Check back for updates throughout the trading day

U.S. stocks moved higher Thursday, while Treasury yields retreated and the dollar gave back earlier gains against its global peers, as a key inflation reading suggest price pressures are moving closer to the Federal Reserve's target, indicating the likelihood of spring rate cuts.

Updated at 12:15 PM EST

Tech boost

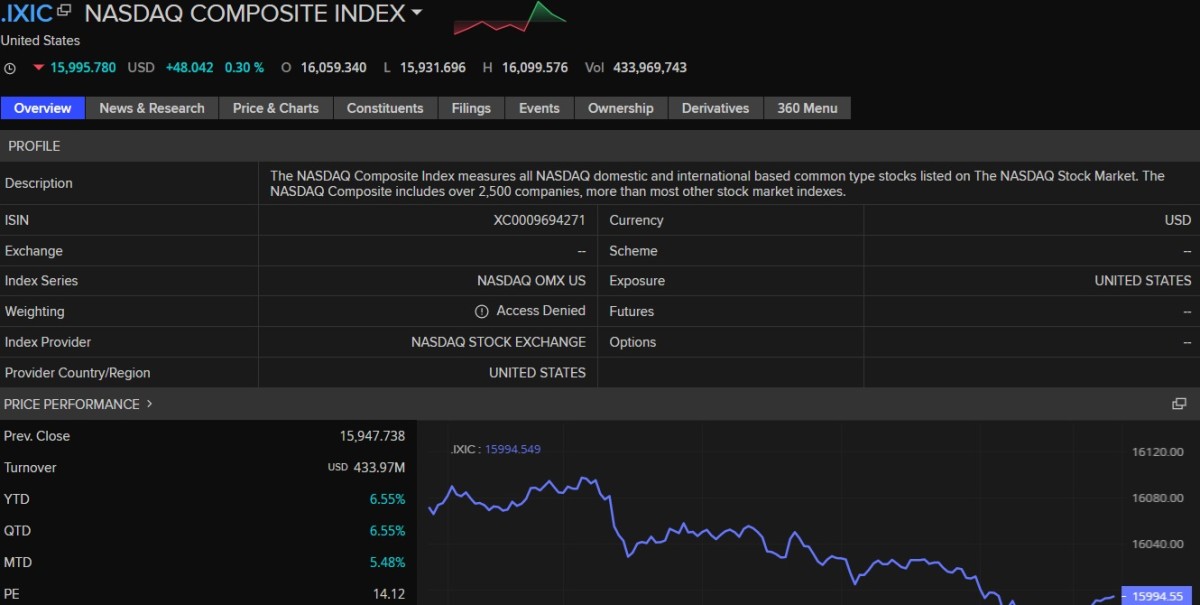

A pullback in Treasury bond yields in the wake of a mixed, but dovish, January inflation report has tech stocks leading market gainers in mid-trading, with the Nasdaq marked 50 points higher, or 0.36%, despite declines for index heavyweights Microsoft (MSFT) , Apple and Tesla (TSLA) .

The broader S&P 500 was marked 6 points, or 0.12% higher while the Dow slipped 77 points.

Updated at 11:10 PM EST

Hardly bombastic

Atlanta Fed President Raphael Bostic said Thursday that the first rate cut of the year will likely come "this summer", but added during a banking conference in the Georgia capital that he needs to see more consistent evidence that inflation is returning to the central bank's 2% target.

"Experience will ultimately be our guide, will be my guide in thinking about what's appropriate, and so we'll have to see what happens over the next several months," Bostic said. "That will really determine whether that summer expectation is appropriate, or whether I should pull it forward even further, or push it back if things go in a different way."

FED'S BOSTIC: ECONOMIC DATA WILL ULTIMATELY BE OUR GUIDE ON WHEN RATE CUTS START

— *Walter Bloomberg (@DeItaone) February 29, 2024

Updated at 9:45 PM EST

Firmer Open

U.S. stocks opened firmly higher following the January PCE Price Index data, with the S&P 500 rising 23 points, or 0.46%, while the Dow Jones Industrial Average added 50 points and the tech-focused Nasdaq jumped 127 points.

Benchmark 10-year Treasury note yields were 6 basis points lower at 4.254 % while 2-year notes were pegged 6 basis points lower at 4.641%.

Related: Fed Inflation gauge ticks higher in January, but headline pressures ease; Stocks jump

Updated at 9:21 PM EST

Joy in June?

Traders are adding to bets that the Fed will begin the first of at least three rate cuts planned for this year in June, according to the CME Group's FedWatch tool, which indicates a 52.4% chance of a quarter point reduction and an 11.7% chance of a half-point decline.

“Inflation continues to moderate despite upgraded outlooks for the U.S. economy, said David Russell, global head of market strategy at TradeStation. "Today’s numbers show just enough softening to keep worries at bay. It could be hard for the bears to get a toehold in this market.”

Market expectations for Fed Funds Rate path:

— Charlie Bilello (@charliebilello) February 29, 2024

-Mar 20, 2024: Pause

-May 1, 2024: Pause

-June 12, 2024: 25 bps cut to 5.00-5.25%

-July 31, 2024: Pause

-Sep 18, 2024: 25 bps cut to 4.75-5.00%

-Nov 7, 2024: 25 bps cut to 4.50-4.75%

-Dec 18, 2024: Pause pic.twitter.com/n62WoOjLkH

Updated at 8:48 PM EST

Mixed Bag

The Fed's preferred inflation gauge, the core PCE price index, ticked higher on a monthly basis in January, but slowed for the twelfth consecutive month, suggesting price pressures are slowly but surely heading back towards the Fed's 2% target.

The core PCE deflator, the Fed's key metric, quickened 0.4% in January, up from 0.2% in December, but slowed to an annual rate of 2.8%. Both readings matched Street forecasts.

Stocks pared earlier gains on the dovish tone of the release, with futures tied to the S&P 500 indicating a 17 point opening bell gain and the Dow looking at a 40 point bump. The Nasdaq is called 100 points higher.

US Jan PCE Data: Personal income up 4.8% Y/Y, compensation 5.5%, wage & salary 5.7%, disposable income 4.5, personal spending 4.5 & savings at 3.8%. Real spending up 3.6% on a three-month average annualized pace. That is a function of a strong economy and inflation moderation…

— Joseph Brusuelas (@joebrusuelas) February 29, 2024

Updated at 8:25 AM EST

Baked Apple

Apple (AAPL) shares extended their recent run of declines, falling 0.44% in pre-market trading, following a report that suggests the tech giant is discounting its new iPhone 15 by as much of a $180 in China amid worryingly weak demand in the world's biggest smartphone market.

Apple Inc.’s resellers in China are cutting prices on iPhone 15 models by up to $180, due to continued weak demand.

— Wall St Engine (@wallstengine) February 29, 2024

iPhone 15 Pro Max prices have dropped by 1,300 yuan ($180) on Alibaba’s Tmall.

The discount is steeper than last year's $120 reduction, with similar cuts on JD…

Stock Market Today:

The Bureau of Economic Analysis will publish its formal reading of January inflation prior to the start of trading, with investors focused firmly on the Fed's preferred inflation gauge, the core PCE Price Index, which is expected to tick modestly higher from December levels.

A bigger-than-expected gain could trigger changes to both the Fed's current rate projections, which call for around three quarter-point reductions this year, as well as the market's assumptions that cuts will begin at the central bank's fourth meeting of the year in June.

A downtick in press pressure, however, could suggest that inflation is now moving more convincingly to the Fed's preferred 2% target, stoking both a pullback in Treasury bond yields and a likely jump in broader stock prices.

Benchmark 10-year Treasury note yields were trading modestly higher ahead of the data release at 4.307% while 2-year notes, the most sensitive to interest-rate changes, were marked at 4.693%.

The U.S. dollar index, which tracks the greenback against a basket of six global currencies, was marked 0.01% higher at 103.981.

On Wall Street, stocks are set for a modestly weaker open, but much of today's action will be dictated by both the January PCE reading and weekly jobless-claims data, both of which are set for release at 8:30 am Eastern Time.

Among individual stocks, Snowflake (SNOW) shares wee the most active in premarket trading, plunging more than 23% after the cloud-focused data-analytics group issued a softer-than-expected sales forecast, offsetting a solid fourth-quarter-earnings report.

A weaker sales guide also clipped shares of Salesforce (CRM) , which were last marked 1.9% lower at $294.06, as the customer-relations-management-software group signaled a slowdown in corporate spending.

WW International (WW) shares were also on the move, falling nearly 25% after superstar endorser Oprah Winfrey said she was leaving the board of the consumer health group.

In broader markets, futures contracts tied to the S&P 500, which is up 4.8% on the month and just under 6.5% for the year, are priced for an 11 point pullback at the start of trading.

Futures tied to the Dow Jones Industrial Average, meanwhile, suggest a 130 point opening-bell decline while those linked to the Nasdaq suggest a 40 point pullback.

In Europe, the regionwide Stoxx 600 was marked 0.17% in Frankfurt, while Britain's FTSE 100 rose 0.25% in London, with both markets keenly eyeing today's inflation report prior to the close of trading.

Overnight in Asia, Japan's Nikkei 225 closed 0.11% lower at 39,166.19. Solid gains for stocks in China helped the MSCI ex-Japan index rise 0.25% into the close of trading.

Related: Veteran fund manager picks favorite stocks for 2024