/Delta%20Air%20Lines%2C%20Inc_%20HQ%20sign-by%20wellsenterprises%20via%20iStock.jpg)

Atlanta, Georgia-based Delta Air Lines, Inc. (DAL) provides scheduled passenger and cargo air transportation. With a market cap of $46.5 billion, the company offers flight status information, bookings, baggage handling, and other related services. The global airline leader is expected to announce its fiscal fourth-quarter earnings for 2025 in the near term.

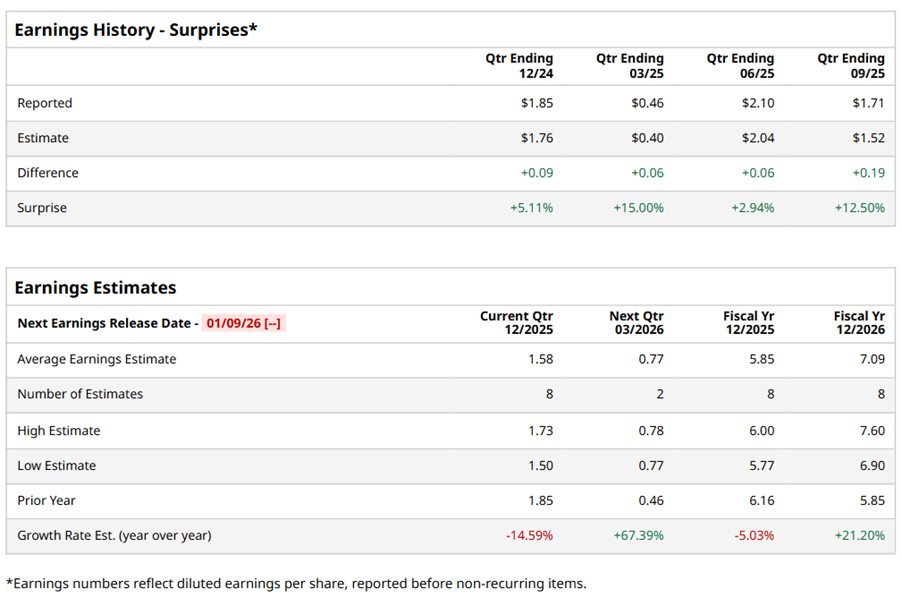

Ahead of the event, analysts expect DAL to report a profit of $1.58 per share on a diluted basis, down 14.6% from $1.85 per share in the year-ago quarter. The company beat the consensus estimates in each of the last four quarters.

For the full year, analysts expect DAL to report EPS of $5.85, down 5% from $6.16 in fiscal 2024. However, its EPS is expected to rise 21.2% year over year to $7.09 in fiscal 2026.

DAL stock has outperformed the S&P 500 Index’s ($SPX) 11.1% gains over the past 52 weeks, with shares up 14.7% during this period. Similarly, it outperformed the Industrial Select Sector SPDR Fund’s (XLI) 12.7% gains over the same time frame.

DAL is outperforming due to strong demand in premium and corporate travel, effective cost management, and a robust loyalty program. Additionally, growth in its premium revenue was driven by new aircraft and retrofits, while the SkyMiles program and American Express Company (AXP) partnership fueled double-digit gains. Corporate travel volumes exceeded 2019 levels, with strong fare growth and operational reliability also contributing to the airline's success.

On Oct. 9, DAL shares closed up more than 4% after reporting its Q3 results. Its revenue of $16.7 billion beat the consensus estimates by 3.8%. The company’s EPS was $2.17, surpassing the consensus estimates by 39.8%.

Analysts’ consensus opinion on DAL stock is bullish, with a “Strong Buy” rating overall. Out of 22 analysts covering the stock, 20 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and one gives a “Hold.” DAL’s average analyst price target is $75.44, indicating a potential upside of 8.2% from the current levels.