Former NFL player Rob Gronkowski stated that his most successful investment to date was buying shares of Apple Inc. (NASDAQ:AAPL) a decade ago.

What Happened: Gronkowski shared in an interview with Fortune that his home builder advised him to invest in Apple back in 2014.

“The guy actually who built my house in Foxborough, he told me, ‘Hey buy Apple stock. I’m telling you that’s where it’s at,” Gronkowski recalled.

Following this advice, Gronkowski directed his financial advisor to buy $69,000 worth of Apple shares.

At the time of Gronkowski’s investment, Apple was gearing up to launch the iPhone 6, which eventually became a massive success. The tech giant also debuted its first Apple Watch the following year. Since the iPhone 6’s launch on Sept. 9, 2014, Apple’s stock has skyrocketed by over 900%. Consequently, a $69,000 investment on that day would be worth around $740,000 today.

Gronkowski confessed that he had overlooked his Apple shares for about two-and-a-half years, only to find out they were valued at approximately $250,000. He sold a portion of the shares and kept the rest.

“So I sell off the portion of the $69,000 I bought in and I have, now to this date, I have over $600,000 in Apple stock all because of the investment I made in 2014, having no idea what I was doing, but just listening to the guy that built my house here in New England so I appreciate that,” Gronkowski stated.

Gronkowski, a four-time Super Bowl champion, played for the New England Patriots and the Tampa Bay Buccaneers during his 11-season NFL career. He accumulated about $70 million during his tenure in the league.

Why It Matters: Apple is now facing modest growth as the smartphone market rebounds, with global shipments expected to rise by 6.2% year-over-year in 2024. However, this growth is anticipated to slow down to low single-digit figures from 2025 onwards.

Tim Cook-led tech giant is facing new competition from Huawei’s advances in domestic chip technology, despite ongoing U.S. sanctions. The Chinese tech giant’s increasing market share in China, where consumer demand is rising, poses a potential threat to Apple’s position in the global smartphone market.

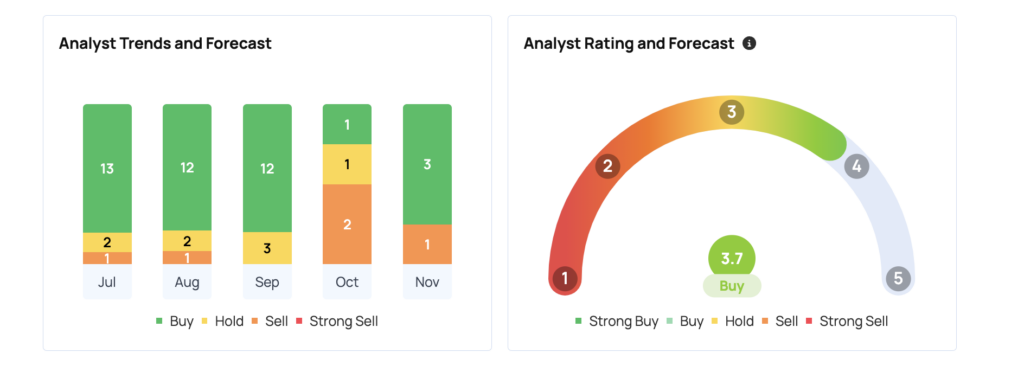

According to data from Benzinga Pro, Apple has a consensus price target of $242.26, based on ratings from 31 analysts. The latest ratings were issued by Morgan Stanley, Maxim Group, and Barclays on Nov.25 and Nov. 1 (for both Maxim and Barclays). These three analysts have an average price target of $224, indicating a potential downside of -4.76% for the company based on their projections.

Price Action: Apple stock closed flat on Wednesday at $234.93 apiece. Banks, post offices, shipping services, stock markets and all the other over-the-counter markets like bond markets will be closed on Thursday for Thanksgiving.

Read Next:

Image via Shutterstock