StockX has issued a public response to Nike’s NFT lawsuit against the resale platform. While claiming that the lawsuit is “without merit,” StockX insists that its NFTs “are absolutely not ‘virtual products’ or digital sneakers” [emphasis theirs]. The company points to fair use and nominative first sale doctrines in trademark law to argue that its selling of NFTs based on Nike sneakers is lawful.

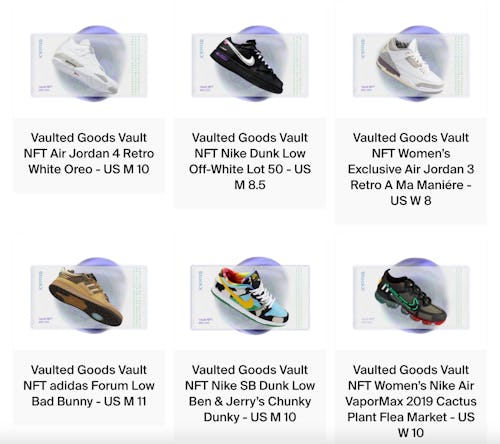

StockX’s first entry into the metaverse came in mid-January when it launched a series of sneaker NFTs consisting almost entirely of Nike designs. Subsequent releases have brought tokens for other sneakers and streetwear collectibles, and each NFT is tied to a physical product kept in StockX’s “vault.” NFT holders can redeem and give up ownership of their tokens in exchange for the corresponding physical product — although when and how users would be able to do so was not initially made clear, just one of several issues surrounding StockX’s entry into the NFT marketplace.

Nike filed a lawsuit against StockX within two weeks of the launch accusing the defendant of trademark infringement and trademark dilution. Lawyers for the sportswear giant say StockX is engaging in “blatantly freeriding, almost exclusively, on the back of Nike’s famous trademarks and associated goodwill” and is likely to create confusion among customers who think Nike supports the initiative.

StockX isn’t backing down —

Having already pursued legal action against a number of independent shoe designers who deal in custom sneakers or ones based heavily on existing designs, Nike has turned its attention to StockX’s dealings in the metaverse. Nike has its own plans to release sneaker NFTs after it acquired digital sneaker brand RTFKT Studios, plans that its lawyers say are jeopardized by StockX’s actions.

Most recent defendants in suits filed by Nike, with the exception of John Gieger, have settled out of court before a ruling could be handed down by a judge — likely because of a significant imbalance in resources when compared to the multi-billion-dollar company. StockX, however, should be well equipped to ride out legal proceedings in its defense. Its latest round of funding values the company at $3.8 billion, making it the most valuable player in the sneaker resale market besides eBay.

StockX says that its NFTs are merely a way to “track ownership of physical products and save [its] customers time and money while reducing the environmental impact of repeated shipping.” It argues further that what it is doing is no different than any platform using images to accurately depict the products up for sale.

The difference, though, is that StockX’s NFTs cost significantly more than it would to just buy the corresponding sneaker. A pair of the highly coveted Nike SB x Ben & Jerry’s Dunk Low “Chunky Dunky” can be purchased on StockX for approximately $1,500, depending on sizing. The corresponding NFT has sold for as much as $5,000, suggesting buyers are placing value on the tokens differently than on the mere representation of a physical good.

NFTs are inherently grift-y, no matter what someone invested in them might tell you, but we may have to look to the courts to see if StockX’s business in the metaverse rises to the level of illegality.