Shares of Johnson & Johnson (JNJ) have been getting crushed lately. The stock has fallen in seven straight weeks and the sellers have shown no sign of backing off.

Does that make it a buy candidate? My thinking is straightforward.

First, this is a high-quality stock with high-quality earnings. Analysts may expect just single-digit earnings and revenue growth this year and next, but that’s a lot better than many companies can say right now.

Plus those earnings are dependable, which is why J&J is considered a blue-chip stock by many investors. And it’s also considered a dividend king, as it has raised its payout for 60 consecutive years. It will likely do so again in April.

At just under 15 times earnings with a dividend yield of 2.9%, I think the J&J stock charts are worth a further look.

Plus, the stock hasn’t declined in seven straight weeks for 20 years. In 2009, it suffered a six-week losing streak, but you’d have to go all the way back to November 2002 to find a seven-week streak for the bears.

Trading Johnson & Johnson Stock

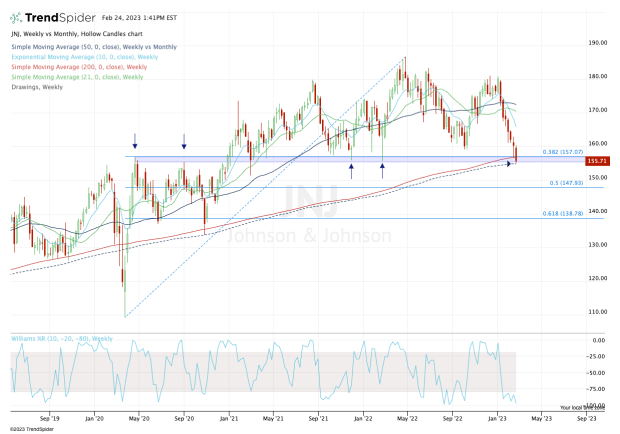

Chart courtesy of TrendSpider.com

Months ago, I wrote about a potential buy-the-dip zone in J&J. Unfortunately, it resolved higher before testing this level and went on to rally toward $180.

That support zone is now in play, however, as Johnson & Johnson stock tumbles into the mid-$150s.

Near current levels we find the 38.2% retracement from the all-time high down to the 2020 covid low. It’s also where we find the 200-week and 50-month moving averages, as well as a key support/resistance zone.

The stock may very well fail to hold this level or otherwise give bulls a meager bounce before further rolling over.

My thought process with Johnson & Johnson is simple: Either the overall market firms up and J&J bounces as a result, or the marketwide selling pressure continues and this name will ultimately be a flight to safety.

It's worth mentioning that this is a longer-term approach to J&J vs. a quick scalp or trade.

So what are the levels to know now?

On the upside, note that the declining 10-week moving average could be resistance on a bounce. Above that would open the door back toward $170.

On the downside, failure to hold the $154 to $155 area could quickly put the $148 to $150 zone in play. While seven straight weekly declines favors a bounce, it doesn’t mean lower prices can’t happen.

Below $148 and it’s possible we see a dip all the way down to the $135 to $137 zone.

The bottom line: There’s no guarantee Johnson & Johnson stock will find support near current levels. But when we marry the fundamentals and the technicals, it’s clear we could get a bounce out of the $155 zone.