Southwest Airlines (LUV) stock is under pressure on Tuesday, down about 5% at last check.

At today’s low, the shares were down 6.3% and coming into the session, the stock has now declined in three straight weeks.

The airlines have seen a robust return, and despite looming recession worries, travelers continue to book trips and take vacations.

Of course, they had to deal with a monstrous storm that wreaked havoc on travelers’ holiday plans this year. While many airlines were looking to have cleared the worst of it, Southwest Air had some real issues.

On Monday, the company canceled almost 3,000 flights, accounting for more than 70% of its flights that day. For what it's worth, more than 4,000 flights coming into or within the U.S. were canceled.

Of the four major airline stocks, Southwest Airlines is the only one struggling on the day. Delta (DAL) and American Airlines (AAL) are about flat while United Airlines (UAL) is up 1%.

Trading Southwest Airlines Stock

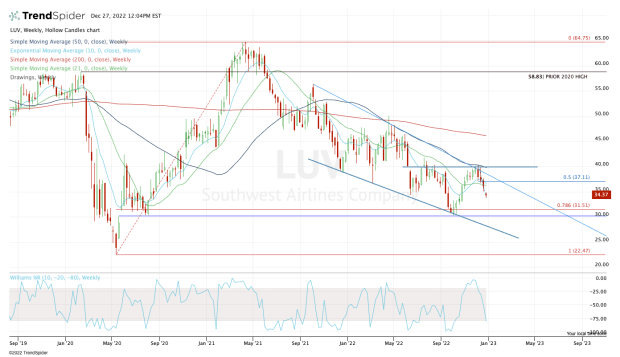

Chart courtesy of TrendSpider.com

While Southwest may be lagging its peers this morning, it’s the only stock of this group that rebounded enough to take out its February 2020 high. None of the others really even got close.

Still, the stock has suffered quite a bit lately, down 47% from its post-covid high in April 2021.

Quite frankly, the stock looks to be a bit in no man’s land -- unless it can regain $35.

If Southwest stock moves back above $35, the bulls will want to see it regain the 10-week and 21-week moving averages, as well as the 50% retracement of the current decline.

If it can do that, Southwest has more potential upside. If it moves above downtrend resistance, the declining 50-week moving average would be the main target, currently near $40.

That measure has been active resistance so far this year.

On the downside, a break of $33.75 opens the door down to the $30 to $31.50 zone. The latter is the 78.6% retracement of the larger range, while $30 has been notable support for the past 18 months.

A true breakdown could put $27.50 in play.

The bottom line is simple: Watch $33.75 on the downside and $35 on the upside for clues as to what may come next for Southwest stock.

More Southwest Coverage:

- Southwest Airlines Explains What Went Wrong (and Where the Blame Lies)

- Twitter Reaction to Southwest Air's Epic Failure Reveals Stunning Scenes

- Southwest Airlines Faces Investigation Over Flight Cancellations

- Southwest Flight Canceled? How You Might Be Able to Get Home

- What to do if Your Southwest, Alaska or Other Flight Gets Canceled

- FAA Has Serious Southwest Airlines Safety Concerns

Season's Savings!

It’s time to take your financial future into your own hands. Level up your investing knowledge when you save $300 on our most comprehensive investing product.