Retail theft has hit record levels as inflation soars and real wages deteriorate, hitting the share price of supermarket giants, but strong gains from miners kept the ASX in positive territory.

Disclaimer: this blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Global markets update

By Gareth Hutchens

As of 4.30pm AEDT:

- ASX200: +0.052%, to 7,255.4 points (close)

- Hang Seng: -0.74%, to 20,468 points

- Nikkei: +0.01%, to 27,518 points

- Australian dollar: US$0.6735 (-0.35%)

- New Zealand dollar: US$0.6223 (-0.64%)

Signing off

By Gareth Hutchens

That's it from me today.

Thanks for having me and we'll see you again tomorrow.

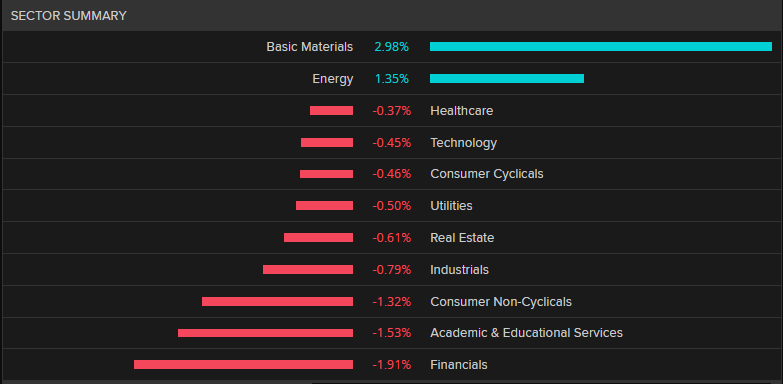

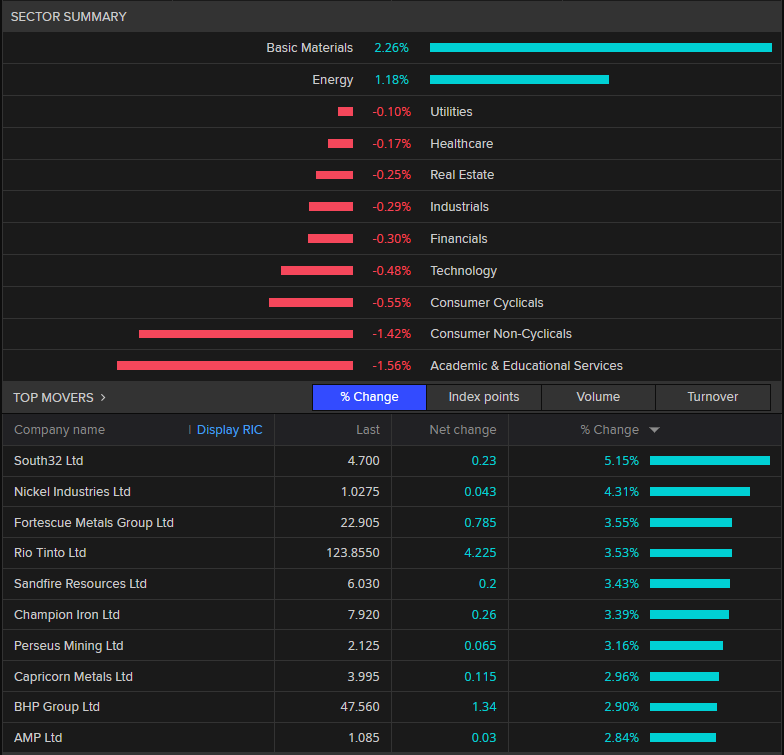

Sector summary

By Gareth Hutchens

If it wasn't for basic materials and energy stocks, the market would have had a much worse day.

One the 200 stocks on the ASX, 119 lost value and 4 were unchanged. Only 77 gained some value.

Nouriel Roubini warns of a 'great stagflationary debt crisis'

By Michael Janda

Nouriel Roubini is an economic guru of doom of global renown.

The Professor Emeritus at New York University's Stern School of Business was one of those who sounded warning bells ahead of the global financial crisis.

Now he's warning of a looming "great stagflationary debt crisis" as global central banks are forced to keep raising rates even as their economies start grinding to a halt (is any of this sounding familiar to you, with the Reserve Bank due to meet again next week?).

"I think that the Fed funds rate will have to be certainly above 6% to achieve a 2% inflation target. But if you raise interest rates to 6%, then you're gonna have a real hard landing, then you'll have also a crash in financial markets, you'll have a severe correction of equity markets, you'll have bonds going higher, you'll have credit spreads for borrowing by the private sector rising, so you'll have severe financial distress. That financial distress is going to make the recession more severe, and a more severe recession by having a contraction of income and output is going to increase the number of defaults by households, businesses, corporates, and even some financial institutions and some governments in poor countries that have serious debt problems."

Professor Roubini says today's debt levels make the prospect of stagflation far more dangerous than it was when it wreaked economic havoc in the 1970s.

"The debt ratio in advanced economies was only 100% of GDP [in the 1970s], today it is 420% of GDP, in private and public debt. So, in this case, if we have those shocks to say all prices, not only you get inflation, not only get recession and stagflation, but you get what I call a great stagflationary debt crisis, because with interest rates so high, then that ratio has become unsustainable.

"Now we're facing the perfect storm — inflation, recession, stagflation and a potential debt crisis."

You can watch the interview with Nouriel Roubini tonight on The Business with Alicia Barry at 8:45pm AEDT on ABC News Channel, or on iView or YouTube.

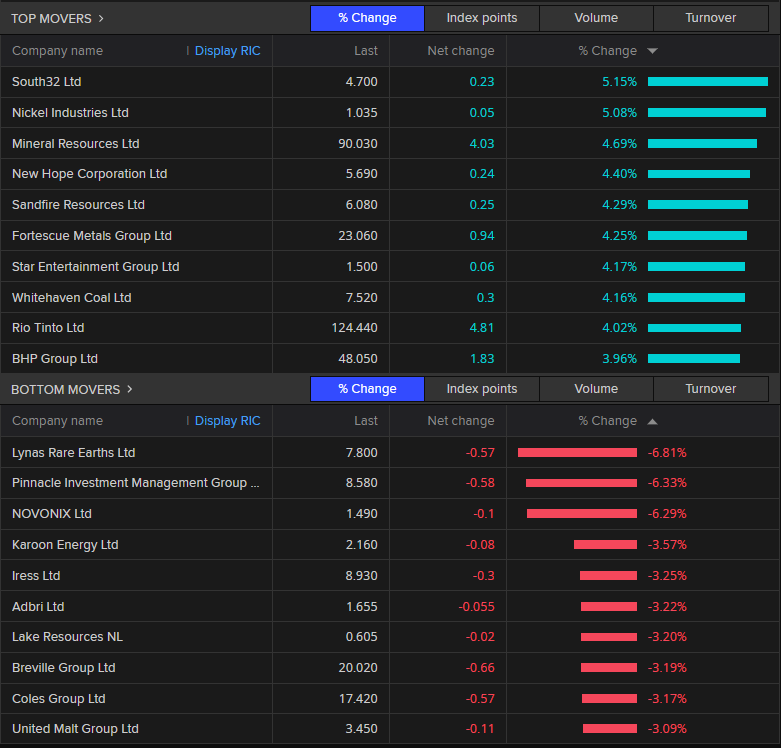

Miners dominate gains

By Gareth Hutchens

Here are the 10 best performers and 10 worst performers

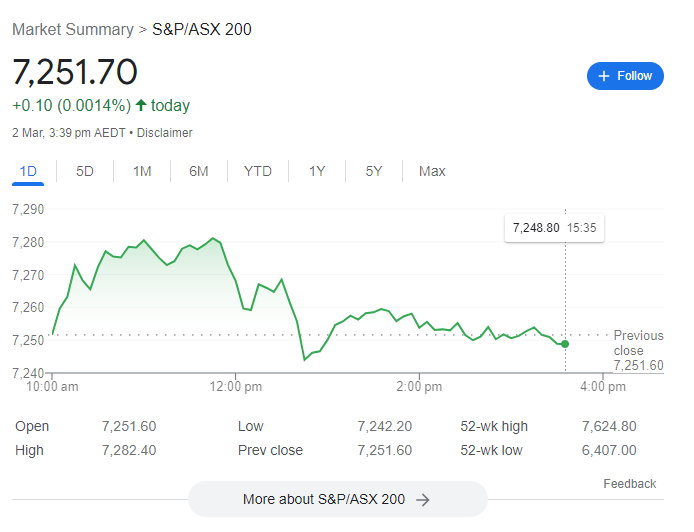

Trades settle with market barely in positive territory

By Gareth Hutchens

With trades settling for the day, it looks like the ASX only just managed to make some gains today.

The index has closed on 7,255.4 points, up 0.052%, or 3.8 points.

Holding on with fingernails

By Gareth Hutchens

There's less than 30 minutes of trading left today, and the ASX is barely in positive territory.

It's been dipping in and out of negative territory this afternoon and at this point it's just 0.0014% higher than yesterday's close.

Retail theft soars as inflation bites

By Gareth Hutchens

Theft from grocery stores is increasing as high inflation, a record deterioration in real wages, and aggressive consecutive rate hikes from the Reserve Bank put pressure on household incomes.

Record retail theft puts pressure on Australia's supermarket giants

By Gareth Hutchens

What's happening to the supermarket giants today?

Coles shares have lost 3.34% in value, to $17.40, and Woolworths has shed 1.59% in value, to $36.18.

This Reuters story may have something to do with it:

Retail theft has hit record levels in Australia, government statistics show, putting pressure on grocery giants Woolworths Group Ltd and Coles Group Ltd that are already struggling with soaring supply costs and freight blockages.

Store theft rose 23.7% in New South Wales, the home state of a third of Australians, from 2021 to 2022, state government figures showed on Thursday, the fastest year-on-year increase since records began in 1995.

Queensland, Australia's third-largest state, had the highest monthly rate of shop stealing on record this January, according to publicly available police data. Neither state's data specified which retailers reported theft.

The data underscores concerns raised by analysts and social researchers that surging living costs - from grocery shelf prices to power bills to mortgages - will drive up crime.

That may impact profit at Woolworths and Coles, which together ring up two-thirds of Australian grocery sales and noted rising store theft in trading updates last month.

"We would see a risk that that continues to rise if and when we start to see an increase in unemployment and tougher economic conditions," said Craig Woolford, a retail analyst at MST Marquee.

"Supermarkets operate on very thin profit margins. You only need a small change in the stock loss to have an impact on profitability," he added. Supermarkets refer to goods lost to theft, expiry or payment error as stock losses.

Woolworths and Coles declined to comment.

On a Feb. 22 earnings call with analysts, Coles Chief Operating Officer Matt Swindells said the company was experiencing "elevated theft" and was investing in staff training and technology to counteract it.

Australia's jobless rate rose in January to its highest since May after nine interest rate rises that are designed to slow inflation, currently running near 8%.

"High inflation plus interest rate increases are good candidate explanations for an increase in theft from retail outlets," said Roger Wilkins, deputy director of the Melbourne Institute of Applied Economic and Social Research, part of University of Melbourne.

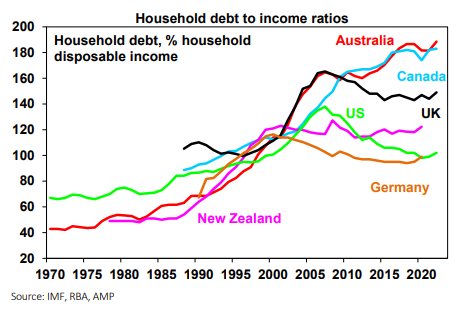

Mortgage stress in Australia - worse than people think

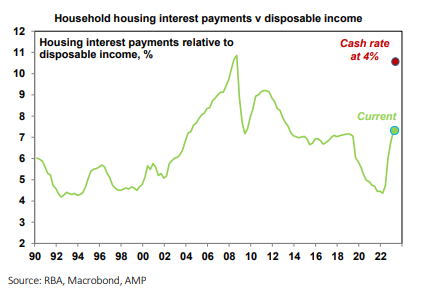

By Gareth Hutchens

Diana Mousina, a senior economist at AMP, has put out a special note on the level of mortgage stress in Australia.

She says Australian household debt as a share of income is sitting around a record high at 189% of income, which is significantly above most of our global peers, and the majority of this debt is in housing.

"This makes Australian households vulnerable to changes in home prices and interest rates, with the risk of mortgage stress increasing as home prices fall and interest rates are increased," she says.

She says a significant increase in mortgage repayments due to higher interest rates is the biggest risk to household spending in 2023.

Household interest costs (as a share of income) reached a bottom of 4.4% in March 2022 thanks to the decline in interest rates over the pandemic, but they've and have now increased to around 7% (however, that measure also includes households that don't have a mortgage, so it dilutes the impact for indebted households).

She says the average household in Australia has a mortgage of around $600,000 (across variable and fixed loans). As a rough guide, monthly mortgage repayments are due to increase by around $13,000 per year if we account for the full increase in the cash rate so far (by 325 basis points).

But that's underestimating the increase in mortgage servicing costs that will hit households in coming months.

She says variable mortgage holders (70% of loans outstanding) will see repayments changing around 3 months after the RBA adjusts the cash rate and fixed mortgage holders (30% of outstanding loans) are only impacted when the loan term expires, with most fixed loans set for 2-3 years in Australia.

She says the majority of the interest rate impact on mortgaged households will happen this year, as around 880,000 fixed loans expire in the next 12 months and reset to mortgage interest rates that are 2-3 times higher.

Look where things could head (assuming the cash rate hits 4%).

There are other parts to her analysis, but her conclusion isn't great.

"We think that the downside risks to the household sector are greater than the RBA (and most commentators) are estimating," she says.

"In our view, the risk of mortgage stress lies with recent borrowers (those who have taken out loans between 2020 - mid 2022) which is around 62% of outstanding housing loans. These households have not had time to build prepayment buffers, have faced large declines in home prices, have had a very fast repricing of mortgage rates, are more likely to have taken out larger loans and were probably not stress tested for the current increase in interest rates."

Market update at 1.30pm (AEDT)

By Gareth Hutchens

- ASX 200: +0.11%, to 7,259 points

- Hang Seng: -0.72%, to 20,472 points

- Nikkei: -0.14%, to 27,479 points

- Australian dollar: US$0.67 (-0.21%)

- New Zealand dollar: US$0.62 (-0.48%)

Should you diversify, or just concentrate on a few stocks?

By Gareth Hutchens

When investing in the stock market, is it a good strategy to "diversify" your investments and spread your risk around?

It seems to make intuitive sense.

But the British economist John Maynard Keynes came to believe that that was the wrong thing to do.

He thought it was actually less risky to have a focused portfolio, where you restrict your investments to stocks and industries that sit within your "circle of competence" (ie where you feel very confident with your analysis).

As he wrote in a letter to the chairman of the Provincial Insurance Company in the UK:

As time goes on I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes. It is a mistake to think that one limits one's risk by spreading too much between enterprises about which one knows little and has no reason for special confidence.

He famously became extremely wealthy from playing the stock market.

Between the Wall Street Crash in 1929 and the end of 1936, he multiplied his wealth more than sixtyfold, turning net assets of less than £8,000 into more than £500,000.

He never owned a house or any other property.

But when he died, his stock portfolio represented more than 80 per cent of the total assessed value of his assets.

Why miners are having a good day

By Gareth Hutchens

Australian shares have climbed higher this morning, led by mining and gold stocks.

According to Reuters, better-than-expected manufacturing activity data in China has spurred hopes of a rebound in demand, improving risk appetite, and it's supporting higher commodity prices:

Data released on Wednesday showed manufacturing activity in China, the world's top steel consumer, expanded at the fastest pace in more than a decade in February, exceeding analysts' forecast, helped by the removal of its stringent COVID-19 curbs.

Australian miners, which rely heavily on exports to China, rose as much as 2.2% to a one-week high and were set for third session of gains.

Mining giants BHP Group, Rio Tinto, and Fortescue Metals Group gained between 2.3% and 2.8%.

Gold stocks climbed 1.6% on stronger bullion prices, with Newcrest Mining and Northern Star Resources adding 2.5% and 3.3%, respectively.

Energy stocks advanced 1.4%, with sector majors Santos and Woodside Energy gaining 0.6% and 1.6%, respectively.

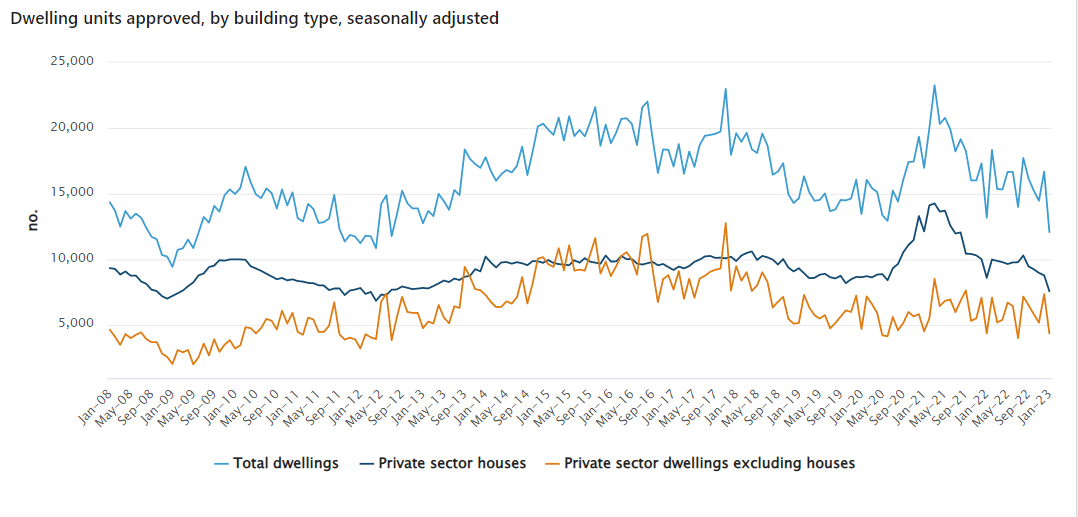

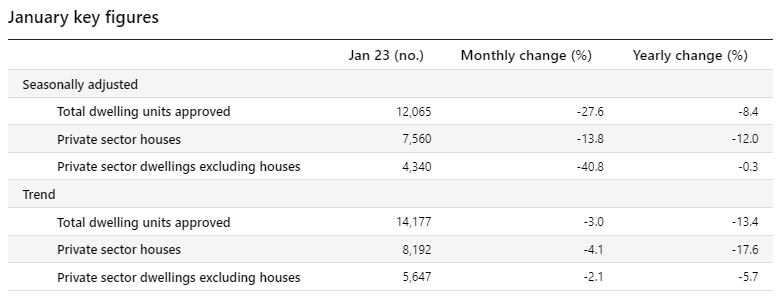

Dwelling approvals falling

By Gareth Hutchens

This shows you how dwelling approvals are tracking.

That light-blue line (total dwellings) and the dark-blue line (private sector houses) have fallen to 2012 levels.

This table shows some of the same information with numbers.

Private sector house approvals hit 10-year low

By Gareth Hutchens

The ABS has released dwelling approvals data for January.

The total number of dwellings approved fell 27.6 per cent in January (seasonally adjusted) after a 15.3 per cent increase in December.

Daniel Rossi, ABS head of construction statistics, said: "Approvals for private sector houses fell by 13.8 per cent, the fifth consecutive drop, to be the lowest result recorded since June 2012".

Across Australia, total dwelling approvals decreased in New South Wales (-49.0 per cent), Victoria (-38.6 per cent), Tasmania (-31.7 per cent), Western Australia (-7.9 per cent), and South Australia (-6.5 per cent). Only Queensland recorded an increase (+25.6 per cent), driven by apartment developments approved in January.

Approvals for private sector houses fell in all states: Western Australia (-18.7 per cent), New South Wales (-17.3 per cent), Queensland (-16.6 per cent), Victoria (-9.9 per cent) and South Australia (-2.8 per cent).

Basic materials and energy stocks doing all the work

By Gareth Hutchens

At 11.30am AEDT, the ASX 200 index is up around 0.35 per cent.

More than half of the 200 stocks on the index have lost value this morning, and only 80 stocks have increased in value.

But their gains have been big enough to lift the entire index higher. And they're concentrated in the basic materials and energy sectors.

Some big mining companies have had a decent morning.

Where are house prices headed?

By Gareth Hutchens

SQM Research founder Louis Christopher says the housing downturn is showing very tentative signs of easing up a little, with a few more buyers entering the market in Sydney and Melbourne.

However, he's also conscious that this could just be a "potential false dawn.

He says if the Reserve Bank ends up lifting the cash rate target above 4 per cent (it's currently 3.35 per cent) we could see a "second leg" in the housing downturn.

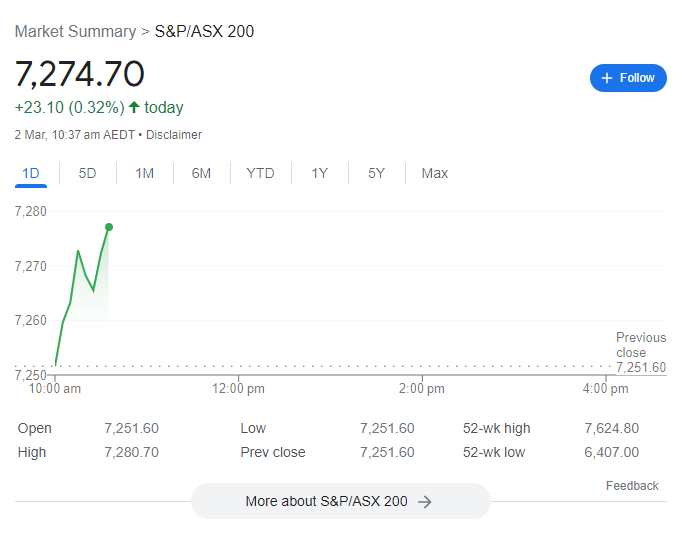

Market up

By Gareth Hutchens

The futures were wrong, which can often happen.

The market's gained a little bit of ground in the first half hour of trading today.

The futures were suggesting the ASX 200 index would slip a little on the opening bell, but that wasn't what happened.

Greenwashing by businesses in Australia

By Gareth Hutchens

Here's the ACCC's report on greenwashing, which contains the findings of its "internet sweep" of businesses.

ACCC investigating businesses for ‘greenwashing’

By Gareth Hutchens

The competition regulator - the Australian Competition and Consumer Commission (ACCC) - says it will be investigating a number of businesses for potential ‘greenwashing’.

It says a recent "internet sweep" found more than half of the businesses reviewed made concerning claims about their environmental or sustainability practices.

Of the 247 businesses reviewed during the sweep, 57 per cent were identified as having made concerning claims about their environmental credentials.

The cosmetic, clothing and footwear and food and drink sectors were found to have the highest proportion of concerning claims among the industries targeted in the operation.

"Our sweep indicates a significant proportion of businesses are making vague or unclear environmental claims. This warrants further scrutiny," ACCC Deputy Chair Catriona Lowe said.

"Consumers are now, more than ever, making purchasing decisions on environmental grounds. Unfortunately, it appears that rather than making legitimate changes to their practices and procedures, some businesses are relying on false or misleading claims. This conduct harms not only consumers, but also those businesses taking genuine steps to implement more sustainable practices.

"Businesses using broad claims like ‘environmentally friendly’, ‘green’, or ‘sustainable’ are obliged to back up these claims through reliable scientific reports, transparent supply chain information, reputable third-party certification or other forms of evidence.

"Where we have concerns, we will be asking businesses to substantiate their claims.

"Already, we have several active investigations underway across the packaging, consumer goods, food manufacturing and medical devices sectors for alleged misleading environmental claims and these may grow, as we continue to conduct more targeted assessments into businesses and claims identified through the sweep.

"We will take enforcement action where it is appropriate to do so as it is critical that consumer trust in green claims is not undermined."