Few companies are more closely associated with the rise and dominance of the American technology industry over the course of the 20th century than International Business Machines (IBM).

The company that came to be known as Big Blue is sort of the O.G. of big tech stocks. IBM, founded before World War I, became the industry leader in pretty much every market it entered, from early punch-card tabulating systems to electric typewriters to mainframe and personal computers.

IBM stock was a fantastic buy-and-hold bet over those many decades. From 1926 to December 2019, IBM created $525.9 billion in shareholder wealth, according to research by Hendrik Bessembinder, a finance professor at the W.P. Carey School of Business at Arizona State University.

Only seven U.S. stocks generated better returns for shareholders over that span.

Times change. IBM ceded ground to any number of peers, including some of the Magnificent 7 stocks sporting multitrillion-dollar market caps today. The result? Shares in this long-time Dow Jones stock have been a major disappointment for decades.

As a member of the S&P 500 Dividend Aristocrats, IBM is a top-notch name for dependable dividend growth. Not only has the company paid consecutive quarterly dividends since 1916, it has increased its payout annually for 30 years and counting.

However, even after factoring in those reliable and rising dividends, IBM stock has been a market laggard for some time.

The bottom line on IBM stock?

IBM's 20th century glory days are so much a thing of the past that the stock's performance now lags that of the broader market over any standardized time period beyond five years.

Here's the breakdown: IBM stock's all-time annualized total return (price change plus dividends) comes to 4.9%. The S&P 500 generated an annualized total return of 10.8% over the same span.

It doesn't end there. Shares in the tech giant beat the broader market on an annualized total return basis in the past one-, three- and five-year periods, but lag badly over longer time frames.

It should come as no surprise that if you invested a grand in IBM stock a couple of decades ago, you would be deeply disappointed by the results today.

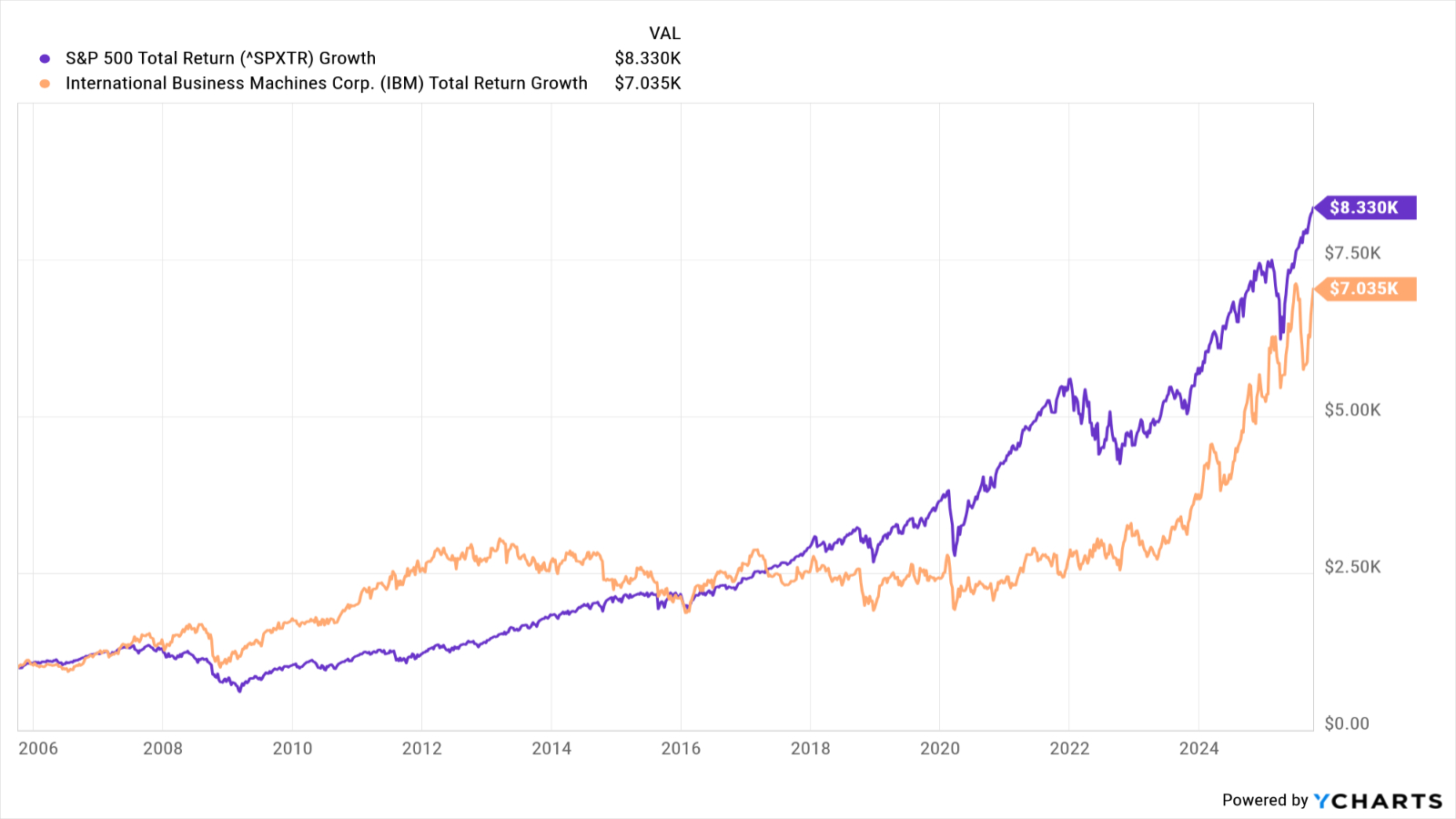

Have a look at the above chart, and you'll see that if you put $1,000 into IBM stock 20 years ago, it would be worth about $7,000 today. That's good for an annualized total return of 10.3%.

The same sum socked away into the S&P 500 over the past two decades would theoretically be worth about $8,300 today, or 11.2% annualized.

The bottom line? Big Blue has been a buy-and-hold bust in the 21st century,