Sempra (SRE), based in San Diego, California, operates as an energy infrastructure company. Valued at $61.8 billion by market cap, the company focuses on delivering sustainable energy to consumers, as well as invests in, develops, and operates transmission and distribution infrastructures.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and SRE perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the utilities - diversified industry. Sempra boasts a robust market presence, driven by its extensive utility customer base in Southern California and Texas. Its stake in Sempra Infrastructure partners diversifies its portfolio and leverages cross-border energy trade opportunities, solidifying its position as a key player in the North American energy market.

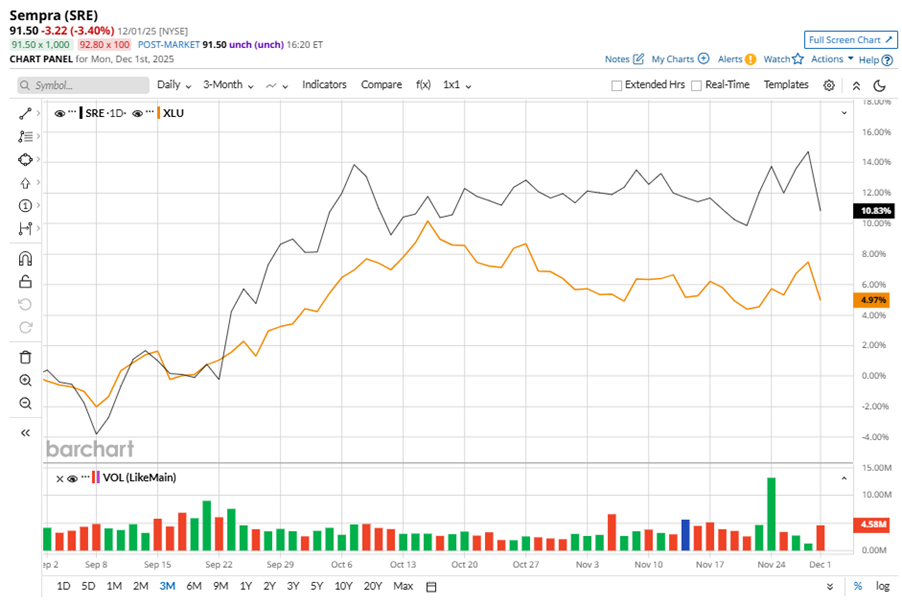

Despite its notable strength, SRE slipped 4.4% from its 52-week high of $95.72, achieved on Oct. 8. Over the past three months, SRE stock gained 10.8%, outperforming the Utilities Select Sector SPDR Fund’s (XLU) 5% gains during the same time frame.

In the longer term, shares of SRE rose 4.3% on a YTD basis but dipped 2.3% over the past 52 weeks, underperforming XLU’s YTD gains of 16.9% and 6.7% returns over the last year.

To confirm the bullish trend, SRE has been trading above its 50-day moving average since late April, experiencing slight fluctuations. The stock has been trading above its 200-day moving average since late July.

On Nov. 5, SRE shares closed down marginally after reporting its Q3 results. Its adjusted EPS of $1.11 topped Wall Street expectations of $0.93. The company’s revenue stood at $3.2 billion, up 13.5% year over year. SRE expects full-year adjusted EPS in the range of $4.30 to $4.70.

SRE’s rival, The AES Corporation (AES) shares have taken the lead over the stock, with an 8.7% uptick on a YTD basis and 7.3% gains over the past 52 weeks.

Wall Street analysts are reasonably bullish on SRE’s prospects. The stock has a consensus “Moderate Buy” rating from the 18 analysts covering it, and the mean price target of $100.86 suggests a potential upside of 10.2% from current price levels.