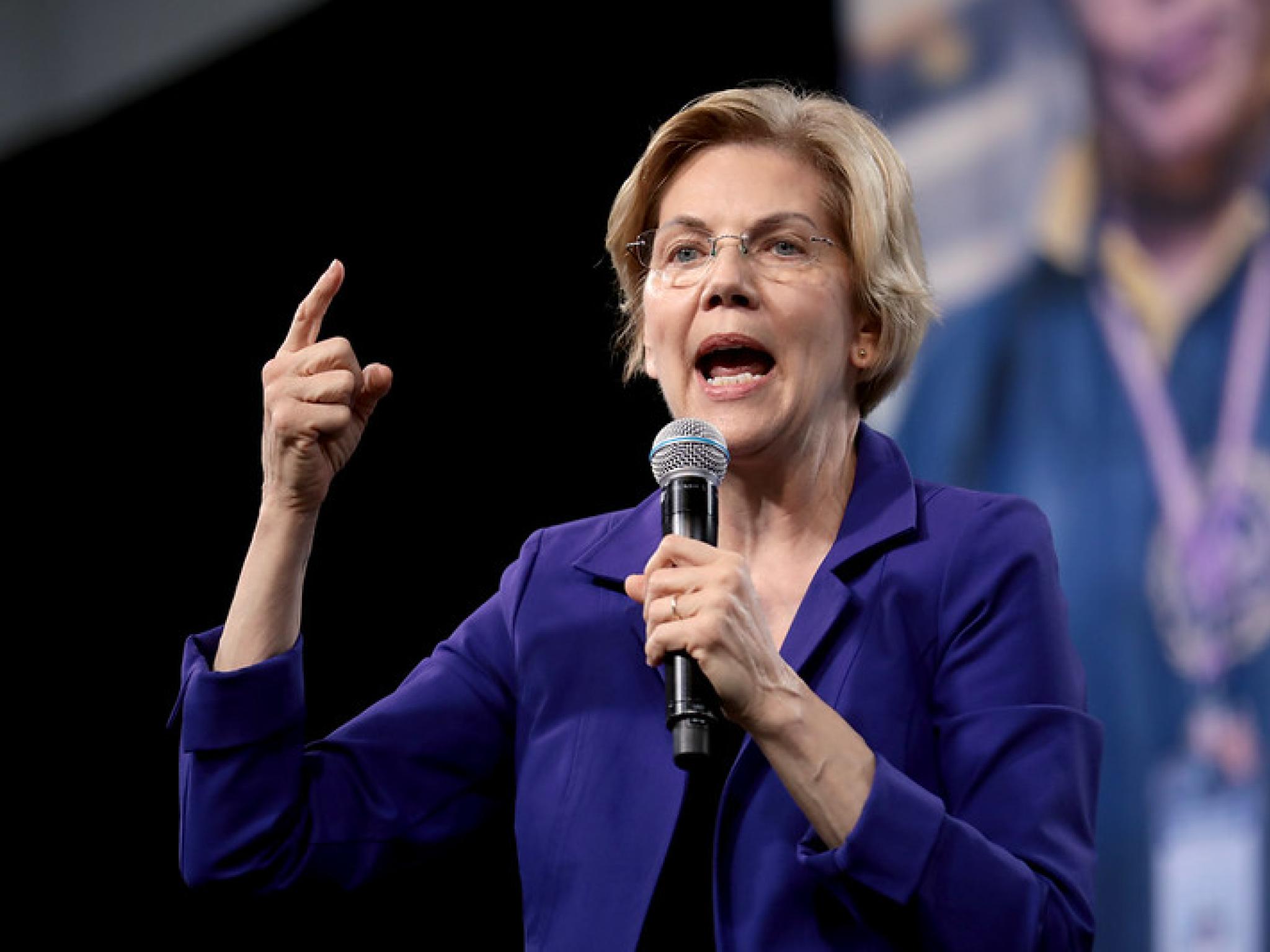

Sen. Elizabeth Warren (D-Massachusetts) is calling on Fidelity Investments to explain its decision to allow its investors to add Bitcoin (CRYPTO: BTC) to their 401(k) retirement accounts.

What Happened: Warren and Sen. Tina Smith (D-Minnesota) sent a letter to Fidelity CEO Abigail Johnson expressing concern about the company’s new Digital Assets Account, which allows investors to have a portion of their retirement savings allocated to Bitcoin through their 401(k) plan. The senators claim Fidelity ignored a U.S. Department of Labor warning to 401(k) plan fiduciaries to exercise “extreme care” when deciding to include cryptocurrency as an investment vehicle.

“Investing in cryptocurrencies is a risky and speculative gamble, and we are concerned that Fidelity would take these risks with millions of Americans’ retirement savings,” the senators wrote, adding that “Bitcoin’s volatility is compounded by its susceptibility to the whims of just a handful of influencers. Elon Musk’s tweets alone have led to Bitcoin value fluctuations as high as 8%. The high concentration of Bitcoin ownership and mining exacerbates these volatility risks. One study estimates that just 10% of Bitcoin miners are responsible for processing 90% of Bitcoin transactions and that 1,000 individuals control 3 million Bitcoins – about 15% of the current Bitcoin supply.”

See Also: Biden And Trump Readying For 2024 Rematch, But Who Will Announce First?

What Else Happened: The senators also questioned if the company had a conflict of interest because it was involved in crypto mining.

“Despite a lack of demand for this option – only 2% of employers expressed interest in adding cryptocurrency to their 401(k) menu – Fidelity has decided to move full speed ahead with supporting Bitcoin investments,” they said.

The senators gave Fidelity until May 18 to answer questions regarding risks related to cryptocurrency and whether this offering posed a conflict of interest.

The Wall Street Journal reported Fidelity responded to the senators’ concerns via an emailed statement.

“As a Massachusetts-based company with a proven 75-plus-year history of doing what’s in the best interest of our customers, we look forward to continuing our respectful dialogue with policy makers to responsibly provide access with all appropriate consumer protections and educational guidance for plan sponsors as they consider offering this innovative product,” the company said. “Consistent with our ongoing dialogue with regulators and policy makers, we will respond directly.”

Photo by Gage Skidmore / Flickr Creative Commons