Billionaire Mike Cannon-Brookes has claimed control of the controversial Sun Cable solar export project in the Northern Territory over his former project partner Andrew "Twiggy" Forrest.

Meanwhile ASIC has ordered buy now, pay later provider Humm to stop signing new customers under an interim order "in relation to concerns regarding the target market determination".

Look back on the day's financial news and insights as they happened with our blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

How the market finished at 4:20pm AEST

By Kate Ainsworth

- ASX 200: +0.2% to 7,154 points

- All Ordinaries: +0.3% to 7,334 points

- Australian dollar: +0.2% at 65.16 US cents

- Nikkei: +0.5% to 30,942 points

- Hang Seng: -1.9% to 18,746 points

- Shanghai: +0.3% to 3,210 points

- S&P 500: +0.9% to 4,151 points

- Nasdaq: +1.7% to 12,698 points

- FTSE: -0.7% to 7,570 points

- EuroStoxx: -0.3% to 456 points

- Spot gold: +0.4% to $US1,947/ounce

- Brent crude: -0.2% to $US76.13/barrel

- Iron ore: $US95.50/tonne

- Bitcoin: -0.4% to $US26,387

ASX suffers worst week in two months despite last minute gains

By Kate Ainsworth

Amidst all the Sun Cable developments, the Australian share market finished slightly higher for the day, but still led to the worst weekly performance in two months.

The ASX finished up 0.2% to 7,154 points, but that wasn't enough to save it from previous losses at the end of trade every other day this week.

It wasn't just a bad day for the ASX though, with Fisher & Paykel Healthcare experiencing one of their worst days in two years, after bleak financial year results.

Here's the top five best performers of the day:

- Megaport +6.2%

- BrainChip +6.17%

- Costa Group +3.9%

- Altium +3.6%

- NEXTDC 3.5%

And the five companies that had the worst performance:

- Fisher & Paykel Healthcare -6.3%

- CSR -5.1%

- Block -4.8%

- New Hope -2.6%

- Monadelphous -2.4%

Looking ahead to next week and there's no shortage of big developments coming our way, with RBA governor Philip Lowe is at Senate Estimates on Wednesday — the same day as the latest inflation figures will be released.

The latest data on house prices will also be out later next week.

Thanks for your company throughout the day (and the whole week), we'll be back to do it all again bright and early on Monday.

You can catch up on today's developments below, or download the ABC News app and subscribe to our range of news alerts for the latest news.

The big banks have stopped trying to entice new customers — here's why

By Kate Ainsworth

As the Reserve Bank has been lifting rates, so too have the big banks — but now some are increasing their mortgage rates out of step with the RBA.

It signals the end to an era of incentives from the banks to entice new customers, and broadly shows a trend of banks ditching competitive practices in favour of restoring their sliding margins.

RateCity's research director Sally Tindall told Alicia Barry on The Business that new customers in particular don't have much of a choice when it comes to differences in mortgage rates.

If you missed it last night, you can catch up on their full chat below 👇

Andrew 'Twiggy' Forrest congratulates Mike Cannon-Brookes on Sun Cable decision

By Kate Ainsworth

Andrew Forrest has just shared a statement about the Sun Cable decision — you can read it in full below:

"Congratulations to Mike Cannon-Brookes – any project that takes the world closer to real zero is positive for the planet.

"While Squadron Energy (Mr Forrest's private entity) did not participate in the final binding bid process for Sun Cable, we are delighted that other investors like Grok are playing a role in tackling global warming, by replacing fossil fuel investment with green energy projects.

"Squadron decided the capital allocation did not align with Squadron's strategic goals, as we are already working to deliver 30 per cent of the renewable energy required to meet the Federal Government's target of 82% renewables by 2030 and want to bring new green electrons into the grid as soon as possible.

"We have decided to focus on the existing 20GW pipeline of assets as a much faster way to achieve those goals and take Australia closer to a carbon-free future.

"We remain unconvinced of the commercial viability of the Australia-Asia Powerlink but if others believe it can be achieved, we wish them all the best.

"As an interested shareholder we look forward to better understanding the details of the deal."

Sun Cable decision 'a big step in the right direction'

By Kate Ainsworth

Mike Cannon-Brookes has just released a statement about the decision for the billionaire to acquire Sun Cable and its assets.

Sun Cable's administrators have entered into a sale agreement with an entity connected to Cannon-Brookes's Grok Ventures.

In a joint statement released by Grok and Quinbrook, a specialist investor in renewables they said:

"We believe Sun Cable can achieve long-term success by delivering globally competitive electrons to Australia and the world. We will continue to pursue customer off-take agreements in Singapore and Darwin, and collaborate with the Singaporean and Northern Territory governments to achieve this mission.

"We are excited to do this with a group of old and new investors to Sun Cable, who bring significant experience to renewables project delivery, and who will assist management."

Cannon-Brookes said the decision was a "big step in the right direction".

"We've always believed in the possibilities Sun Cable presents in exporting our boundless sunshine, and what it could mean for Australia," he said.

"It's time to stretch our country's ambition. We need to take big swings if we are going to be a renewable energy superpower. So swing we will."

Not sure what Sun Cable is all about?

By Kate Ainsworth

Fear not — my colleague Emilia Terzon has done plenty of stories on this to get you up to speed.

She travelled to the outback Northern Territory town of Elliott, near the proposed site of the project.

You can read her very comprehensive story about the project and how it got to today's development here:

BREAKING: Mike Cannon-Brookes wins Sun Cable stoush over Andrew 'Twiggy' Forrest

By Kate Ainsworth

Mike Cannon-Brookes has claimed control of the controversial Sun Cable solar export project, winning a bidding war with his former project partner, Andrew Forrest.

The pair, who are among Australia's richest men, were in a closed door bidding process to wrestle control of the $30 billion dollar project Sun Cable.

Sun Cable's administrators say the company has entered into a sale agreement with an entity connected to Cannon-Brookes' Grok Ventures.

Under the multi-billionaire's control, it is likely the project will still pursue its original goal of exporting solar power from the outback of Australia to the island nation of Singapore.

Electricity to 'become a drag on inflation' in 2024

By Kate Ainsworth

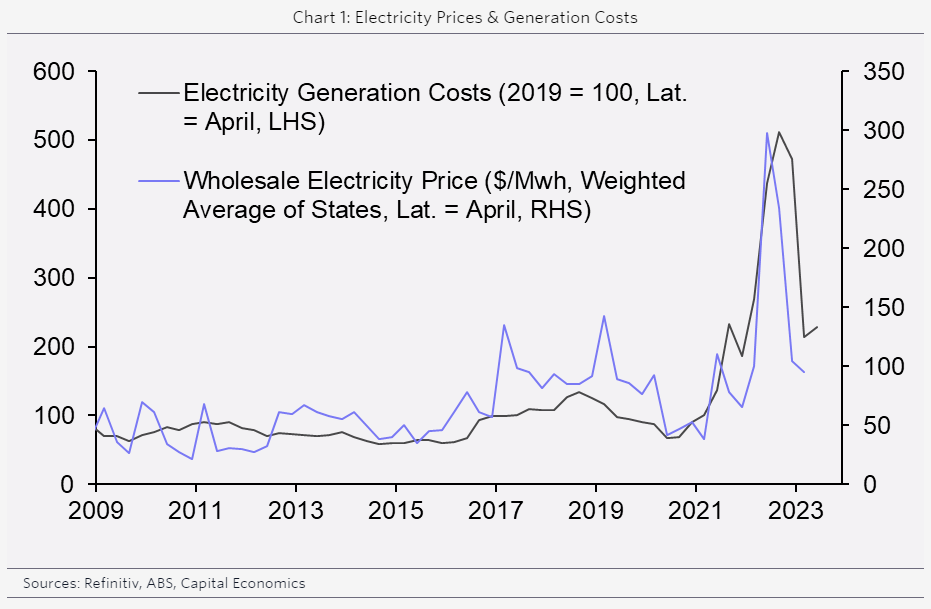

The analysts over at Capital Economics are certainly having a busy Friday — their head of Asia-Pacific economics Marcel Thieliant has published some analysis on electricity and how it will affect inflation.

He notes that electricity inflation will reach its highest level since the 1980s this year, but expects a big drop come 2024.

Why? He points to plunging costs of generating electricity.

I'll let him do the explaining:

"The broader scope of the federal [energy] rebates this time around means that we've pencilled in a 9% quarter-on-quarter fall in electricity prices in Q3. That would knock off 0.2%-pts from the quarterly rise in consumer prices and means that consumer prices may rise by just 0.8% quarter-on-quarter.

"However, we've pencilled in a 35% quarter-on-quarter jump in Q4 as the rebates will have run their course, which would boost consumer prices by 0.8%-pts.

"If we are right, annual electricity inflation would become the highest it has been since the early 1980s.

"However, we have pencilled in a 20% quarter-on-quarter fall in electricity prices in the third quarter of next year. As Chart 1 shows (below), wholesale electricity prices have fallen by two-thirds from their peak last year.

"Energy generation costs, which we calculate as a weighted average of thermal coal and wholesale gas prices, have more than halved, too.

"Either way, those large swings in electricity prices will almost certainly be stripped out of the trimmed mean CPI, the RBA's preferred measure of underlying inflation, and therefore won't have major implications for monetary policy."

Why are power bills rising when wholesale prices are falling?

By Kate Ainsworth

It was hard to miss yesterday, but the Australian Energy Regulator and Victoria's Essential Services Commission confirmed electricity price increases, which will take effect from July 1.

But wholesale prices are falling, which begs the question: why are power bills getting more expensive?

That's the question my colleague, business reporter Rhiana Whitson, endeavoured to answer last night (with the help of some energy experts).

You can hear their take on it below:

Latitude expecting a substantial hit to their profit after cyber attack

By Kate Ainsworth

Latitude has given its investors an update into its cyber attack back in March, saying it expects a half-yearly loss between $95 to $105 million as a result of the incident.

That includes a $53 million provision which accounts for costs associated with the cyber incident, including remediation costs. That figure however doesn't account for regulatory fines, potential class actions, future system changes or assumed insurance proceeds.

Latitude is now expecting a profit between $15 million and $25 million.

The company also says it has contacted all affected customers (past and present) impacted by the data breach, and there has been no suspicious activity in its systems since March 16.

The incident is also under investigation by the AFP, and Latitude says they're cooperating fully with the OAIC.

Latitude also says their regular business operations are now back online after around "five weeks" of delays.

(Sidenote, but if you're a Latitude customer and want to get in touch, I've done stories in the past couple of months on the breach. Feel free to send me an email at ainsworth.kate@abc.net.au or you can use the comment button above — I won't share them on the blog.)

PwC names close to being revealed

By Daniel Ziffer

The names of around 50 senior members of consulting firm PwC, the subject of intense political and media scrutiny, are edging closer to being known.

The names are noted in heavily-redacted emails about a plot to use secret government information to win clients by helping them avoid not-yet-created taxes. Those emails were released by a Senate committee earlier this month.

Just now, Greens Senator Barbara Pocock attempted to read the names at a Senate Estimates hearing. After a short recess she has held off, pending legal advice.

"Thank you to all here for their thoughtful consideration of this matter," she said at its resumption.

"I believe there's a strong public interest in those names of those involved in recent events in PwC being in the public realm, but I accept the decision and respect the decision that we've just made as a committee that we will seek the advice of the clerk and proceed accordingly.

"I believe that the truth and the names of people involved in this event will [come] out and I think that's it's important the Australian public have that knowledge sooner rather than later. Thank you."

Treasury has referred the former head of international tax at PwC Peter-John Collins to the Australian Federal Police for consideration of a criminal decision.

Australia has strict defamation laws, but things said in parliament and most courts are "protected speech" meaning they can be discussed and reported more freely.

ASX gaining modestly as industrials and healthcare stocks take a hit

By Kate Ainsworth

The Australian share market has risen slightly at lunch, making up from its initial falls this morning.

It's a mixed bag on the sectors front, with industrials and healthcare taking the biggest hits — they're down 1.52% and 0.8% respectively, and real estate has also fallen by 0.8%.

But there have been some gain in sectors too, with technology, utilities and academic services up.

Let's have a quick look at the top five movers:

- BrainChip +3.7%

- Domino's Pizza +3.3%

- Incitec Pivot +3.2%

- Nickel Industries +3%

- Altium +2.9%

Meanwhile the worst performers haven't changed too much since this morning:

- CSR -5.2%

- Fisher & Paykel Healthcare -5.2%

- Block -4.6%

- Allkem -2%

- Karoon Energy -2%

NSW, Victoria are experiencing a 'retail recession'

By Kate Ainsworth

Callam Pickering, Asia-Pacific economist at Indeed says the retail figures signal that NSW and Victoria are experiencing a "retail recession".

He says the retail figures show momentum has ground to a halt as cost of living pressures keep building in the economy.

"Given strong population growth and rising prices, it's clear that Australian households, on average, are consuming fewer retail products than they did last year," he said.

"High cost-of-living, rising mortgage rates and the sharp decline in inflation-adjusted wages will make things difficult for the retail sector over the remainder of the year. That will be partially offset by high immigration and low unemployment.

"We anticipate a considerable slowdown in household spending over the second half of the year."

He says looking at state and territory figures, two of Australians biggest states are in a recession when it comes to retail.

"Both New South Wales and Victoria are in a retail recession that began in the December quarter last year," he said.

"By comparison, spending in South Australia is booming and reached a record level in April, following events such as the AFL Gather Round."

How the market looks at 12:30pm AEST

By Kate Ainsworth

- ASX 200: +0.1% to 7,147 points

- All Ordinaries: +0.1% to 7,326 points

- Australian dollar: +0.1% at 65.10 US cents

- Nikkei: +0.8% to 31,059 points

- Hang Seng: -1.9% to 18,4746 points

- Shanghai: -0.4% to 3,188 points

- S&P 500: +0.9% to 4,151 points

- Nasdaq: +1.7% to 12,698 points

- FTSE: -0.7% to 7,570 points

- EuroStoxx: -0.3% to 456 points

- Spot gold: +0.4% to $US1,947/ounce

- Brent crude: -0.5% to $US75.91/barrel

- Iron ore: $US95.50 a tonne

- Bitcoin: -0.2% to $US26,426

Weak retail figures suggest RBA is 'done hiking interest rates'

By Kate Ainsworth

That's according to Capital Economics, who say the weak retail sales just released from the ABS strengthen the argument that the Reserve Bank of Australia has finished its current rate hiking cycle.

Marcel Thieliant from Capital Economics said the unchanged values were weaker than analysts had been expecting (which was a 0.2% rise).

He says that even if there are modest monthly rises in retail spending in May and June, there are signs that consumer spending is "running out of steam".

"What's more, April data point to a strong rise in vehicle sales this quarter. However, there are mounting signs that the recovery in services spending is running out of the steam, so overall consumer spending will remain sluggish this quarter," he wrote.

"Coupled with rising unemployment and lukewarm wage growth, that should prompt the Reserve Bank of Australia to keep interest rates unchanged over the coming months."

Retail sales flat in April as cost of living pressures mount

By Kate Ainsworth

Retail sales in Australia were unchanged in April, according to figures just released by the Australian Bureau of Statistics.

There has been a 0.2% and 0.4% rise in February and March respectively, but the total amount spent didn't change at all in April.

According to the ABS, Australians spent $35,626,000,000 in April.

The ABS's head of price statistics, Ben Dorber, says the data is proof that Australians are feeling the pinch of cost of living pressures.

"Retail turnover has plateaued over the last six months as consumers spent less on discretionary goods in response to cost-of-living pressures and rising interest rates," he said.

"Spending was again soft in April but was boosted by increased spending on winter clothing in response to cooler and wetter than average weather across the country."

Household goods retailing suffered the biggest drop, down 1%, while cafes, restaurants and takeaway food dipped 0.2%.

Food retailing also fell by 0.1% — the first fall after 13 straight months of rises.

Clothing, footwear and personal accessories gained 1.9%, and department stories were up 1.5%.

"The modest fall in food-related spending comes after a period of consistent growth driven largely by high food inflation," Mr Dorber said.

"Spending at cafes, restaurants and takeaway food services remains at a particularly high level despite the fall in April, with turnover up 13.3% compared to this time last year."

"Spending has also been boosted by the return of large-scale sporting and cultural events."

No change to interest rates at RBA's next meeting, Commonwealth Bank says

By Kate Ainsworth

We're less than a fortnight away from the next RBA meeting, and what they will decide to do with the cash rate.

But new analysis from the Commonwealth Bank suggests it's likely we won't see another rate rise.

How likely? They're giving it a 90% chance of no change, and a 10% chance of a 0.25 percentage point increase (which would take the cash rate to 4.1%).

CBA's head of economics Gareth Aird says there are a couple of reasons behind their thinking:

"Another rate increase would require the economic data, particularly around inflation, GDP, the unemployment rate and wages/unit labour costs, to come in stronger than the RBA's updated forecasts.

"Put another way, we do not think the RBA will lift the cash rate again if the economic data prints in line or weaker than their forecasts from the May Statement on Monetary Policy (SMP).

"Since the May Board meeting the main economic data that will feed into policy deliberations at the June Board meeting has come in slightly weaker than the RBA's latest forecasts.

"The 2023 May Commonwealth Budget has also been handed down since the May Board meeting. And our assessment is that it does not add to inflationary pressures in the economy.

"The run of recent data coupled with our take on the Commonwealth Budget means at this juncture we do not think the June Board meeting is 'live'."

Of course, this is just a prediction — but CBA was the only one of the big four banks to correctly call the shock rise this month.

(And while I'm talking about the RBA, we can expect to hear more about the bank's decisions and thinking when governor Philip Lowe appears at Senate Estimates next Wednesday...)

Coming up: ABS retail trade figures

By Kate Ainsworth

If you're into economic data, we'll have some coming your way a little later this morning.

The ABS will release its monthly and quarterly retail trade figures at 11:30am, which follows quarterly data released earlier this month which showed Australia was in a "consumer recession".

I'll bring you that data, and any analysis about what it means for the economy from experts when it comes through.

In the meantime, if you want to learn more about the "consumer recession" we're experiencing, David Taylor has you covered 👇

How the market looks at 10:40am

By Kate Ainsworth

- ASX 200 : -0.1% to 7,143 points

- All Ords: -0.1% to 7,312 points

- Australian dollar: -0.2% to 64.97 US cents

- Dow Jones: -0.1% to 32,764 points

- S&P 500: +0.9% to 4,151 points

- Spot gold: flat at $US1,939.89/ounce

- Brent crude: flat at $US76.23/barrel

- Iron ore: $US95.50 a tonne

- Bitcoin: -0.1% at $US26,451

ASX opens lower as Fisher & Paykel's profit and revenue falls

By Kate Ainsworth

The Australian share market has opened slightly lower on Friday morning, down 0.1% as of 10:30am AEST, sitting at 7,143 points.

Fisher & Paykel has suffered the biggest loss so far, after the company disclosed its profit and revenue has fallen for the 2023 Financial Year, but the company says it's "on track" to return to more normal conditions after COVID-19.

That's also resulted in a big dip in the healthcare sector, which is down 0.5%.

As for other sectors, only utilities and basic materials are in positive territory (and even then, they're only just in the green), while all others are in the red.

The top five companies gaining ground so far are:

- BrainChip +3.7%

- Liontown Resources +1.9%

- Incitec Pivot +1.4%

- Fortescue Metals +1.2%

- Domino's Pizza +0.8%

And the companies who have suffered the biggest losses:

- Fisher & Paykel Healthcare -5%

- CSR -4.9%

- Allkem -2%

- Lifestyle Communities -1.7%

- Mirvac -1.3%