Transcript:

Conway Gittens: I’m Conway Gittens reporting from the New York Stock Exchange. Here’s what we’re watching on TheStreet today.

Volatility has returned to Wall Street with stocks zig-zagging from day to day. Investors are grappling with concerns that the recent run in tech stocks may have gone too far, too fast. Meanwhile, earnings season brings fresh information to trade on. American Express posted mixed results Friday. Its affluent customer base continued to spend last quarter, and even though that spending was not as robust as forecast, the company still beat profit targets.

Watch More Videos:

- New dyslexia treatment aims to overcome biggest hurdle in cognitive healthcare

- How this YouTuber built a huge audience by playing slots

- Yes, there are fewer chips in the bag: Shrinkflation, explained

In other news….A worldwide software glitch has mercilessly grounded many operations to a halt, in what is being described as the largest IT outage in history.

Related: Stranded by the airport IT outage? Here is what you can do

The glitch, which was identified and fixed by software security firm Crowdstrike, impacted computers worldwide that use Microsoft's operating system. Airlines have been forced to ground flights, hospitals are scrambling to reboot systems, and media companies were knocked off the air. Industries on every continent from trading desks in Europe to banking systems in Africa to emergency service operations in Asia were all impacted.

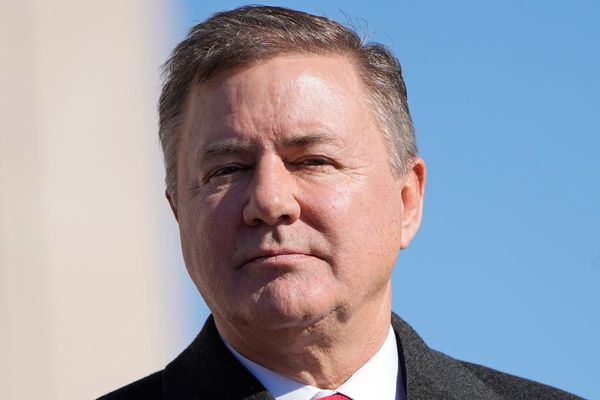

Crowdstrike CEO George Kurtz went on CNBC, where he apologized to “every person and every company” impacted by the snafu. In a separate interview on NBC he said many of his customers have rebooted their computers but for others “it could be some time for some systems that won’t automatically recover.”

Crowdstrike did make clear that this wasn’t a security incident or a cyberattack,

That’ll do it for your Daily Briefing. From the New York Stock Exchange, I”m Conway Gittens with TheStreet.

Related: CrowdStrike stock tumbles after update triggers global IT chaos