean target price of $401.86. This indicates potential upside of about 221% from current levels. Out of 16 analysts covering the stock, 13 have a “Strong Buy” rating, one has a “Moderate Buy” rating, and two have a “Hold” rating.