PVH (NYSE:PVH) will release its quarterly earnings report on Wednesday, 2024-12-04. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate PVH to report an earnings per share (EPS) of $2.57.

The announcement from PVH is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

Performance in Previous Earnings

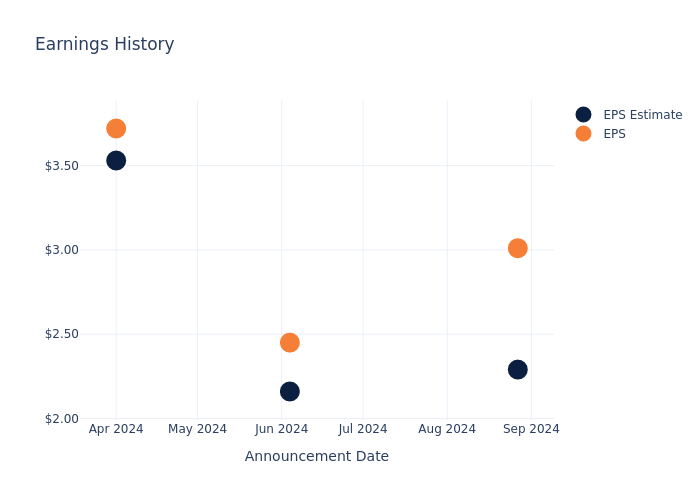

The company's EPS beat by $0.72 in the last quarter, leading to a 6.42% drop in the share price on the following day.

Stock Performance

Shares of PVH were trading at $111.17 as of December 02. Over the last 52-week period, shares are up 6.29%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on PVH

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on PVH.

PVH has received a total of 4 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $110.5, the consensus suggests a potential 0.6% downside.

Comparing Ratings Among Industry Peers

In this comparison, we explore the analyst ratings and average 1-year price targets of Kontoor Brands, Levi Strauss and Columbia Sportswear, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Kontoor Brands is maintaining an Buy status according to analysts, with an average 1-year price target of $97.86, indicating a potential 11.97% downside.

- The consensus outlook from analysts is an Buy trajectory for Levi Strauss, with an average 1-year price target of $24.57, indicating a potential 77.9% downside.

- The consensus among analysts is an Neutral trajectory for Columbia Sportswear, with an average 1-year price target of $84.0, indicating a potential 24.44% downside.

Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Kontoor Brands, Levi Strauss and Columbia Sportswear, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| PVH | Neutral | -6.01% | $1.25B | 3.08% |

| Kontoor Brands | Buy | 2.39% | $299.51M | 19.49% |

| Levi Strauss | Buy | 0.38% | $910.70M | 1.08% |

| Columbia Sportswear | Neutral | -5.47% | $467.56M | 4.99% |

Key Takeaway:

PVH ranks at the top for Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Delving into PVH's Background

PVH designs and markets branded apparel in more than 40 countries. Its key fashion categories include men's dress shirts, ties, sportswear, underwear, and jeans. Its two designer brands, Calvin Klein and Tommy Hilfiger, now generate practically all its revenue after its recent disposition of most of its smaller brands. PVH operates e-commerce sites and about 1,500 stores, licenses its brands to third parties, and distributes its merchandise through department stores and other wholesale accounts. The firm traces its history to 1881 and is based in New York City.

Financial Insights: PVH

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: PVH's revenue growth over a period of 3 months has faced challenges. As of 31 July, 2024, the company experienced a revenue decline of approximately -6.01%. This indicates a decrease in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: PVH's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 7.62%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of 3.08%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): PVH's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.43%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.69.

To track all earnings releases for PVH visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.