KEY POINTS

- Canary noted that Litecoin has a proven growth and reliability track record

- The asset manager previously filed an S-1 application for an $XRP ETF

- Some crypto users predicted that an $LTC ETF will not do well

Australian asset manager Canary Capital has filed an application on S-1 document with the U.S. Securities and Exchange Commission (SEC) for a Litecoin (LTC) exchange-traded fund (ETF), pumping LTC prices and drawing mixed reactions from the cryptocurrency community.

The filing was accomplished Tuesday, with Canary noting that the Litecoin network "is an alternative software implementation of Bitcoin," but with transactions on Litecoin being completed four times faster than on the BTC network.

Senior Bloomberg ETF analyst Eric Balchunas said the filing is the first ever in the United States "but may also be first ever in [the] world."

Exposing Investors to Time-Tested $LTC

In a statement following its S-1 filing, Canary said it believes that "Litecoin presents a unique and compelling opportunity for investors seeking exposure to a time-tested and reliable cryptocurrency."

"Litecoin has demonstrated a proven track record of growth and reliability with significant enterprise-grade use cases. With its strong foundation, Litecoin continues to play a leading role in the broader cryptocurrency ecosystem, which Canary believes could make it attractive to a wider range of institutional investors," the asset management firm added.

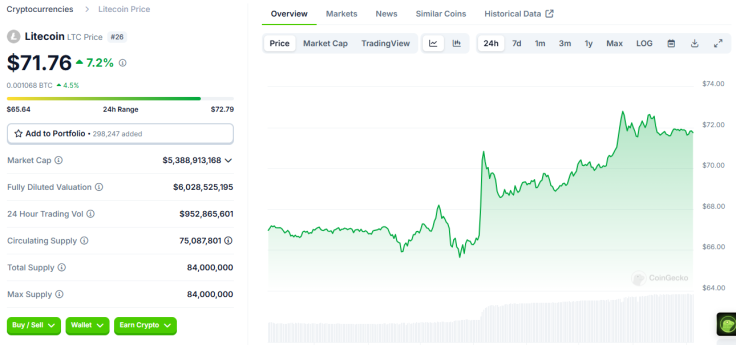

Litecoin Spikes Amid Development

Following news of Canary's filing, LTC surged by over 7% to around $71. Earlier in the day, Litecoin was trading at around $66 amid a 14% rally in the past 30 days. At one point late Tuesday, the digital coin hit $72.79 as per CoinGecko data.

Being an open-source, fully decentralized network that offers instant, low-cost transactions worldwide, Litecoin has made a name for itself and is touted as "a proven medium of commerce complementary to Bitcoin," the world's first decentralized cryptocurrency.

Crypto Users Divided Over Canary's Latest Move

When Canary filed for an XRP ETF, many crypto users celebrated the move, especially during a critical time for the token's largest holder, Ripple, as it attempts to fend off the SEC's continuing crackdown.

However, its Litecoin ETF filing got mixed, at times wild, reactions from the crypto community.

The official account of the Rayls blockchain ecosystem said that if Canary's application is approved, it could represent "a significant step in bringing even more diversity to the crypto ETF space."

If approved, this could represent a significant step in bringing even more diversity to the crypto ETF space. While Bitcoin has been the dominant choice for ETFs, the introduction of other alternatives raises interesting questions about how far the crypto market can diversify…

— Rayls (@RaylsLabs) October 15, 2024

One user said it must have been an "easy" choice to make for Canary since "Litecoin is everything Bitcoin is, but more," noting how LTC is being "shaded" for being a reliable alternative to BTC.

Others weren't as happy for the Litecoin community. One user asked why Canary filed for an LTC ETF, saying Dogecoin (DOGE) should be first. DOGE is much higher in the ranks of the world's top digital assets compared to Litecoin. Some were even more extreme with their comments about the filing, with predictions that an LTC ETF "will fail and bomb."

This will go so badly 😆 Nobody wants this.

— parachutesBTC (@parachutesBTC) October 15, 2024

Litecoin still around ? Have not heard about that for years

— The Gnarley Goat 💎🟩 (@FuturistOfMoney) October 15, 2024

Still, LTC users were extremely happy with the news. Some users said a Litecoin ETF was inevitable, and others said such a fund can provide new opportunities for retail and institutional investors alike.

Exciting news! This could open up new opportunities for both individuals and institutions. Looking forward to the approval!

— Kuma1 (@Kuma1Eth) October 15, 2024