Video communication rapidly established itself as our virtual conduit during the pandemic, enabling us to continue our professional activities within a digitized context. The gradual progression toward digital transformation was suddenly accelerated, with individuals required to contemporize their daily routines virtually overnight.

Zoom Video Communications, Inc. (ZM) has emerged as a crucial player in the video communication industry during the pandemic. The epidemiological climate and the escalating shift toward remote work can be attributed to the company’s positive trajectory.

Despite moving beyond the pandemic-induced boom, the company, with a diverse consumer base, has experienced a seamless transition owing to the continual demand for video communication solutions.

ZM’s first-quarter financial performance exceeded expectations. Due to the solid start to the year, the company has raised the outlook for fiscal year 2024. Total revenue is expected to be between $4.465 billion and $4.485 billion, and non-GAAP income from operations is expected to be between $1.63 billion and $1.65 billion.

ZM is taking significant strides to make interactions more meaningful and communications effective by investing heavily in cutting-edge innovations such as generative AI. In June, ZM launched prominent features of Zoom IQ, a revolutionary product designed to cultivate collaboration and unleash creativity through the potential of generative AI.

Let’s look at ZM’s key financial metrics trends to understand why it could be a wise portfolio addition now.

ZM's Financial Performance: P/E Ratio, Revenue, Gross Margin, and Current Ratio (2020 - 2023)

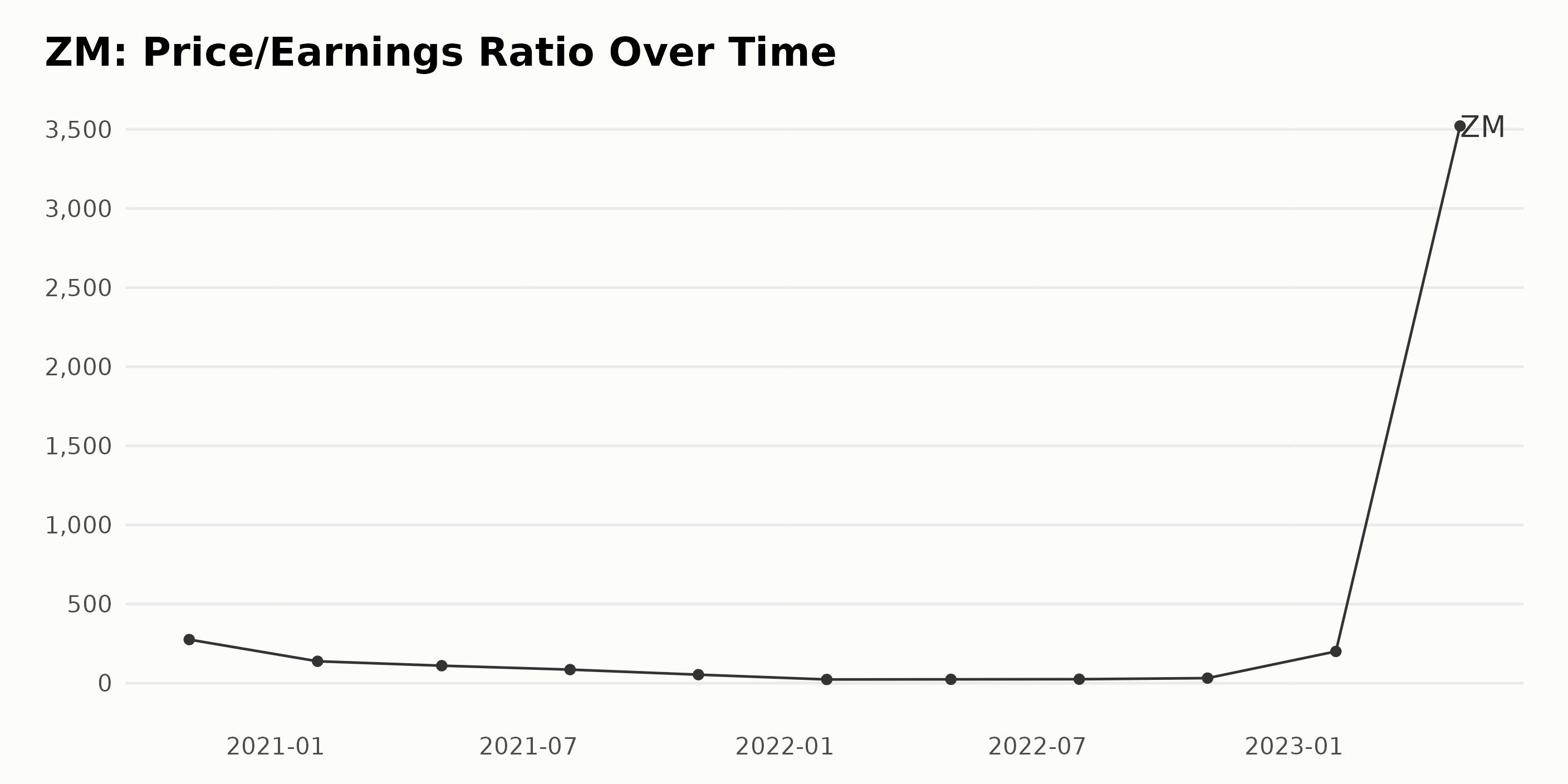

ZM’s Price/Earnings (P/E) ratio shows broad fluctuations between October 2020 and April 2023, exhibiting overall significant growth despite some periods of considerable downturn.

Summarized Key Trends and Fluctuations:

- In October 2020, ZM’s P/E ratio was 275.60.

- In January 2022, this gradually decreased to a low of 23.47, a stark decrease of approximately 92% from the initial value in October 2020.

- A slight increase occurred after this period, with the P/E ratio reaching 31.88 by October 2022.

- However, the most noticeable escalation came in April 2023, when it surged to an all-time high of 3,521.01.

Key Points:

- Initial Decrease: From October 2020 to January 2022, there was a significant drop in the ratio from 275.60 to 23.47.

- Moderate Increase: From January 2022 to October 2022, we observed a moderate recovery in the ratio, increasing to 31.88.

- Substantial Surge: In April 2023, there was an unparalleled hike in the P/E ratio, marking it at 3521.01.

- Calculated Growth: The growth rate calculated by measuring the last value from the first is approximately 1,175%.

The most recent data toward April 2023 indicates a stark rise in ZM's P/E ratio. While there is clear fluctuation throughout the analyzed period, the substantial increase in recent times suggests increasingly higher investor expectations for future earnings.

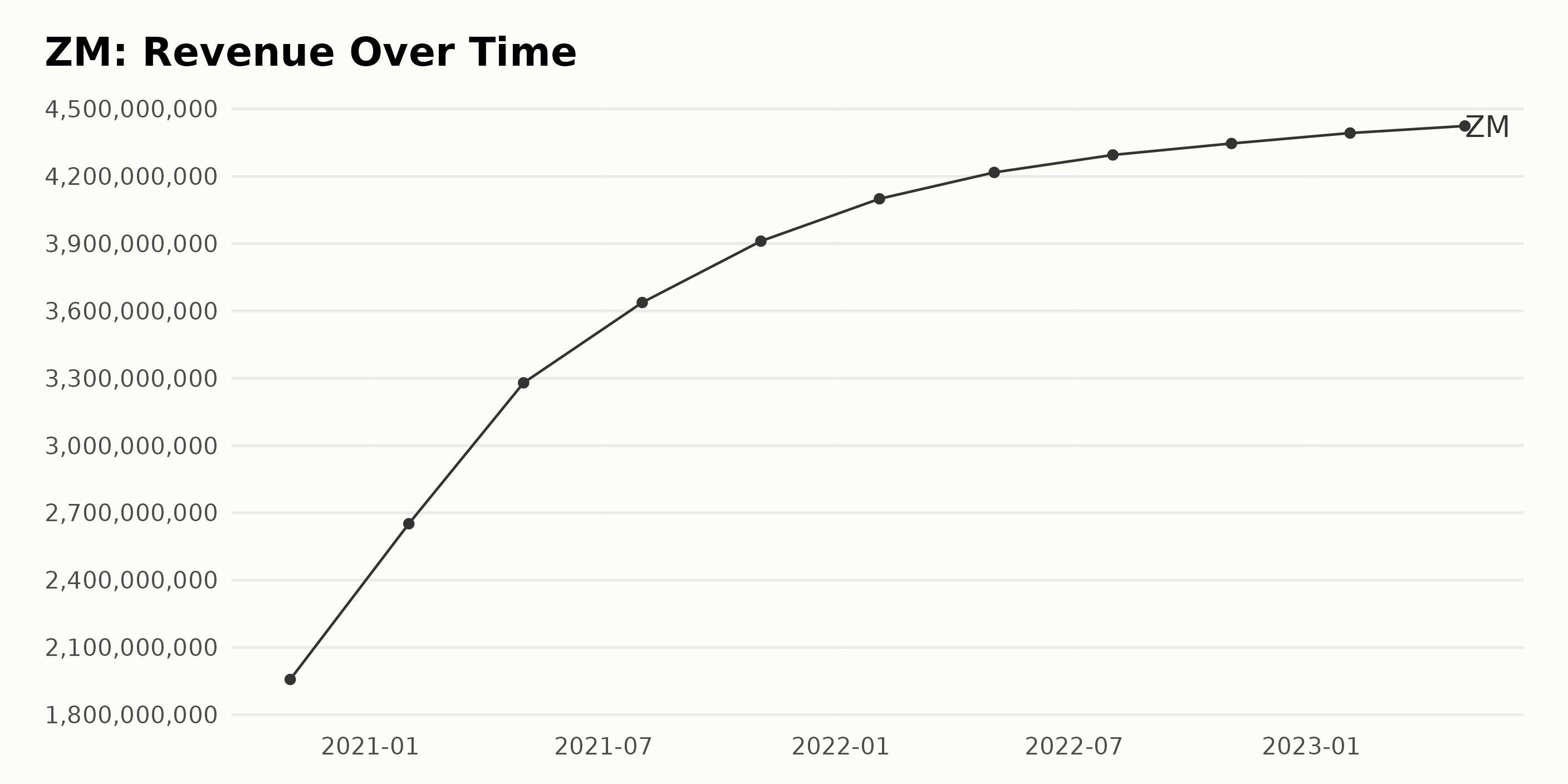

ZM’s trailing-12-month revenue has reflected a general upward trend from October 2020 through April 2023 based on the provided data series. Notable fluctuations were observed in its sequential growth, which has significantly shaped the trends' overall frequency and amplitude. Here are the key highlights:

- ZM's revenue rose steadily from $1.96 billion in October 2020 to $4.42 billion in April 2023.

- Between October 2020 and January 2021, its revenue jumped from $1.96 billion to $2.65 billion.

- Sustaining growth, by April 2021, the revenue stood at $3.28 billion and climbed to $3.64 billion in July 2021.

- In the latter half of 2021 and early 2022, a slight deceleration was observed. Nevertheless, the revenue grew to $3.91 billion in October 2021, $4.10 billion in January 2022, and $4.22 billion in April 2022.

- While minor fluctuations continued over 2022, the revenue was about $4.35 billion by October.

- In 2023, a further increase was tracked, with revenue reaching $4.40 billion in January and $4.42 billion in April.

In terms of growth rate, from the first value in October 2020 ($1.96 billion) to the last value in April 2023 ($4.42 billion), the company’s revenue grew by 125.33%.

These evolutions suggest periods of rapid growth interspersed with periods of slower growth for ZM, aligning with the business' often cyclic and unpredictable nature. Nonetheless, the overarching epidemiological circumstances and the increasing prevalence of remote work may have significantly influenced this upward trend.

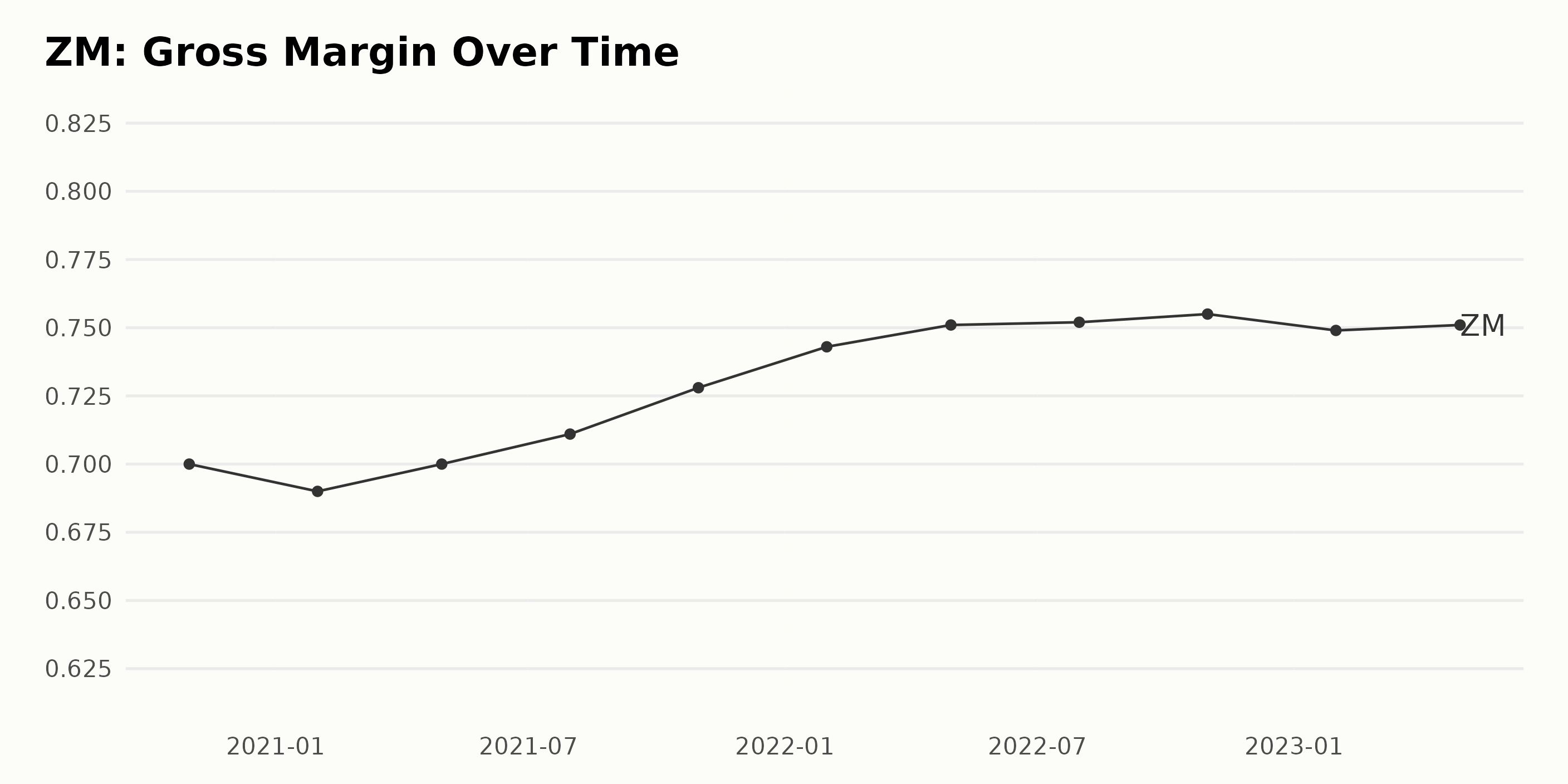

ZM’s gross margin appears to have experienced a general increasing trend between October 2020 and April 2023, although minor fluctuations marked this upward trajectory.

- October 2020: The gross margin stood at 70%.

- January 2021: There was a slight decrease to 69%.

- April 2021: It climbed back to the level of October 2020, at 70%.

- July 2021: It increased to 71.1%.

- October 2021: Further increase was seen with a gross margin of 72.8%.

- January 2022: It reached 74.3%.

- April 2022: An incremental growth was observed when it rose to 75.1%.

- July 2022: It was near stagnant from the previous period at 75.2%.

- October 2022: A slight increase was noted, with the gross margin rising to 75.5%.

- January 2023: It declined to 74.9%.

- April 2023: The last value in the series shows slight growth, reaching 75.1%.

From October 2020 to April 2023, there was a growth rate of approximately 7.3% in ZM's gross margin. The figures, particularly since 2022, highlight that ZM has maintained its gross margin above 75%, indicating strong profitability.

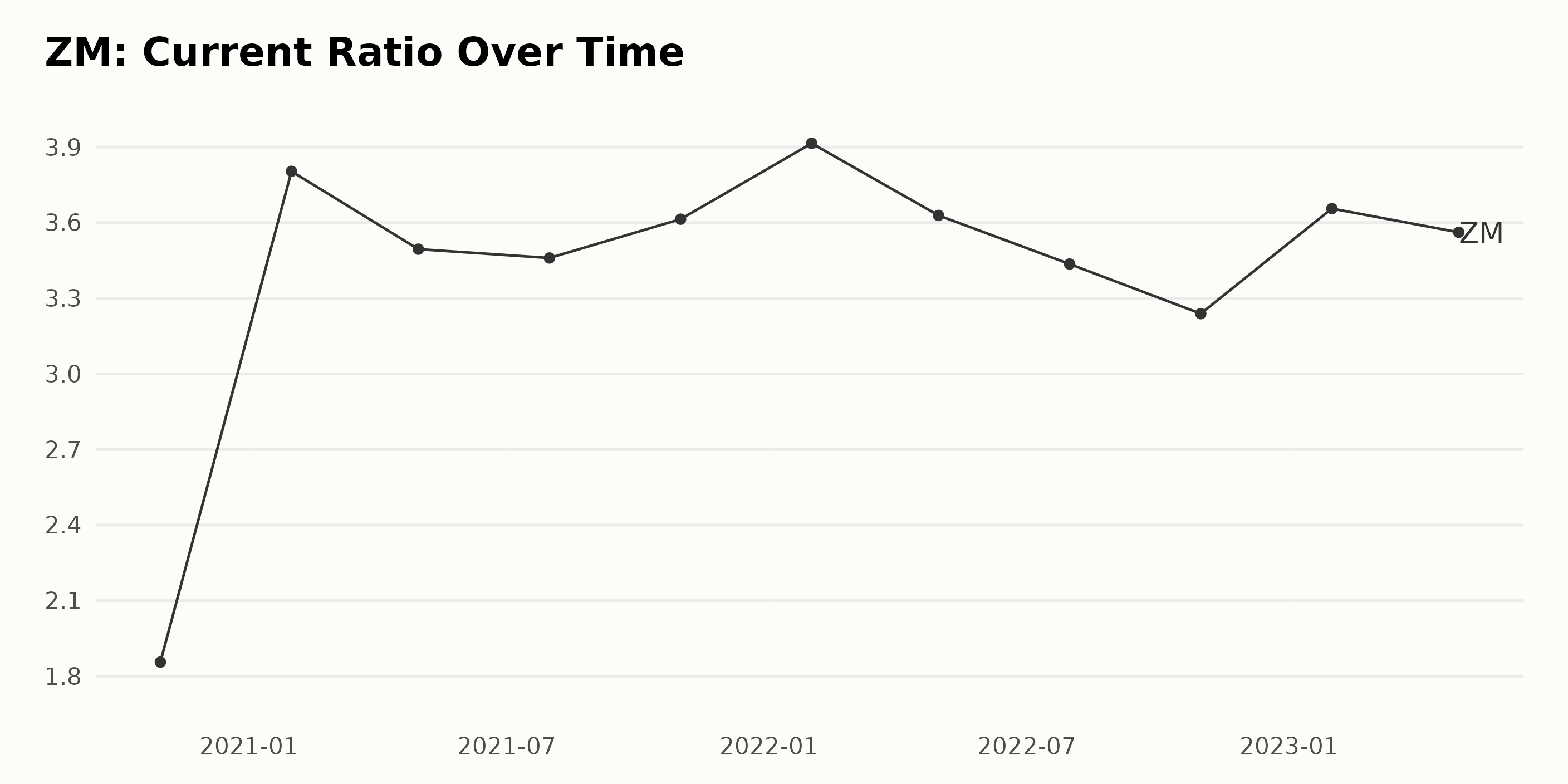

As per the data series, ZM’s current ratio notably fluctuated from October 2020 to April 2023. Here are the key trends and fluctuations:

- In October 2020, the current ratio was 1.86.

- In January 2021, this increased significantly to 3.80.

- From January 2021 to April 2021, it slightly declined to 3.49.

- Between April 2021 and July 2021, the current ratio marginally decreased to 3.46.

- By October 2021, it slightly rose to 3.61 and progressed to 3.91 by Jan 2022.

- It experienced sequential falls – dropping to 3.62 by April 2022, to 3.44 by July 2022, and further declining to 3.24 by October 2022.

- ZM’s current ratio has shown improvement. It reached 3.65 by January 2023 and slightly fell to 3.56 in April 2023.

By comparing the initial value (October 2020: 1.86) to the latest one (April 2023: 3.56), we calculate that ZM's current ratio has seen a growth rate of 91% during this period. This dataset suggests that while it experienced some volatility from 2020 to 2023, the overall trend over time is significant growth. Monitoring it as part of ZM’s financial health assessment will be crucial.

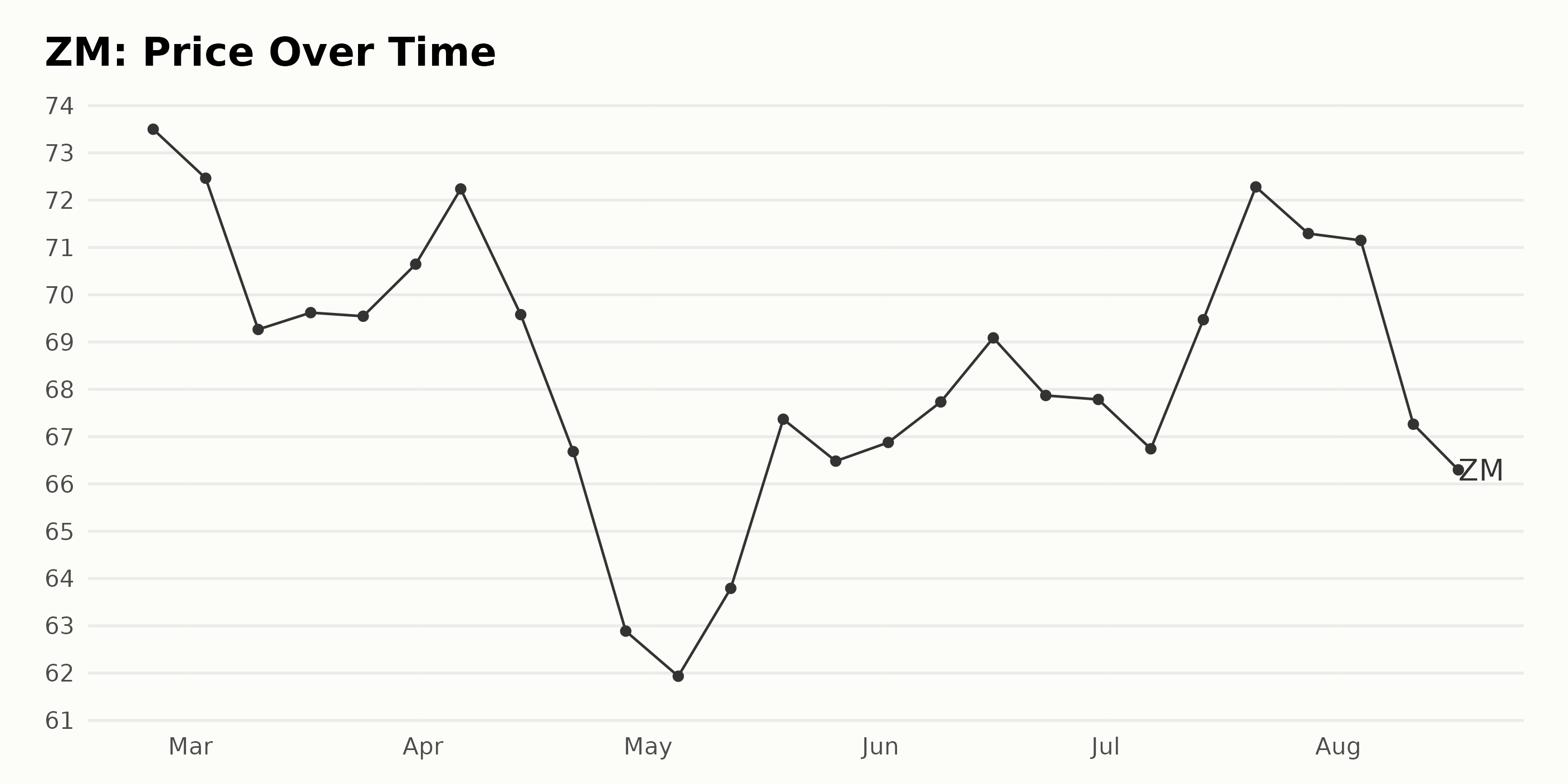

Examining the Fluctuating Trends in ZM's Share Price: Feb-Aug 2023

ZM’s share price shows a fluctuating trend from February 24, 2023, to August 17, 2023.

- On February 24, 2023, the share price was $73.5.

- A slight decline to $72.46 by March 3, 2023, marks a slight decremental trend, and this trend persisted till March 10, 2023, when the value depreciated to $69.26.

- However, the share price had a minor increment to $69.62 on March 17, 2023, but remained relatively stable till the end of March, with a minor rise to $70.64 by March 31, 2023.

- This increment continued into April, peaking at $72.23 on April 6, 2023, but decreased again to $66.68 by April 21, 2023. The decrease continued through the end of the month, with the share price dropping further to $62.88 by April 28, 2023.

- In May, the share price hit its lowest on May 5, 2023, at $61.93, and then rebounded to $67.36 by May 19, 2023, indicating an increasing trend.

- From June to July 2023, the share price demonstrated a mild upward trend reaching $69.47 by July 14, 2023.

- However, this increment did not persist as in the following week, July 21, 2023, the share price rose sharply to $72.28 before slightly declining to $71.15 by early August.

- From August 4, 2023, to August 17, 2023, the share price reduced considerably, reaching $66.29, indicating a decelerating trend in growth.

Overall, the growth rate of ZM's share price appeared to be inconsistent and somewhat fluctuating over the observed period, with phases of moderate acceleration and deceleration noted. Here is a chart of ZM's price over the past 180 days.

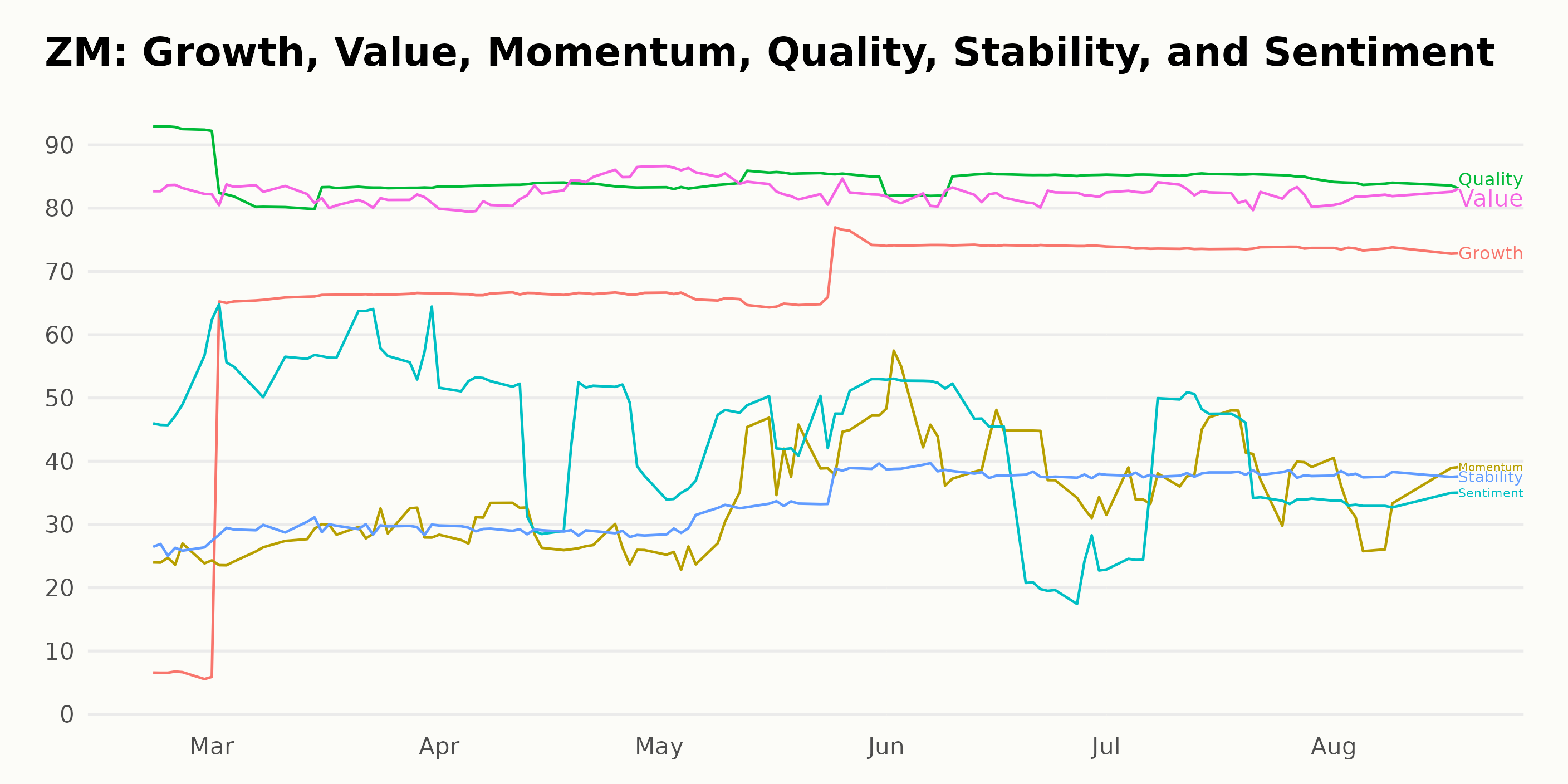

Analyzing Key Measures of Zoom's Performance: Quality, Value, and Growth (2023)

The POWR Ratings of ZM, under the Technology – Services industry, show gradual fluctuations over time. The POWR Ratings are calculated by considering 118 different factors, each weighted to an optimal degree.

- As of February 2023, ZM had a POWR Grade of C (Neutral) and was ranked #33 in the category.

- The stock showed improvement by March 2023, upgrading to a POWR Grade B (Buy). It maintained this grade through August 2023, according to available data. Over this period, its rank improved, reaching as high as #16 place in June but fluctuating slightly thereafter.

- As of the latest data point on August 18, 2023, ZM's POWR Grade remains at B (Buy). Its current ranking within the 76-stock Technology - Services industry is #19.

The ongoing fluctuation in ZM’s standings indicates that dynamic market influences are very much at play.

ZM’s three most noteworthy dimensions in the POWR Ratings are Quality, Value, and Growth.

Quality: Quality consistently had the highest ratings throughout the given period, February to August 2023. This dimension saw a high rating of 93 in February 2023 before dropping to 83 in March and further stabilizing with a range from 84-85 from April through August 2023.

Value: The Value dimension presented steady high ratings over the period, beginning at 83 points in February and oscillating between 82 to 84 points in the noted timeframe. Minor fluctuation within this small range suggests a relatively stable appreciation of ZM’s value.

Growth: This factor saw the most prominent trend with a substantial upward trajectory. Starting from 6 in February 2023, this dimension experienced a significant increase, reaching 74 by June. This stable and positive trajectory continues into August at 74 points.

In summary:

- The Quality dimension started on top but decreased slightly, maintaining a steady trajectory afterward.

- Value, while remaining relatively high, showed stability with minimal fluctuation.

- The Growth dimension exhibited the clearest upward trend, indicating an overall improvement in ZM’s growth aspect throughout the period.

How Does Zoom Video Communications, Inc. (ZM) Stack Up Against Its Peers?

While ZM has an overall grade of B, equating to a Buy rating, check out these other stocks within the Technology - Services industry: Serco Group plc (SCGPY), NetScout Systems, Inc. (NTCT), and Teradata Corporation (TDC), with an A (Strong Buy) rating.

43 Year Investment Pro Shares Top Picks

Steve Reitmeister is best known for his timely market outlooks & unique trading plans to stay on the right side of the market action. Click below to get his latest insights…

Steve Reitmeister’s Trading Plan & Top Picks >

ZM shares were trading at $66.30 per share on Friday afternoon, up $0.94 (+1.44%). Year-to-date, ZM has declined -2.13%, versus a 14.79% rise in the benchmark S&P 500 index during the same period.

About the Author: Sristi Suman Jayaswal

The stock market dynamics sparked Sristi's interest during her school days, which led her to become a financial journalist. Investing in undervalued stocks with solid long-term growth prospects is her preferred strategy. Having earned a master's degree in Accounting and Finance, Sristi hopes to deepen her investment research experience and better guide investors.

Is Now the Time to Buy or Sell Zoom Video Communications (ZM)? StockNews.com