/Otis%20Worldwide%20Corp%20company%20sign-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Farmington, Connecticut-based Otis Worldwide Corporation (OTIS) manufactures, installs, and services elevators and escalators. Valued at a market cap of $34.4 billion, the company is scheduled to announce its fiscal Q4 earnings for 2025 before the market opens on Wednesday, Jan. 28.

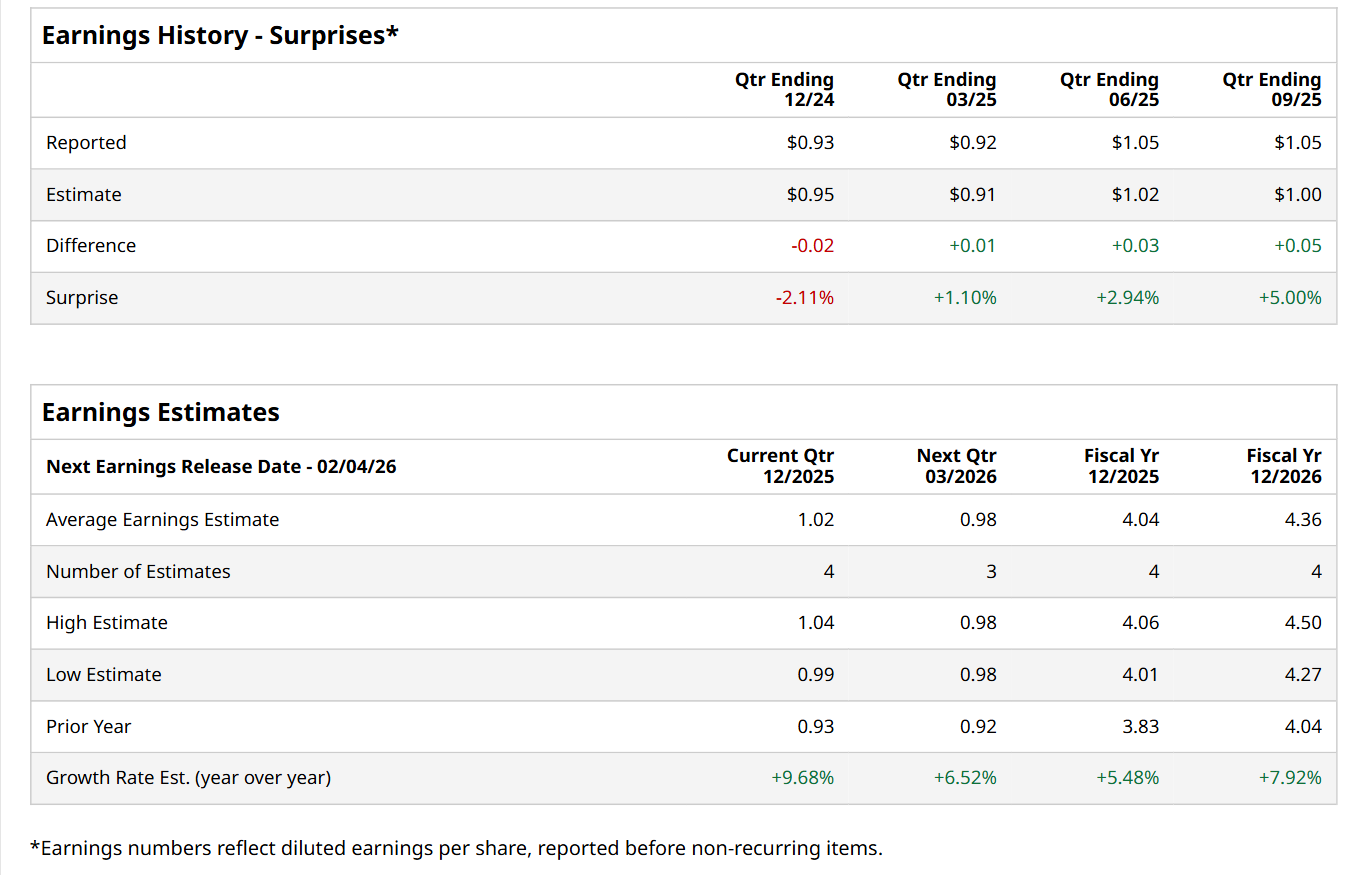

Ahead of this event, analysts expect this industrial company to report a profit of $1.02 per share, up 9.7% from $0.93 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion. Its earnings of $1.05 per share in the previous quarter exceeded the forecasted figure by 5%.

For the current fiscal year, ending in December, analysts expect OTIS to report a profit of $4.04 per share, up 5.5% from $3.83 per share in fiscal 2024. Furthermore, its EPS is expected to grow 7.9% year-over-year to $4.36 in fiscal 2026.

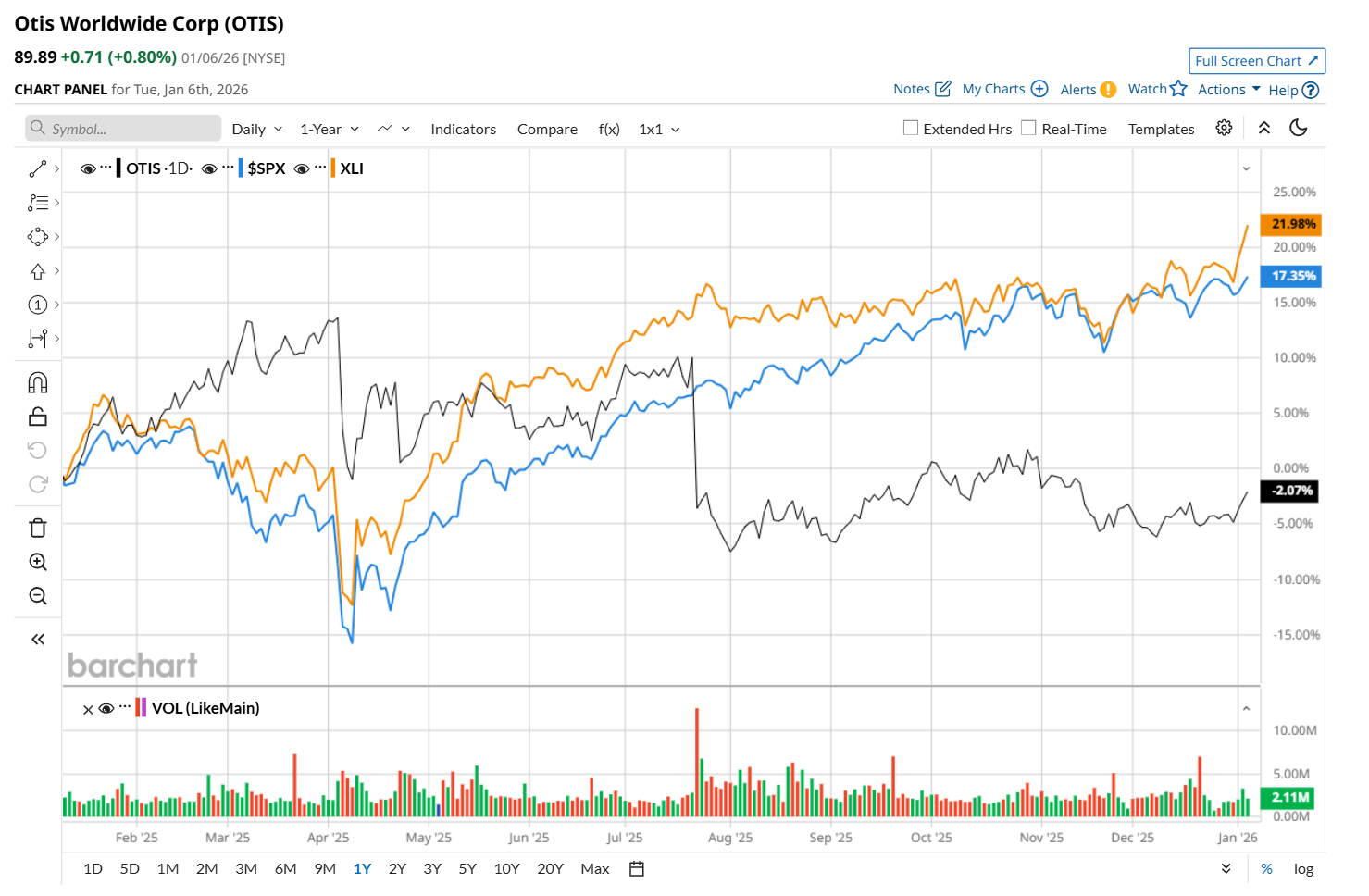

OTIS has declined 2.6% over the past 52 weeks, considerably underperforming both the S&P 500 Index's ($SPX) 16.2% return and the State Street Industrial Select Sector SPDR ETF’s (XLI) 22.3% uptick over the same time period.

On Oct. 29, shares of OTIS surged 2.3% after the company delivered better-than-expected Q3 results. Strong organic service-sales growth and notable expansion in service operating margins contributed to its upbeat results. Overall, the company’s net sales increased 4% year over year to $3.7 billion, beating consensus estimates by 1.1%, while its adjusted EPS grew 9.4% from the prior-year quarter to $1.05, coming in 5% ahead of analyst expectations.

Wall Street analysts are moderately optimistic about OTIS’ stock, with a "Moderate Buy" rating overall. Among 13 analysts covering the stock, five recommend "Strong Buy," one indicates a “Moderate Buy,” six suggest "Hold,” and one advises a “Strong Sell.” The mean price target for OTIS is $103.20, indicating a 14.8% potential upside from the current levels.