Financial giants have made a conspicuous bullish move on Marvell Tech. Our analysis of options history for Marvell Tech (NASDAQ:MRVL) revealed 11 unusual trades.

Delving into the details, we found 63% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $277,600, and 7 were calls, valued at $323,945.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $88.0 and $110.0 for Marvell Tech, spanning the last three months.

Volume & Open Interest Development

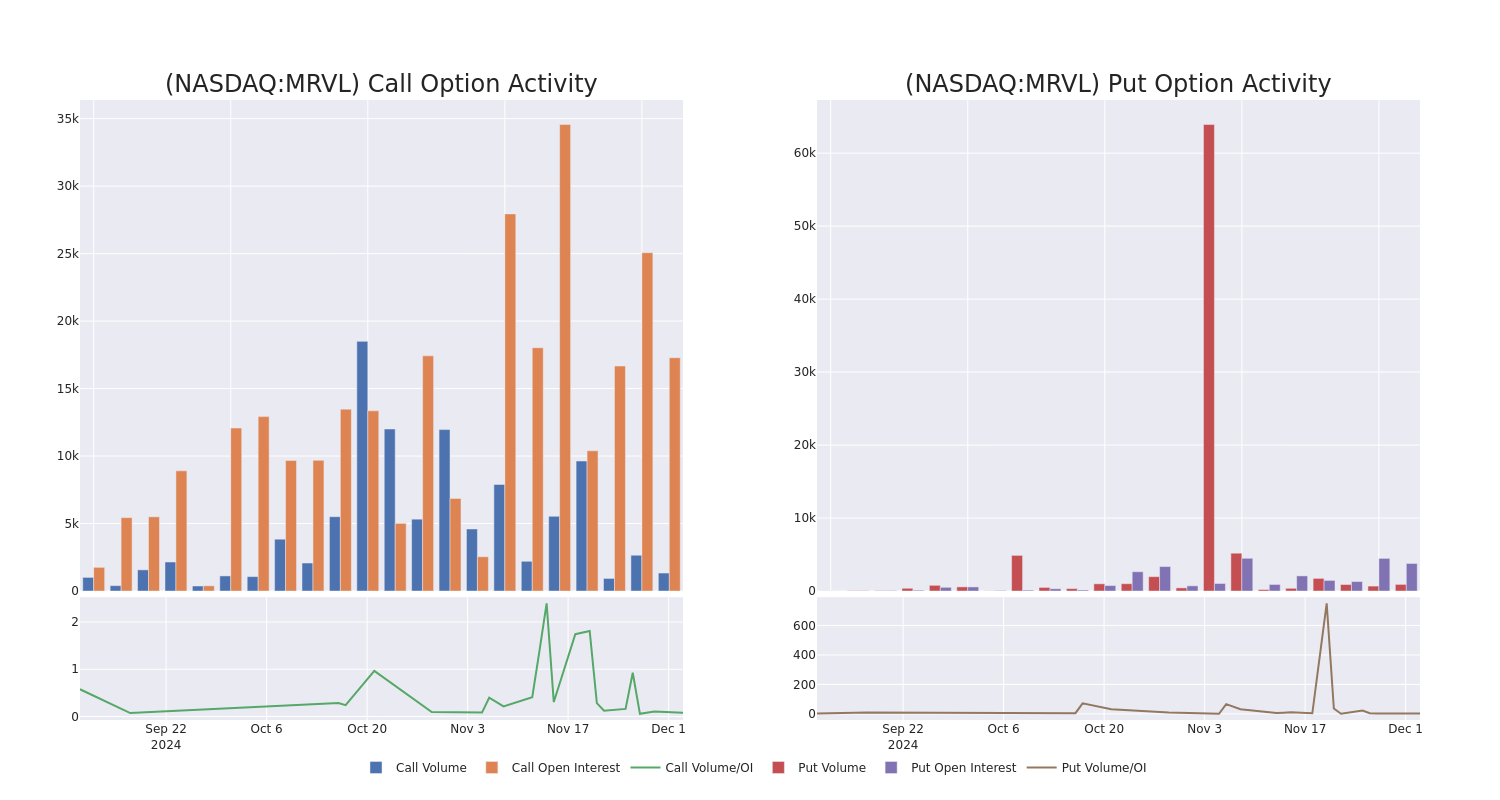

In today's trading context, the average open interest for options of Marvell Tech stands at 2340.56, with a total volume reaching 2,244.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Marvell Tech, situated within the strike price corridor from $88.0 to $110.0, throughout the last 30 days.

Marvell Tech Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRVL | PUT | TRADE | BULLISH | 03/21/25 | $6.4 | $6.2 | $6.2 | $90.00 | $186.0K | 2.0K | 300 |

| MRVL | CALL | TRADE | BEARISH | 12/20/24 | $7.15 | $6.5 | $6.5 | $96.00 | $65.0K | 152 | 100 |

| MRVL | CALL | SWEEP | BULLISH | 01/17/25 | $11.65 | $11.4 | $11.56 | $90.00 | $57.9K | 5.4K | 86 |

| MRVL | CALL | TRADE | BEARISH | 12/06/24 | $7.15 | $5.6 | $5.7 | $95.00 | $57.0K | 2.6K | 103 |

| MRVL | CALL | TRADE | BEARISH | 02/21/25 | $4.55 | $4.5 | $4.5 | $110.00 | $40.0K | 4.3K | 142 |

About Marvell Tech

Marvell Technology is a fabless chip designer focused on wired networking, where it has the second-highest market share. Marvell serves the data center, carrier, enterprise, automotive, and consumer end markets with processors, optical and copper transceivers, switches, and storage controllers.

Having examined the options trading patterns of Marvell Tech, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Marvell Tech

- Currently trading with a volume of 2,844,889, the MRVL's price is up by 1.02%, now at $97.85.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 0 days.

Professional Analyst Ratings for Marvell Tech

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $109.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Marvell Tech, targeting a price of $122. * An analyst from Susquehanna persists with their Positive rating on Marvell Tech, maintaining a target price of $110. * An analyst from Wells Fargo persists with their Overweight rating on Marvell Tech, maintaining a target price of $110. * In a cautious move, an analyst from Loop Capital downgraded its rating to Hold, setting a price target of $95. * An analyst from Oppenheimer has decided to maintain their Outperform rating on Marvell Tech, which currently sits at a price target of $110.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Marvell Tech options trades with real-time alerts from Benzinga Pro.