Connected TV viewing is up 21% per household, with ad-supported services picking up the be bulk of new viewing, according to a new report from Comscore.

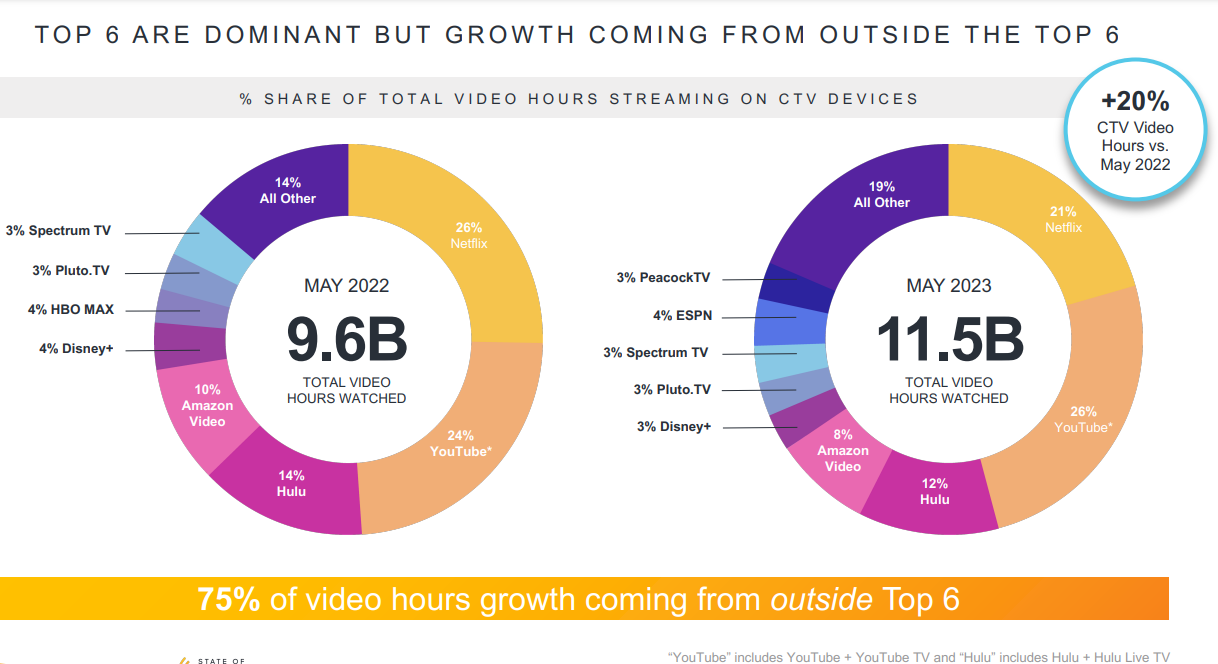

Total CTV hours viewed rose to 11.5 billion in 2023 from 9.6 billion in 2022, according to the measurement company’s seventh annual State of Streaming report.

Comscore said that 75% of the growth in new streaming were going to streaming provider outside of the leaders — Netflix, YouTube, Amazon Prime Video, Hulu, HBO Max (now Max) and Disney Plus — while consumption of free ad-supported streaming television (FAST) channels and targeted programming accelerates.

Streaming of ad-supported streaming services is up 17% over the past two years, while non-ad supported streaming services are up 9%.

Over the last 15 months, audiences for The Roku Channel are up 27%; Pluto TV is up 28%; Tubi is up 48%; and Freevee is up 55%, Comscore said.

Hispanic households increased their consumption of FAST content by 81% over the past year.

As if May, Comscore said that 60% of CTV using households have either cut the cord or never had a subscription to payTV. That’s up from 37% in 2019.

Smart TVs were the dominant device for viewing, with usage in 74.5% of homes that stream content. Usage of streaming boxes and stickers dropped to 64% of homes from 64.5% a year ago and gaming consoles were employed in 43.5% of homes, up from 38.6%.

"While the top US streaming services are keeping up with the demand for subscriptions, new growth can be observed in FAST streaming platforms like Roku, Pluto and Tubi which are increasingly consolidating their position in the household mix," said James Muldrow, VP, product management, Comscore. "At the same time, cable/satellite subscribers remain some of the most engaged users in the streaming landscape. With three cable/satellite providers in the Top 10 ranking of video services based on hours watched per household, these findings highlight the success of these providers in offering advertisers consistently engaged streaming audiences."