/Veralto%20Corp%20logo%20on%20phone%20with%20chart-by%20T_Schneider%20via%20Shutterstock.jpg)

Veralto Corporation (VLTO), based in Waltham, Massachusetts, delivers water analytics, treatment, marking and coding, packaging, and color solutions globally. With a market capitalization brushing $25.5 billion, it operates brands including Hach, Trojan Technologies, ChemTreat, Videojet, Linx, Esko, X-Rite, and Pantone, serving municipal, food, pharmaceutical, and industrial customers with precision tools.

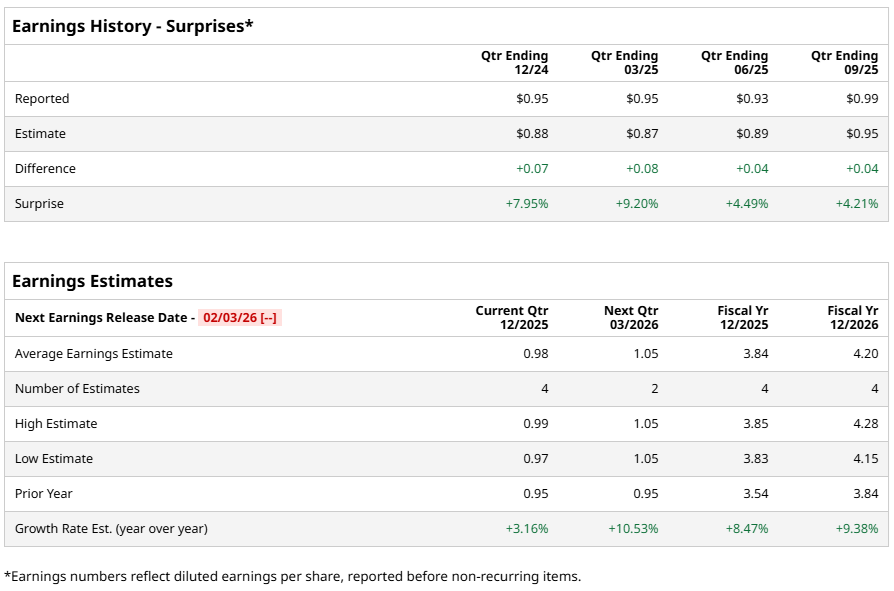

As the company approaches its fiscal 2025 fourth-quarter earnings release, expectations remain encouraging. Analysts project diluted EPS of $0.98, representing 3.2% growth from $0.95 a year earlier. The outlook builds on credibility, as Veralto has exceeded EPS estimates in each of the past four quarters.

Looking beyond the near term, Wall Street forecasts fiscal 2025 diluted EPS of $3.84, implying an 8.5% year-over-year increase. Momentum appears intact into fiscal 2026, with EPS expected to reach $4.20, up 9.4% from the previous year.

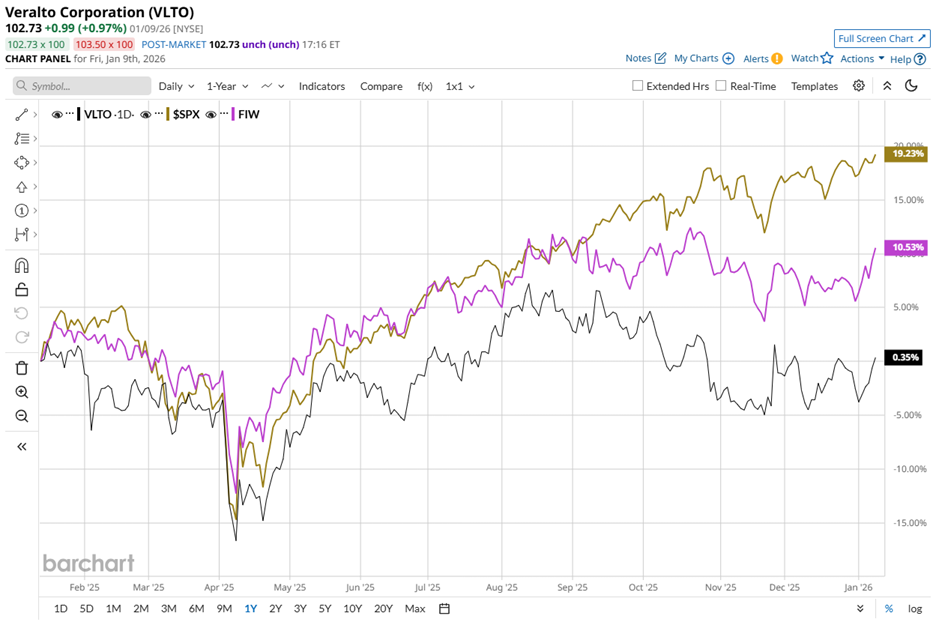

Despite this earnings trajectory, share-price performance has remained measured. VLTO stock has posted marginal gains over the past 52 weeks and is up nearly 3% year-to-date (YTD). By comparison, the S&P 500 Index ($SPX) has jumped 17.7% over the last 52 weeks and 1.8% YTD, creating a relative gap.

A similar pattern emerges against sector peers. The First Trust Water ETF (FIW) gained nearly 12% over the past 52 weeks and 4.7% YTD, again outpacing Veralto.

However, investor sentiment briefly shifted on Nov. 25, 2025, when shares climbed 5.9% intraday following Veralto’s announcement to acquire In-Situ, a global leader in environmental water measurement and monitoring solutions. The transaction carries a headline value of $435 million, or approximately $422 million after estimated tax benefits, and is expected to close in the first quarter of 2026.

Strategically, the acquisition adds both scale and profitability. In-Situ is projected to generate about $80 million in 2025 revenue, with gross margins near 50% and mid-teens EBITDA margins. Veralto expects roughly $11 million in pre-tax run-rate cost synergies by year three, alongside meaningful commercial and operational benefits.

Complementing growth initiatives, Veralto also strengthened its capital-return framework. The board authorized a share repurchase program of up to $750 million, providing flexibility to execute buybacks over time through open-market or privately negotiated transactions.

Taken together, these elements support a steady analyst stance. VLTO stock carries a “Moderate Buy” consensus rating that has remained unchanged for three months. Out of 18 analysts, nine rate the stock a “Strong Buy,” while nine recommend “Hold.”

Meanwhile, price targets point to incremental upside. VLTO’s mean price target of $114.27 represents potential upside of 11.2% while the Street-high target of $123 suggests a gain of 19.7% from current levels.