High-rolling investors have positioned themselves bullish on Fiserv (NYSE:FI), and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in FI often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 14 options trades for Fiserv. This is not a typical pattern.

The sentiment among these major traders is split, with 64% bullish and 28% bearish. Among all the options we identified, there was one put, amounting to $31,140, and 13 calls, totaling $1,846,413.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $225.0 for Fiserv over the recent three months.

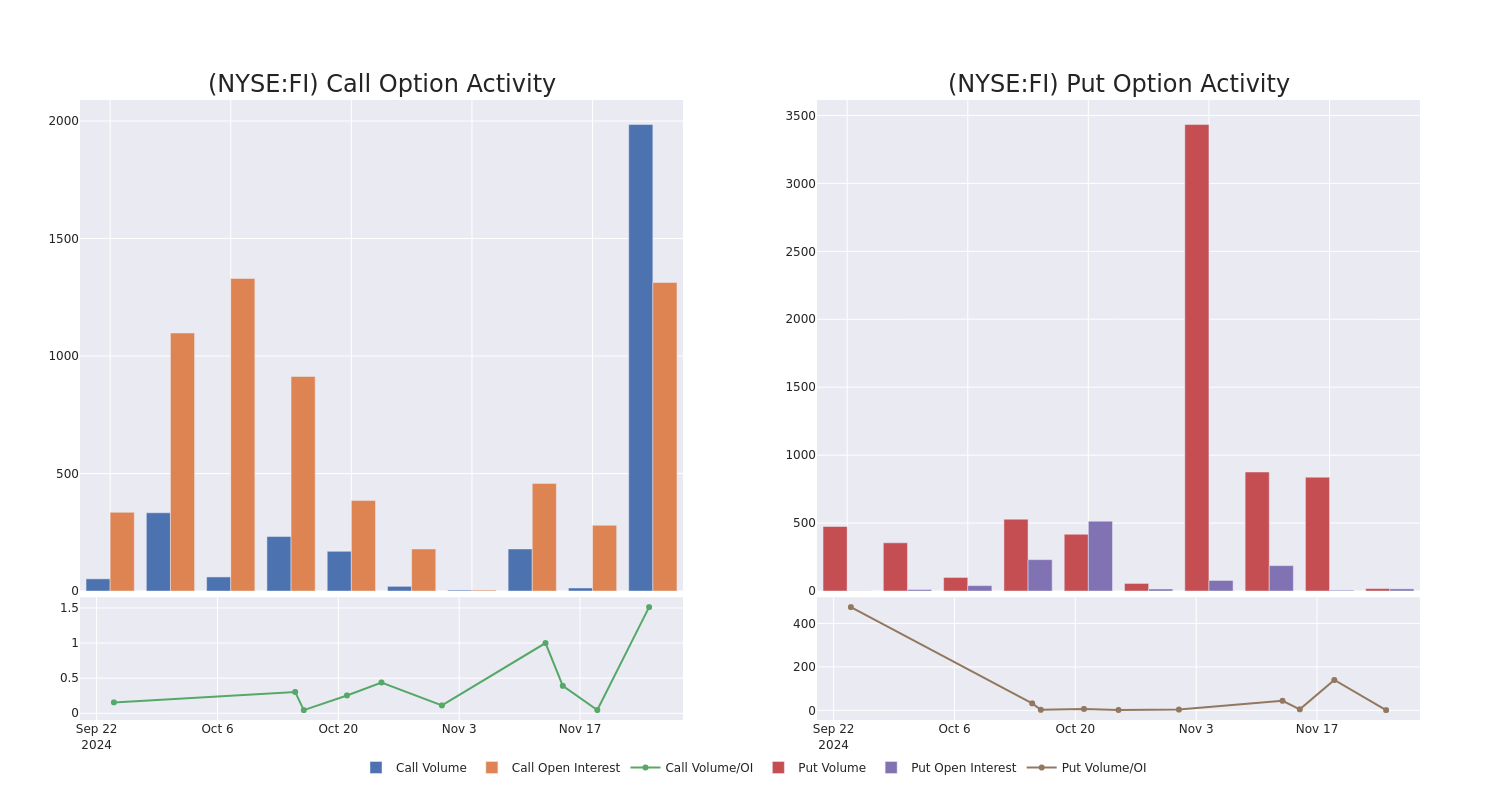

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Fiserv's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Fiserv's whale activity within a strike price range from $100.0 to $225.0 in the last 30 days.

Fiserv Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FI | CALL | TRADE | BULLISH | 01/16/26 | $30.4 | $28.8 | $30.0 | $220.00 | $450.0K | 388 | 511 |

| FI | CALL | SWEEP | BULLISH | 01/16/26 | $30.0 | $28.9 | $30.0 | $220.00 | $360.0K | 388 | 309 |

| FI | CALL | SWEEP | BULLISH | 09/19/25 | $24.3 | $23.0 | $24.2 | $220.00 | $207.5K | 60 | 186 |

| FI | CALL | SWEEP | BULLISH | 01/16/26 | $37.1 | $35.6 | $37.1 | $210.00 | $185.5K | 46 | 50 |

| FI | CALL | TRADE | BULLISH | 01/16/26 | $30.7 | $29.4 | $30.4 | $220.00 | $152.0K | 388 | 188 |

About Fiserv

Fiserv is a leading provider of core processing and complementary services, such as electronic funds transfer, payment processing, and loan processing, for us banks and credit unions, with a focus on small and midsize banks. Through the merger with First Data in 2019, Fiserv also provides payment processing services for merchants. About 10% of the company's revenue is generated internationally.

Having examined the options trading patterns of Fiserv, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Fiserv's Current Market Status

- With a trading volume of 993,428, the price of FI is down by -0.49%, reaching $220.47.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 71 days from now.

Expert Opinions on Fiserv

In the last month, 3 experts released ratings on this stock with an average target price of $251.33333333333334.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * In a cautious move, an analyst from Compass Point downgraded its rating to Buy, setting a price target of $278. * Maintaining their stance, an analyst from Tigress Financial continues to hold a Buy rating for Fiserv, targeting a price of $244. * An analyst from BMO Capital persists with their Outperform rating on Fiserv, maintaining a target price of $232.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Fiserv, Benzinga Pro gives you real-time options trades alerts.