Valued at a market cap of $60.4 billion, Sempra (SRE) is an energy infrastructure company that owns and operates regulated electric and natural gas utilities. The San Diego, California-based company is ready to announce its fiscal Q4 earnings for 2025 in the near future.

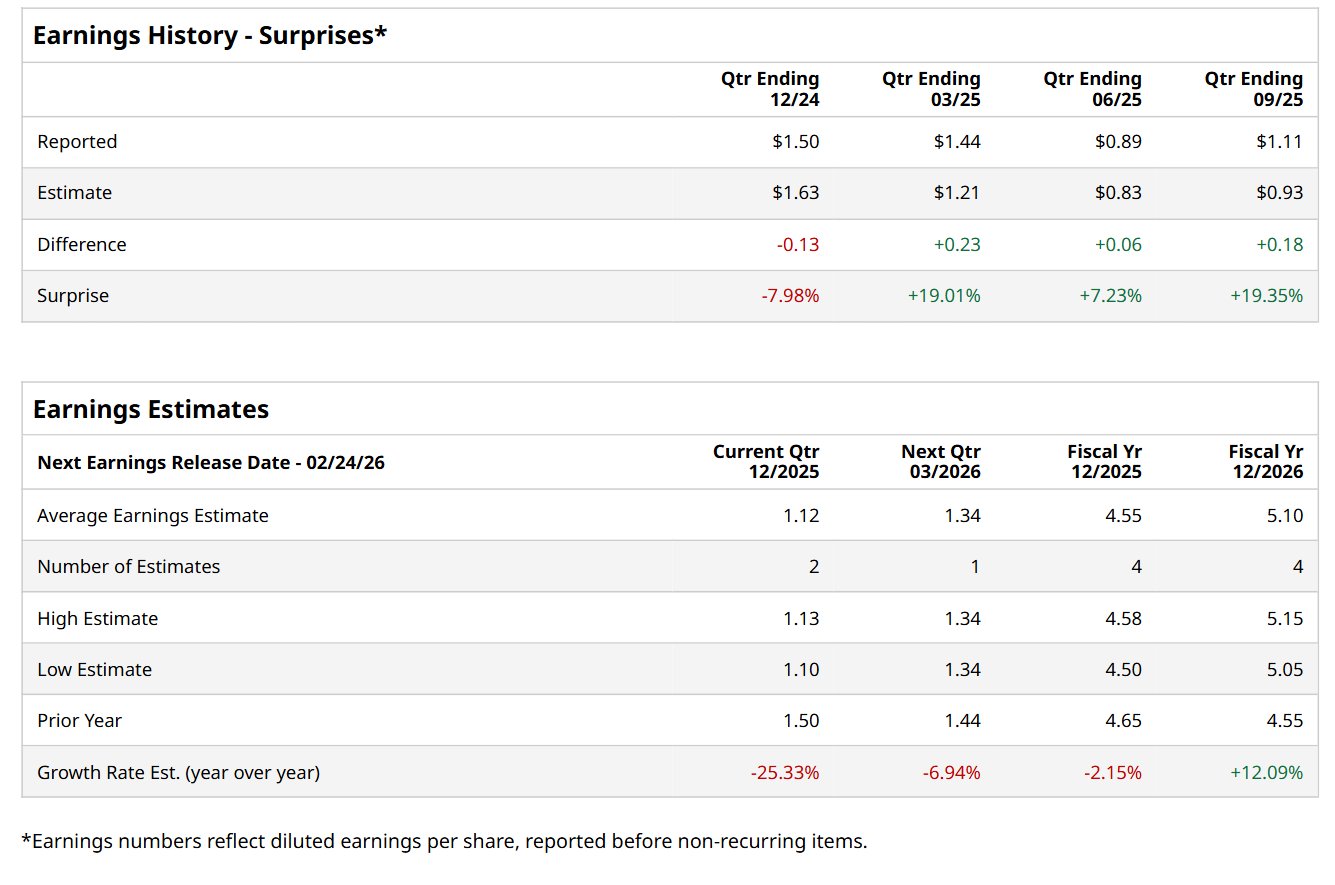

Before this event, analysts expect this utility company to report a profit of $1.12 per share, down 25.3% from $1.50 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $1.11 per share in the previous quarter topped the consensus estimates by 19.4%.

For the current fiscal year, ending in December, analysts expect SRE to report a profit of $4.55 per share, down 2.2% from $4.65 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 12.1% year-over-year to $5.10 in fiscal 2026.

SRE has gained 10.2% over the past 52 weeks, underperforming the S&P 500 Index's ($SPX) 16.9% return over the same time frame but coming in line with the State Street Utilities Select Sector SPDR ETF’s (XLU) 10.2% uptick over the same time period.

On Nov. 5, shares of SRE plunged marginally after reporting its Q3 results. The company’s revenue increased 13.5% year-over-year to $3.2 billion, while its adjusted EPS grew 24.7% from the year-ago quarter to $1.11 and came in 19.4% ahead of analyst estimates. Strong growth in its natural gas and electric revenues supported its performance.

Wall Street analysts are moderately optimistic about SRE’s stock, with a "Moderate Buy" rating overall. Among 18 analysts covering the stock, 10 recommend "Strong Buy," one advises a "Moderate Buy,” and seven indicate "Hold.” The mean price target for SRE is $101, indicating a 9.1% potential upside from the current levels.