The Coca-Cola Company (KO), headquartered in Atlanta, Georgia, is a beverage company that manufactures, markets, and sells various nonalcoholic beverages worldwide. With a market cap of $312.3 billion, the company also distributes and markets juice and juice-drink products to retailers and wholesalers worldwide.

Companies worth $200 billion or more are generally described as “mega-cap stocks,” and KO definitely fits that description, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the beverages - non-alcoholic industry. KO's iconic brand recognition and diverse product portfolio give it a competitive edge. With a vast distribution network, its products are widely available, catering to varied consumer tastes and preferences globally.

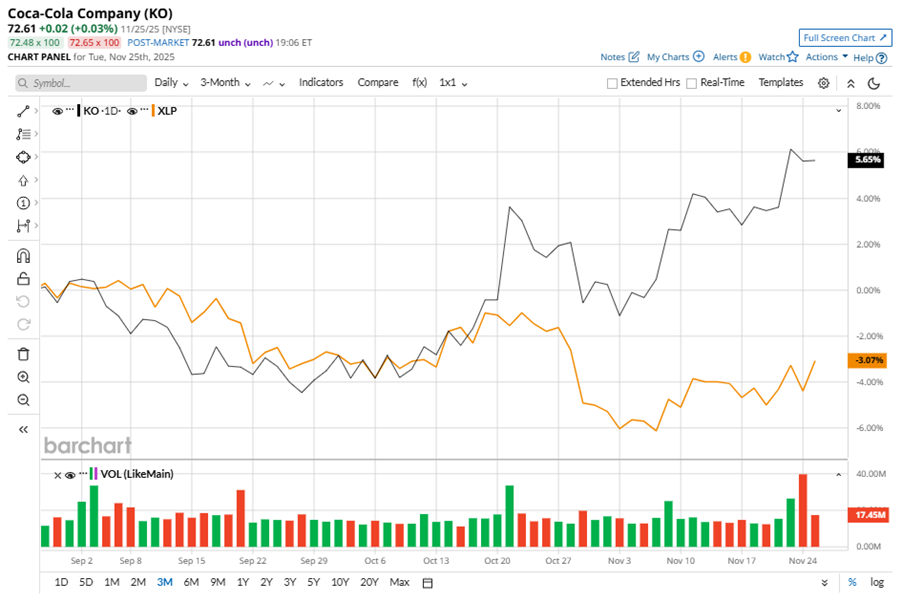

Despite its notable strength, KO slipped 2.4% from its 52-week high of $74.38, achieved on Apr. 22. Over the past three months, KO stock gained 5.3%, outperforming the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.7% decline during the same time frame.

In the longer term, shares of KO rose 16.6% on a YTD basis and climbed 12.8% over the past 52 weeks, outperforming XLP’s YTD marginal dip and 5.1% losses over the last year.

To confirm the bullish trend, KO has been trading above its 50-day and 200-day moving averages since mid-October, with some fluctuations.

On Oct. 21, KO shares closed up more than 4% after reporting its Q3 results. Its adjusted revenue stood at $12.4 billion, up 3.9% year over year. The company’s adjusted EPS increased 6.5% from the prior-year quarter to $0.82.

In the competitive arena of non-alcoholic beverages, PepsiCo, Inc. (PEP) has lagged behind the stock, showing resilience with a 3.9% loss on a YTD basis and a 10.4% downtick over the past 52 weeks.

Wall Street analysts are bullish on KO’s prospects. The stock has a consensus “Strong Buy” rating from the 24 analysts covering it, and the mean price target of $80.17 suggests a potential upside of 10.4% from current price levels.