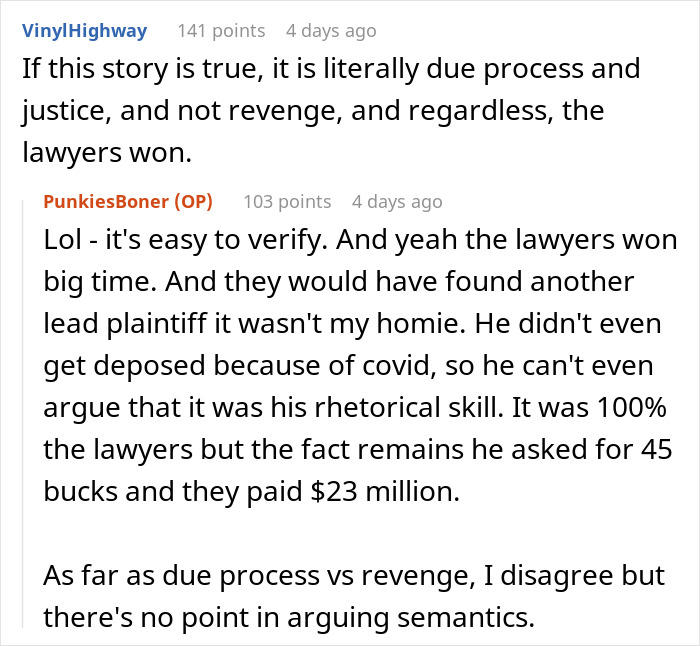

Many corporations employ shady billing practices that take advantage of the average consumer. While a few get away with their schemes, some are rightfully shamed and brought to justice. This story is more about the latter.

A man wanted a $45 refund from a dating app after a bug continuously charged his credit card for a premium feature he had previously signed up for. The company refused, urging him to join a class action lawsuit with others who had a similar experience.

The company lost the case and had to pay $23 million in damages, as the man relished in his victory. His story was shared in the Pro Revenge subreddit as proof that standing up against predatory corporate practices isn’t always a lost cause.

A man successfully sued a dating app company for millions after they refused to pay him a $45 refund

Image credits: onkeybusiness/Envato (not the actual photo)

Not laying down for predatory billing practices – dude was denied a $45 refund, they paid $23 million a couple years later

“A close friend of mine, who would absolutely love to gloat about this here, but can’t because of rule number four (it takes very little imagination to find the public notifications that the case generated) gave me the nod to tell this story which begins with his impulsive decision to try out the paid features of a dating app for one week for the usual reasons, sometime in the middle of 2018.

He says he clicked through the pay wall, was prompted for a credit card number which he provided, agreeing to pay $6.99.

He saw nothing to indicate that it would be a recurrent billing. Of course this was naive, but being a guy who was just coming into the age where he had enough money to afford stuff like that, he didn’t have much experience doing business with tech companies.

He says he wasn’t much more impressed with the paid features than the free ones, and kind of just stopped opening the app, deleted it from his phone a couple weeks later, and pretty much forgot about it.

Fast forward 3 months, he sees a charge for $6.99 paid to “SOCIAL MEDIA INC.” or some similarly non-descriptive name, drills down and sees that he’s been paying it every week for a few months. He ends up having to call his bank, which provided enough information for him to connect the dots.

After searching for a way to contact customer service unsuccessfully he re-downloaded the app, and found no obvious way to unsubscribe. He followed the help links, which provided instructions that didn’t work.

Eventually he found an email address and sent a succinct description of his problem, and received a flippant response which regurgitated the instructions from the help pages in the app.

This initiated a series of emails over the better part of a week, in which he provided increasingly detailed info about the screens he was presented with as he tried to follow their instructions, and received increasingly dismissive and even contemptuous responses, until he received a set of slightly modified instructions that included updating the app.

There had obviously been a bug, but there was no apology and at this point, the amount of time it cost him had added injury to insult.

He requested a $45 refund for the weeks that he hadn’t even had the app installed in his phone, and received a sneering denial in response.

Image credits: Pressmaster/Envato (not the actual photo)

Figuring it was likely that others had been treated the same way, he simply Googled “class action lawsuit against [well known dating app]” and discovered that he was correct.

A law firm that was only one area code away from his had filed a complaint on behalf of a class of people with similar complaints. He called the number left a message, got a return call about an hour later from an attorney that was eager to hear his story.

He was asked to gather some bank statements, Google Play Store account records and write a couple of paragraphs describing his experience, which he provided in a neatly compiled PDF package.

A week or so later there was a second interview with that attorney and one of his colleagues, ending with them inviting him to be the lead plaintiff of their class action lawsuit.

Fast forward two and a half years, during which my friend invested maybe 20 or 30 hours, mostly in phone calls and one in person meeting with the same two attorneys (who it turns out were the entire firm), he received a phone call notifying him that the legal team for this giant Tech firm had crumbled as the court date approached and agreed to a settlement of $23m.

My friend received a modest four digit incentive award in return for being the lead plaintiff. I guess the lawyers did much better in return for the two and a half years of working their a** off in what was kind of a risky David and Goliath situation for them.

The attorneys gleefully invited him to get in touch and share any future perceived injustices with them, which he has but unfortunately tech companies have become much more arbitration-clausey so that’s probably a one-time shot for him.

But, In a world of increasingly predatory corporations that strive to squeeze consumers by trapping us in tldr terms and conditions, and monopolizing every corner of the economy, my friend now has a script for standing up for himself when he perceives that he’s being taken advantage of.

It goes something like “I want to make you aware that I’m a guy who makes time to stand up for myself as a consumer – it’s become sort of a hobby, and I’m pretty good at it. I don’t object to businesses making a fair profit, but if you’re going to try to squeeze me, I promise it won’t be worth it. And if there’s any doubt in your mind that I mean what I say, do a Google search for [his name] vs. [dating app].”

Yes, it can be annoying. I should mention that he has a very patient SO.”

Credits: PunkiesBoner

Fraudulent billing schemes for using apps are typical, and they sometimes involve big-name companies

Image credits: Viralyft/Pexels (not the actual photo)

The unnamed dating app company in the story is just one of the many that utilize predatory billing practices. Some of those involved are the bigwig corporations whose products you’ve likely used frequently.

In 2021, Apple claimed to have ceased almost $1.5 billion of supposedly fraudulent transactions from 1.6 million “risky and untrustworthy apps.” Without giving specifics, the tech giant affirmed it rejected more than 35,000 apps that contained “hidden or undocumented features,” more than 343,000 for “privacy violations,” and terminated over 802,000 “fraudulent developer accounts.”

According to an official news report, the company attributes its success in tracking these suspicious activities to its “continuous monitoring and vigilance across multiple teams.”

That’s not all. In June, the US Federal Trade Commission revealed that Adobe implemented hidden fees to trap people into paying for subscriptions.

According to a Consumer Alert report, Adobe would coax consumers into signing up for free trials that wouldn’t cancel after the trial period lapsed. The company would then place users on an “annual paid monthly” plan without specifying that it would be a one-year contract.

The FTC report claims users who wanted to cancel their subscription would have to pay a hefty termination fee, which was also unspecified during the sign-up. Contacting Adobe support was also futile, as users were left dealing with continuous charges.

You can protect yourself from falling victim to predatory billing practices

Image credits: cottonbro studio/Pexels (not the actual photo)

As the story notes, the user didn’t seem bothered by the charges at first, as they were menial amounts. However, they later became a problem, and he had to take legal action, which required a lot of time, effort, and resources.

Vigilance and due diligence can help you avoid these headaches. The FTC advises doing research and looking for similar complaints. Take note of other keywords attached to the company’s name, such as “problem,” “cancel,” and “fee.”

Checking the terms and conditions is another tedious yet necessary step. Many of these documents are in fine print, but the same strategy of looking for specific keywords may make it less daunting.

Part of the effort in doing in-depth research is checking app permissions. As global security software company McAfee points out, a photo editor app, for example, should not access your location data and contacts list. Permissions that don’t make sense are potential red flags.

But if you’ve already fallen victim to such predatory billing practices, legal action may be your best option. Fortunately for the man, he was able to join a class action lawsuit that may have strengthened his case.

What’s your take, readers? Was there anything the man could have done differently, if not better?

Commenters expressed their doubts as some shared similar experiences