In the latest quarter, 9 analysts provided ratings for Walgreens Boots Alliance (NASDAQ:WBA), showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 0 | 5 | 2 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 4 | 2 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

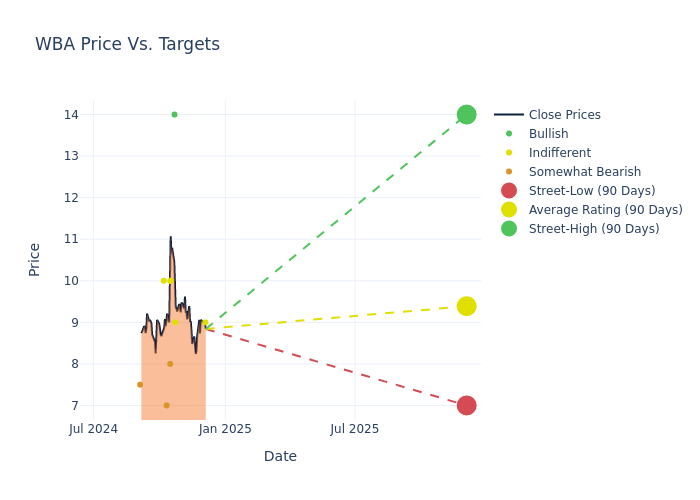

Insights from analysts' 12-month price targets are revealed, presenting an average target of $10.33, a high estimate of $16.00, and a low estimate of $7.00. Experiencing a 19.49% decline, the current average is now lower than the previous average price target of $12.83.

Investigating Analyst Ratings: An Elaborate Study

The perception of Walgreens Boots Alliance by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ben Hendrix | RBC Capital | Lowers | Sector Perform | $9.00 | $13.00 |

| Brian Tanquilut | Jefferies | Lowers | Hold | $9.00 | $19.00 |

| Charles Ryhee | TD Cowen | Lowers | Buy | $14.00 | $16.00 |

| Kevin Caliendo | UBS | Raises | Neutral | $10.00 | $9.00 |

| Steve Valiquette | Barclays | Raises | Underweight | $8.00 | $7.00 |

| Elizabeth Anderson | Evercore ISI Group | Raises | In-Line | $10.00 | $7.50 |

| Erin Wright | Morgan Stanley | Lowers | Underweight | $7.00 | $9.00 |

| David Macdonald | Truist Securities | Lowers | Hold | $10.00 | $13.00 |

| Charles Ryhee | TD Cowen | Lowers | Buy | $16.00 | $22.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Walgreens Boots Alliance. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Walgreens Boots Alliance compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Walgreens Boots Alliance's stock. This analysis reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Walgreens Boots Alliance's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Walgreens Boots Alliance analyst ratings.

Get to Know Walgreens Boots Alliance Better

Walgreens Boots Alliance is one of the largest retail pharmacy chains in the US, with over 8,000 locations. Nearly three quarters of Americans live within five miles of a Walgreens location. Roughly two thirds of revenue is generated from prescription drug sales; Walgreens makes up 20% of total prescription revenue in the US. Walgreens also generates sales from retail products (general wellness consumables and its own branded merchandise), European drug wholesale, and healthcare. With more locations incorporating additional services like Health Corner and Village Medical, Walgreens creates an omnichannel experience for patients and positions itself as a one-stop healthcare provider.

Walgreens Boots Alliance: A Financial Overview

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Positive Revenue Trend: Examining Walgreens Boots Alliance's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 6.0% as of 31 August, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: Walgreens Boots Alliance's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -8.0% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Walgreens Boots Alliance's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -24.95% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -3.66%, the company showcases effective utilization of assets.

Debt Management: Walgreens Boots Alliance's debt-to-equity ratio is notably higher than the industry average. With a ratio of 3.14, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.