Analyst Will Clemente noted the remarkable conviction of Bitcoin (CRYPTO: BTC) HODLers as 64% of Bitcoin supply hasn’t moved in a year despite the tech-heavy Nasdaq plunging 18% from its peak.

What Happened: Clemente tweeted, “Beneath the surface, there is a group of convicted HODLers viewing BTC as their store of value amidst unprecedented uncertainty in markets. Pretty remarkable.”

Despite the Nasdaq being down 18% from its peak, a record high 64% of Bitcoin supply hasn't moved in at least a year.

— Will Clemente (@WClementeIII) April 21, 2022

Beneath the surface, there is a group of convicted HODLers viewing BTC as their store of value amidst unprecedented uncertainty in markets. Pretty remarkable. pic.twitter.com/CsmXvHXGAY

See Also: How To Buy Bitcoin (BTC)

Why It Matters: On Thursday, OANDA analyst Craig Erlam said that Nasdaq had a more “turbulent week” which Bitcoin shrugged off.

“Maybe a sign of it distancing itself from the link between the performance of the two,” said Erlam in a note.

Even in terms of depreciation, Bitcoin has fared better than the Nasdaq. On a year-to-date basis, the tech-heavy Nasdaq has declined 15.8% in 2022, while Bitcoin has fallen 14.9%.

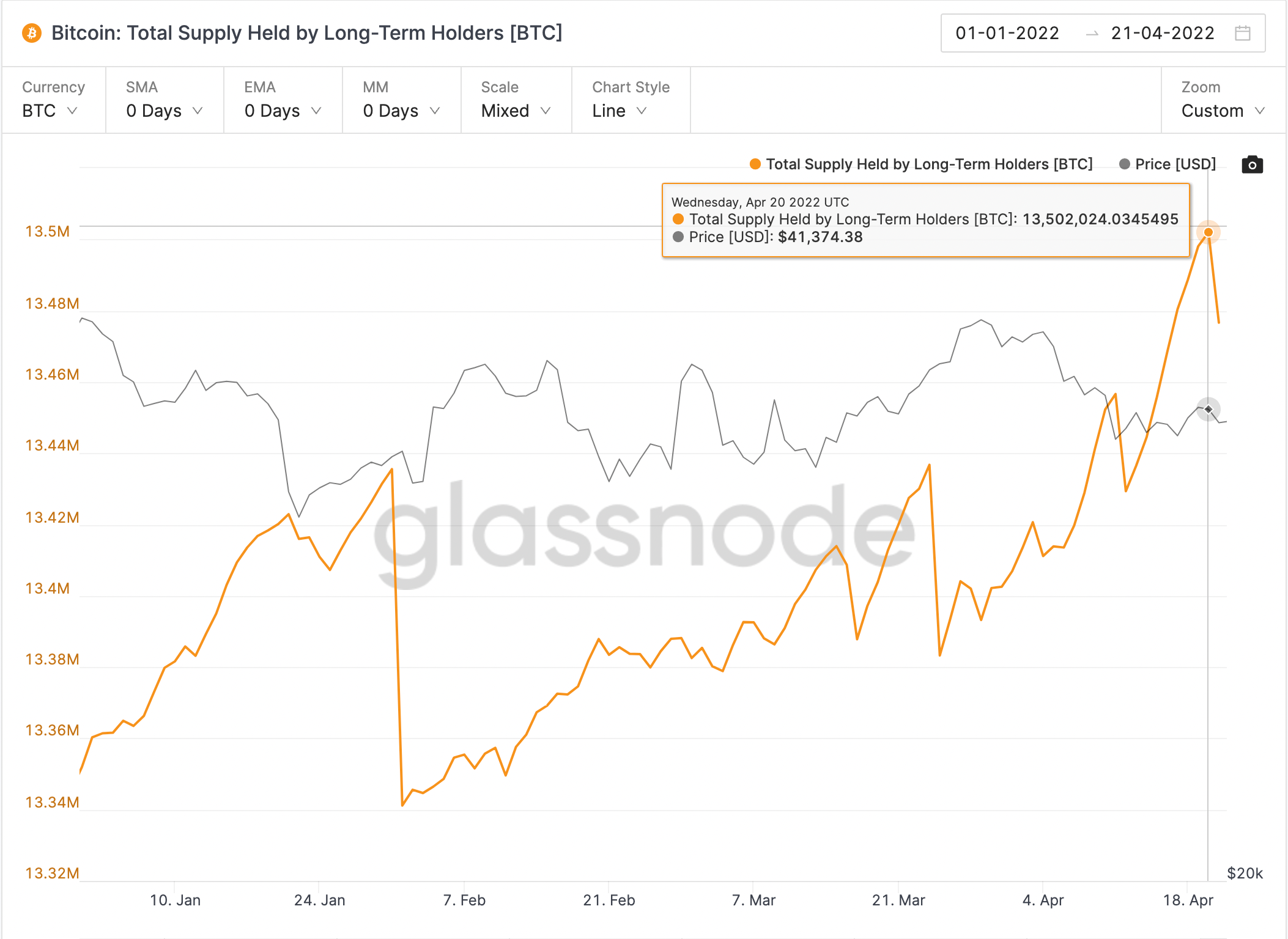

Glassnode data indicates that Bitcoin supply held by “Long-Term Holders” or those investors that keep their Bitcoin for a 155-day holding period touched a peak of 13.5 million BTC or $548.71 billion on Wednesday.

Price Action: At press time, Bitcoin traded 0.5% higher at $40,668.52, according to Benzinga Pro data.