/Jabil%20Inc%20logo%20on%20smartphone-by%20rafapress%20via%20Shutterstock.jpg)

Saint Petersburg, Florida-based Jabil Inc. (JBL) is a trusted partner for the world's top brands, offering comprehensive engineering, manufacturing, and supply chain solutions. With a market cap of $21.6 billion, Jabil operates through Electronics Manufacturing Services and Diversified Manufacturing Services segments.

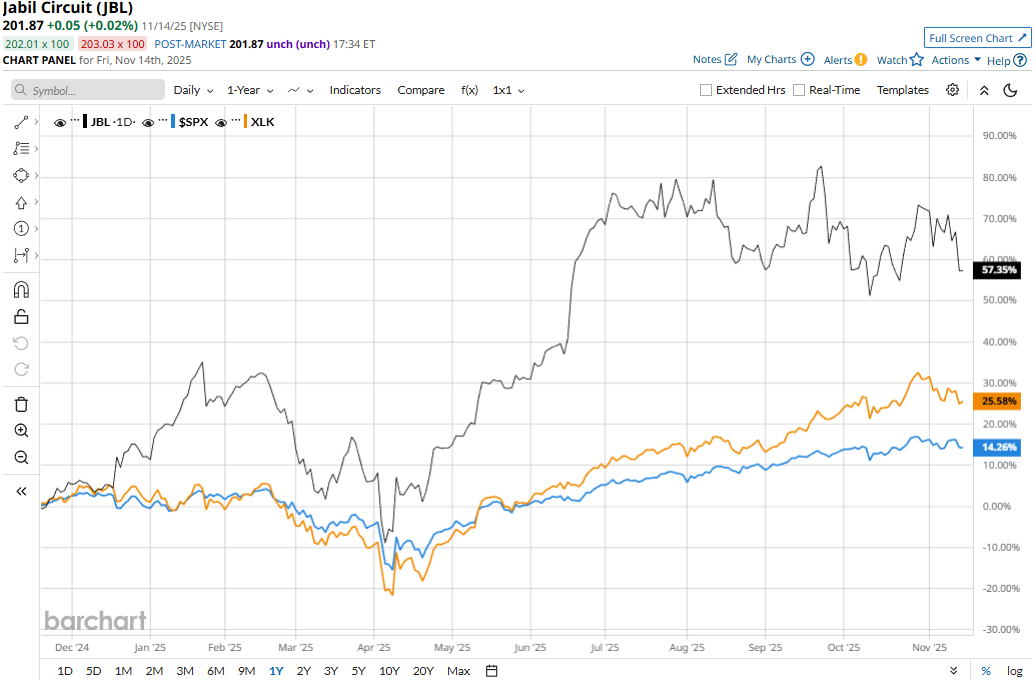

Jabil has substantially outperformed the broader market over the past year. The company’s stock prices have soared 40.3% on a YTD basis and 56.4% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.5% gains in 2025 and 13.2% returns over the past year.

Narrowing the focus, JBL has also outperformed the sector-focused Technology Select Sector SPDR Fund’s (XLK) 23.9% surge on a YTD basis and 22.9% gains over the past 52 weeks.

Despite reporting better-than-expected financials, Jabil’s stock prices declined 6.7% in the trading session following the release of its Q4 results on Sept. 25. Driven by the surge in the demand for its products, the company’s topline for the quarter soared 18.5% year-over-year to $8.3 billion, exceeding the Street’s expectations by 7.7%. Further, its adjusted EPS grew by an impressive 43% year-over-year to $3.29, beating the consensus estimates by 11%. Following the initial dip, JBL stock prices gained 2.7% in the subsequent trading session.

For the full fiscal 2026, ending in August, analysts expect JBL to deliver an adjusted EPS of $10.11, up 13.7% year-over-year. On a more positive note, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

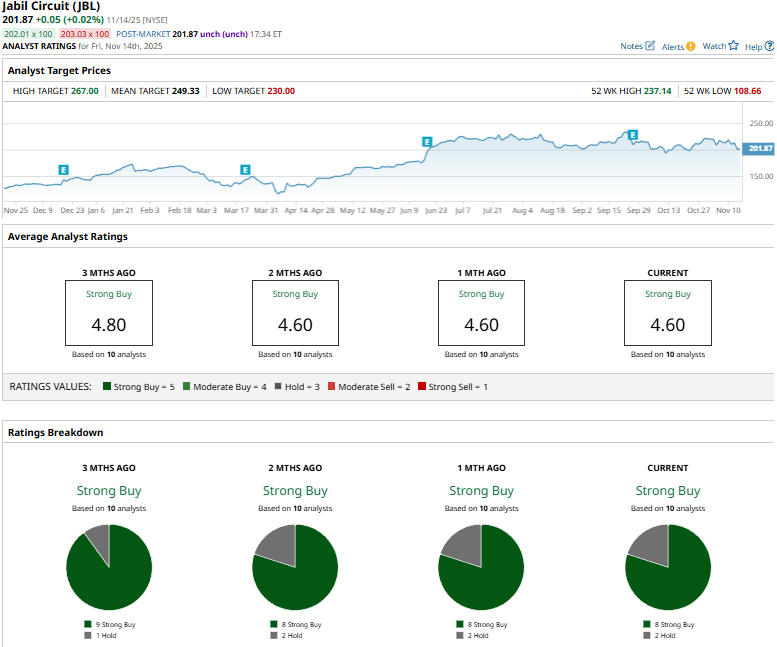

Among the 10 analysts covering the JBL stock, the consensus rating is a “Strong Buy.” That’s based on eight “Strong Buys” and two “Holds.”

This configuration is slightly less optimistic than three months ago, when nine analysts gave “Strong Buy” recommendations.

On Sept. 26, Barclays (BCS) analyst Tim Long reiterated an “Overweight” rating on JBL and raised the price target from $223 to $267.

JBL’s mean price target of $249.33 represents a 23.5% premium to current price levels. Meanwhile, the street-high target of $267 suggests a staggering 32.3% upside potential.