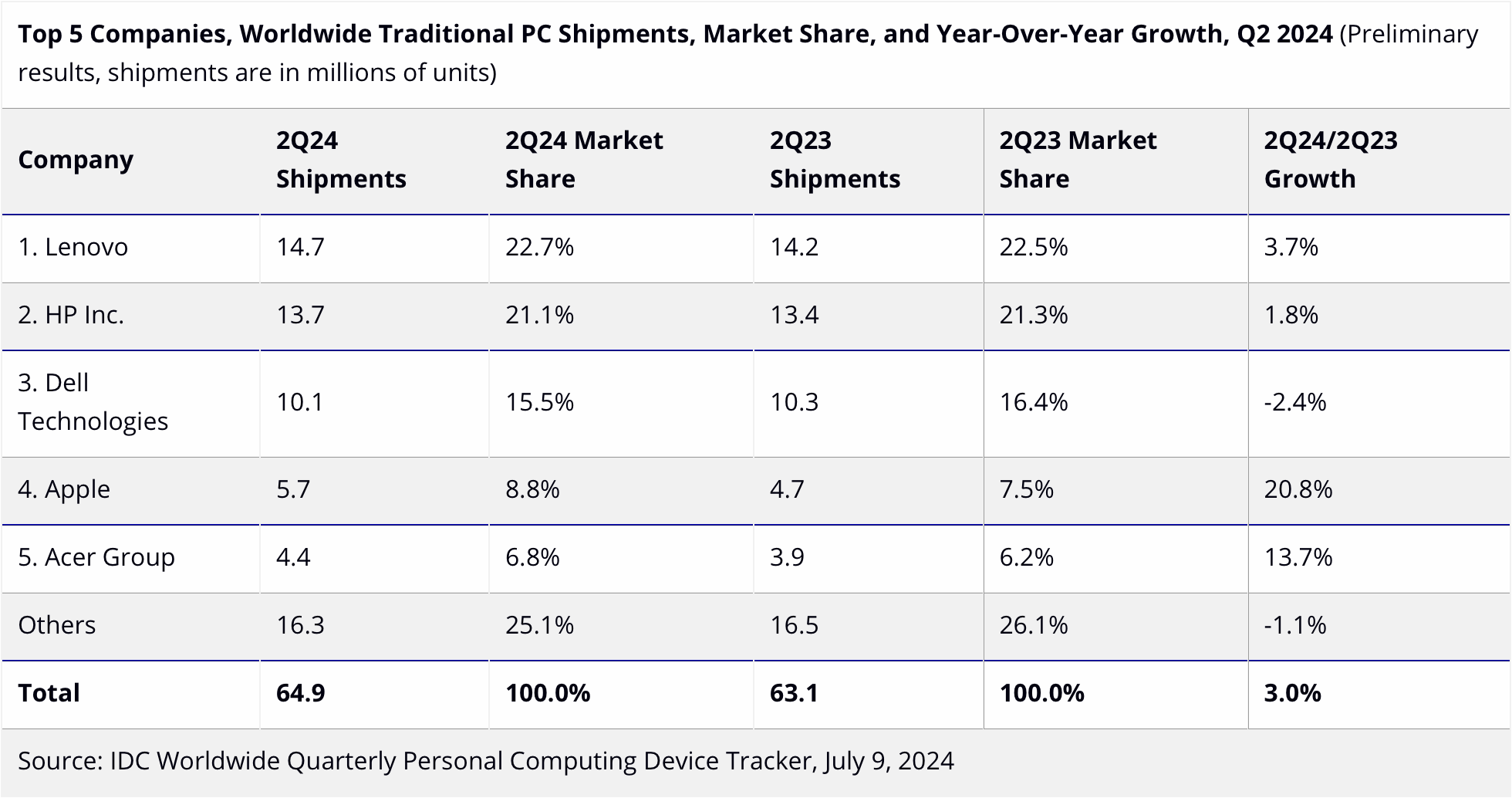

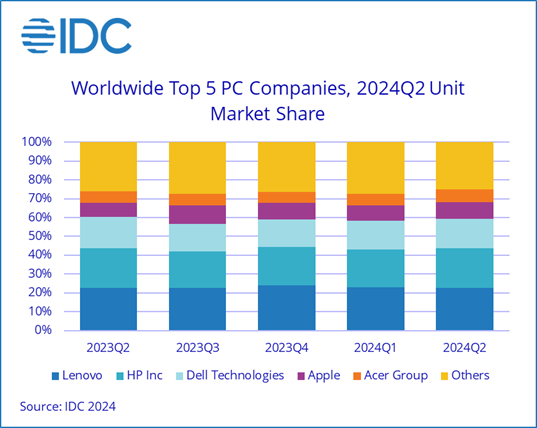

The client PC market saw a positive turn in the second quarter of 2024, with global shipments rising to 64.9 million units, marking a 3.0% increase from the previous year, according to IDC. Sales of PCs from all Top 5 makers except Dell increased year-over-year, but Apple and Acer demonstrated remarkable growth by 20.8% and 13.7%, respectively.

According to IDC, the market hit 64.9 million units after seven consecutive quarters of decline, largely driven by improved conditions outside of China and the buzz surrounding AI PCs and commercial refresh cycles. Despite ongoing challenges due to market maturity and economic pressures, the PC market's growth was notable. Excluding China, which continued to show weak results, global shipments increased by over 5% year-over-year. Of course, this improvement was partly due to favorable comparisons with the previous year's performance.

"Make no mistake, the PC market just like other technology markets faces challenges in the near term due to maturity and headwinds," said Ryan Reith, group vice president with IDC's Worldwide Device Trackers. "However, two consecutive quarters of growth, combined with plenty of market hype around AI PCs and a less sexy but arguably more important commercial refresh cycle, seems to be what the PC market needed. The buzz is around AI, but a lot is happening with non-AI PC purchasing to make this mature market show signs of positivity."

Lenovo remained the world's largest supplier of PCs in Q2 2024. The company shipped 14.7 million units and commanded a 22.7% market share, a 3.7% growth compared to the same quarter in the previous year when Lenovo shipped 14.2 million units and held a 22.5% market share.

Lenovo's rival HP shipped 13.7 million units in the second quarter, achieving a 21.1% market share. The company's shipments marked a 1.8% growth compared to Q2 2023 when HP shipped 13.4 million units and held a 21.3% market share. Despite the slight decrease in market share, HP experienced a year-over-year shipment increase, which is a good sign.

By contrast, Dell shipped 10.1 million units in Q2 2024 while controlling a 15.5% market share. However, this represented a decline compared to Q2 2023, both in terms of shipments and in terms of share: back then, the company supplied 10.3 million units and held a 16.4% market share.

Apple was probably a star of the quarter, at least based on the numbers from IDC, although it only commanded an 8.8% share of the market. In Q2 2024, Apple shipped 5.7 million units, representing significant growth compared to Q2 2023, where Apple shipped 4.7 million units and held a 7.5% market share. Apple's year-over-year growth was 20.8%, indicating a solid performance and a notable increase in its market presence.

The second quarter was also good for Acer Group, which shipped 4.4 million units, a 13.7% increase compared to Q2 2023. The company also commanded a 6.8% market share in Q2 2024, up from 6.2% in the same quarter in the previous year.

"Outside the commercial refresh cycle, promotional activity from consumer-oriented brands and channels have helped bolster the segment," said Jitesh Ubrani, research manager with IDC's Worldwide Mobile Device Trackers. "The market has also moved past the rock bottom pricing brought about by excess inventory last year, signifying growth in average selling prices due to richer configurations and reduced discounting."