/Henry%20Schein%20Inc_%20sign%20outside%20office-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Henry Schein, Inc. (HSIC), based in Melville, New York, is a leading global provider of healthcare products and services for dental, medical, and veterinary professionals. Operating in over 33 countries, the company delivers more than 300,000 products through its automated distribution network. The company operates in two main divisions, Healthcare Distribution and Technology & Value-Added Services.

With around 25,000 employees and over one million customers worldwide, Henry Schein continues to expand its reach as a Fortune 500 organization. The company has a market capitalization of $7.64 billion.

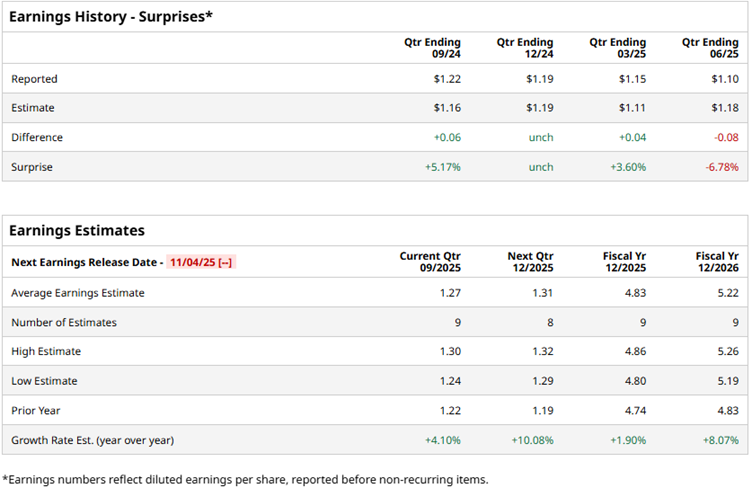

The medical distribution firm is set to report its third-quarter results for fiscal 2025 soon. Ahead of the results, Wall Street analysts see modest growth in its bottom line. For Q3, its profit is expected to grow by 4.1% year-over-year (YOY) to $1.27 per diluted share.

The company has historically had a mixed comparison against consensus EPS estimates, topping or matching them in three of the last four trailing quarters and missing them in one instance. For the current fiscal year, Henry Schein’s profit is projected to grow 1.9% annually to $4.83 per diluted share.

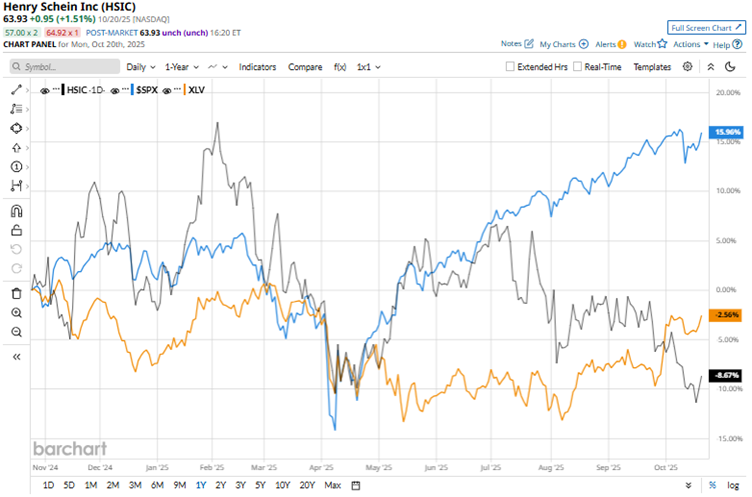

Henry Schein’s stock has been having a bit of an off time on Wall Street. Over the past 52 weeks, it has declined by 11.7%, while it is down by 7.6% year-to-date (YTD). In contrast, the broader S&P 500 Index ($SPX) has gained 14.8% and 14.5% over the same periods, respectively.

The Health Care Select Sector SPDR Fund (XLV) has declined 5.5% over the past 52 weeks, but rose 5.3% YTD. Therefore, the stock has been underperforming its own sector over this period.

On Aug. 5, Henry Schein reported its second-quarter earnings for fiscal 2025. Its topline grew 3.3% YOY to $3.24 billion, which was higher than the $3.22 billion that Wall Street analysts had expected. However, diametrically opposite to this, its adjusted EPS dropped by 10.6% from the year-ago value to $1.10, and missed the expected $1.18. This mixed report led the company’s stock to shed 7.4% intraday.

There are also some weaknesses spotted in its business, like how its organic revenue performance has been underwhelming. In Q2, as we remove the impact of acquisitions and increase from foreign currency exchange, Henry Schein’s sales grew 1.9% YOY.

Wall Street analysts are still optimistic about Henry Schein’s future. Among the 15 analysts covering the stock, the consensus rating is “Moderate Buy.” The ratings configuration is more bullish than it was two months ago, with five “Strong Buy” ratings now, up from four. The overall rating also changed from “Hold” to “Moderate Buy” during this period. The ratings are completed by nine “Holds” and one “Strong Sell.”

The mean price target of $73.15 indicates a 14.4% upside from current levels, while the Street-high price target of $83 implies a 29.8% upside.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.