Last Friday, US memory company Micron broke ground on a new $100 billion multi-foundry complex in Syracuse, New York, as part of the company's $200 billion project to expand facilities in America. Joined by various guests and politicians, the ceremony was also notable for familiar remarks made by the US commerce secretary to reporters: foreign chip makers could be hit with 100% tariffs, unless they invest more in the US.

As reported by Bloomberg, Howard Lutnick (above, second right) pointed out that the possibility of import levies, already addressed in a trade accord with Taiwan, also applies to South Korean firms.

"Everyone who wants to build memory has two choices: They can pay a 100% tariff, or they can build in America. That’s industrial policy.”

The DRAM and NAND flash industry is dominated by three companies: Samsung and SK hynix in South Korea, and Micron in the US. There are other memory makers, more so in the flash sector than pure DRAM, but even grouped together, they have nowhere near the same market share as any of the big three.

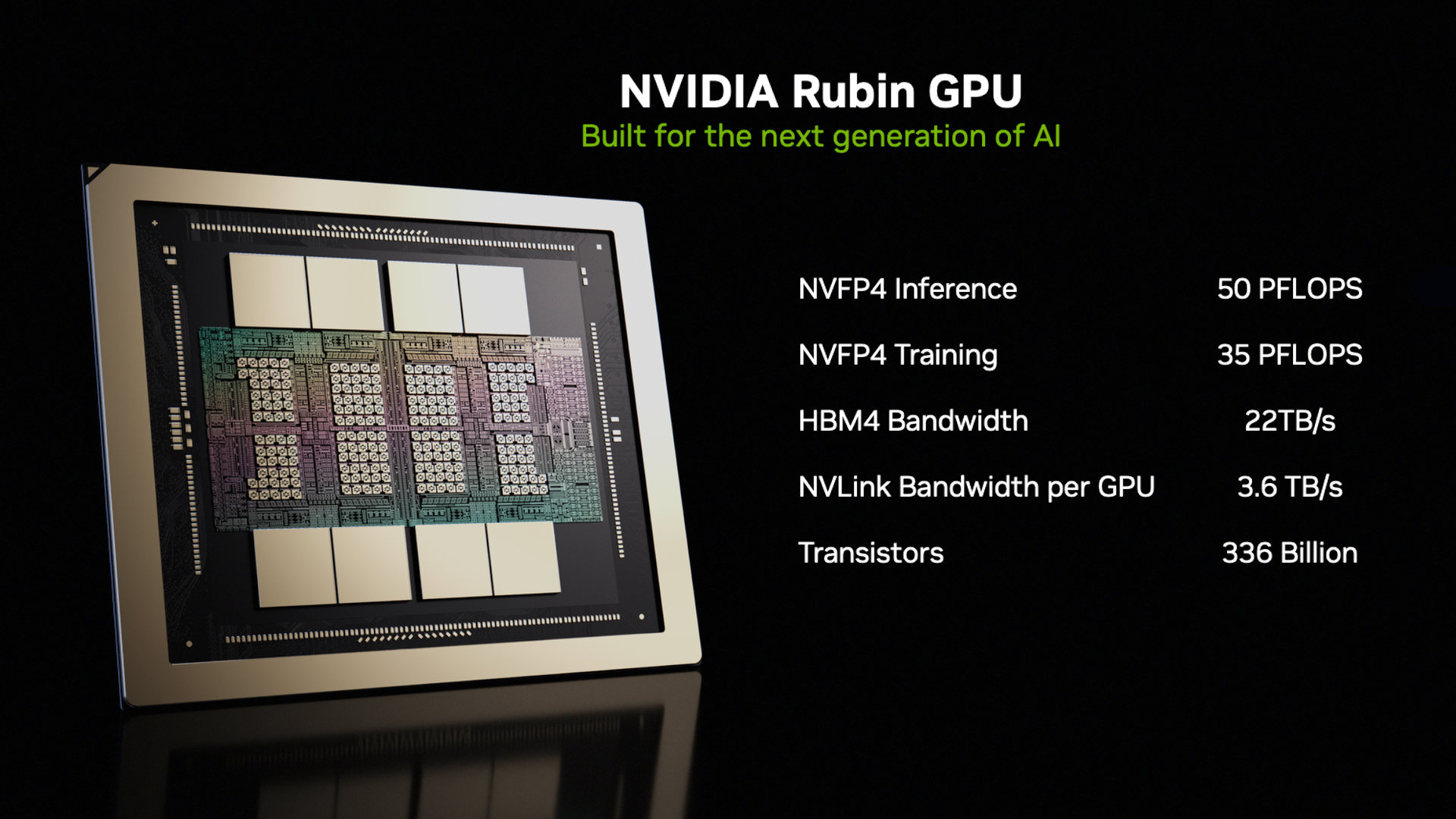

Of more relevance, though, is the fact that it's only these companies that manufacture HBM or high bandwidth memory. These chips are used almost exclusively for AI superchips: Nvidia's Hopper, Blackwell, and Rubin monsters, along with AMD's massive Instinct accelerators, all rely on the stacked-DRAM modules to have as much memory capacity and bandwidth as possible.

So much so that in an attempt to meet the demands of the AI market, memory vendors have been favouring HBM production over standard modules, which is why we're in the current DRAM crisis in the first place. It's been estimated that as much as $2 trillion will be globally invested into all things AI-related by the end of 2026, so it's not hard to see how this has all come about.

The previous US administration relied on its CHIPS Act to woo South Korean firms into investing more in their US operations, with both Samsung and SK hynix receiving billions in the form of grants and loans, though neither firm manufactures the chips that are ultimately used in DRAM sticks or HBM modules in America, just packaging (putting all the dies into a useable form).

As to whether the threat of import levies garners any further investment from non-US memory makers, in addition to that already agreed to in last year's trade talks, it's too early to tell. But if the US government believes that it works, then we certainly haven't heard the last of 100% or more tariffs.