/Paycom%20Software%20Inc%20logo%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $9.4 billion, Paycom Software, Inc. (PAYC) is a U.S.-based provider of cloud-based human capital management (HCM) solutions delivered through a software-as-a-service model for small to mid-sized businesses. The company offers an integrated platform that manages the entire employee life cycle, from recruitment and onboarding to payroll, benefits, and retirement.

Companies valued less than $10 billion are generally described as “mid-cap” stocks, and Paycom Software fits right into that category. Its comprehensive suite of applications includes talent acquisition, time and labor management, payroll, talent management, compliance, analytics, and employee self-service tools.

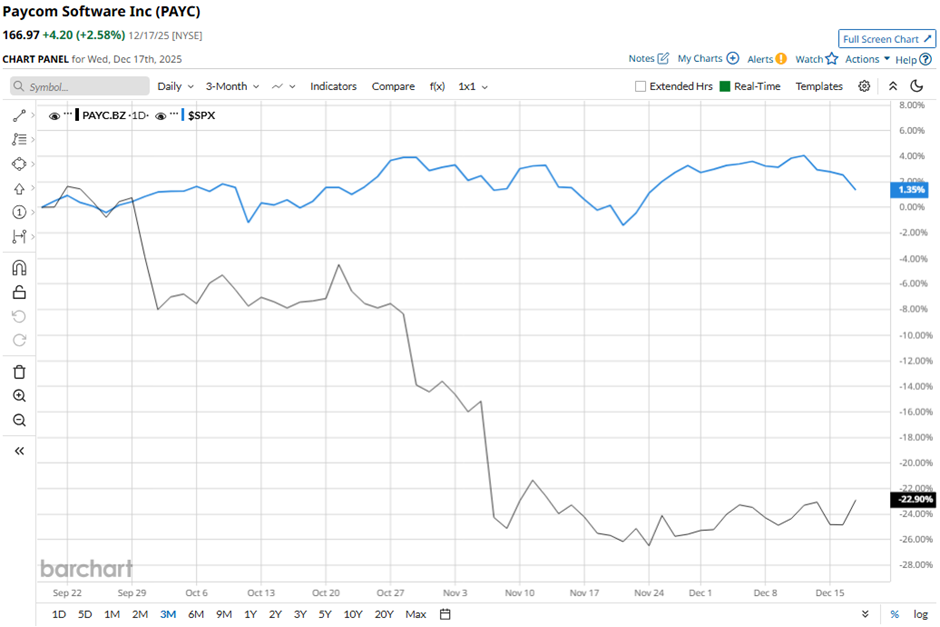

Shares of the Oklahoma City, Oklahoma-based company have fallen 37.6% from its 52-week high of $267.76. Paycom Software’s shares have decreased 22.2% over the past three months, lagging behind the broader S&P 500 Index’s ($SPX) 1.8% gain over the same time frame.

In the longer term, PAYC stock is down 18.5% on a YTD basis, underperforming SPX’s 14.3% rise. Moreover, shares of the human-resources and payroll software maker have dropped 28.3% over the past 52 weeks, compared to the 11.1% return of the SPX over the same time frame.

The stock has been trading below its 50-day moving average since late June.

Despite reporting better-than-expected Q3 2025 revenue of $493.3 million on Nov. 5, Paycom’s shares tumbled 10.7% the next day as adjusted EPS of $1.94 missed the estimate. Investors were also unsettled by a sharp decline in cash and cash equivalents to $375 million from $532.2 million in the prior quarter.

In comparison, rival Shopify Inc. (SHOP) has outperformed PAYC stock. SHOP stock has surged 52.1% on a YTD basis and 35.4% over the past 52 weeks.

Despite the stock’s weak performance over the past year, analysts remain moderately optimistic on PAYC. It has a consensus rating of “Moderate Buy” from the 21 analysts in coverage, and the mean price target of $209.12 is a premium of 25.2% to current levels.