On Friday, bank stocks kicked off the third-quarter-earnings season. On Oct. 17 Bank of America (BAC) weighed in, reporting quarterly results ahead of the open.

Bank of America shares are roughly 5% higher at last check after the financial-services giant reported an earnings and revenue beat for its third quarter.

The stock is on something of a tear. The shares rallied more than 6% on Thursday and were flat on Friday, as a host of other bank stocks reported strong quarterly results (and traded quite well despite the marketwide selloff).

That said, Bank of America stock is rallying right into a key downtrend mark, causing some concern that the rally may be out of steam.

Let’s look at the charts.

Trading Bank of America on Earnings

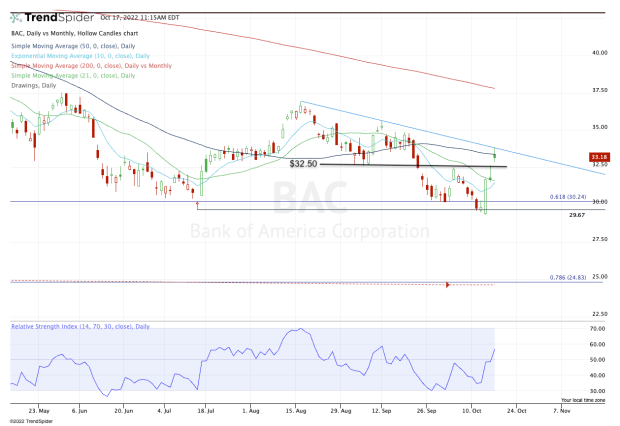

Chart courtesy of TrendSpider.com

Notice last week’s action: Bank of America stock made new lows for 2022 by breaking the July low, and then stormed higher with the rest of the market on Thursday.

Then came today’s action, where the shares gapped higher in the 50-day moving average and downtrend resistance (blue line).

From here, it leaves bulls in a tough spot. Do they chase into resistance or hope for a pullback? Banks have shown some resiliency over the past few days, which is another consideration in the question.

Ultimately, we’ve been in a bear market for the entire year, so buying into resistance has not been the greatest strategy thus far.

As for a dip to buy, aggressive bulls may consider buying a pullback to the $32.50 region. In that zone, the stock would fill its earnings gap, as well as retest a key pivot area.

If this zone doesn’t hold or if it times up with a test of the 10-day and 21-day moving averages, then these measures would also be a reasonable area to look at for support.

If all of the above levels fail, then the $29.50 to $30.25 region is back in play.

On the upside, I’d love to see Bank of America stock clear the 61.8% retracement near $34 and fill the gap up near $35. Above that could put the August high in play near $37.