/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at $422.8 billion by market cap, Advanced Micro Devices, Inc. (AMD) is a leading global semiconductor company. The California-based company designs high-performance computing and graphics chips. AMD was founded in 1969, and it also develops processors and accelerators for desktops, laptops, data centers, gaming consoles, and artificial intelligence applications. Its main product lines include Ryzen CPUs for consumer PCs, EPYC processors for servers, Radeon GPUs for graphics and gaming, and Instinct accelerators for AI and high-performance computing.

Shares of this semiconductor giant have significantly outperformed the broader market over the past year. AMD has gained 104.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 13.9%. Over the past six months, AMD's stock is up 51%, surpassing the SPX’s 8.8% rise.

Zooming in further, AMD has surpassed the broader SPDR S&P Semiconductor ETF (XSD), which has gained about 32.5% over the past year and 31.6% over the past six months.

On Jan. 26, AMD shares fell 3.3% in afternoon trading after Microsoft Corporation (MSFT) unveiled its new Maia 200 AI chip aimed at reducing reliance on external chipmakers. The in-house AI accelerator, designed to support multiple models including those from OpenAI, raised concerns about shrinking demand for third-party suppliers and increased competitive pressure in the semiconductor market.

For FY2025 that ended in December, analysts expect AMD’s EPS to grow 19.5% to $3.13 on a diluted basis. The company’s earnings surprise history is mixed. It beat or matched the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

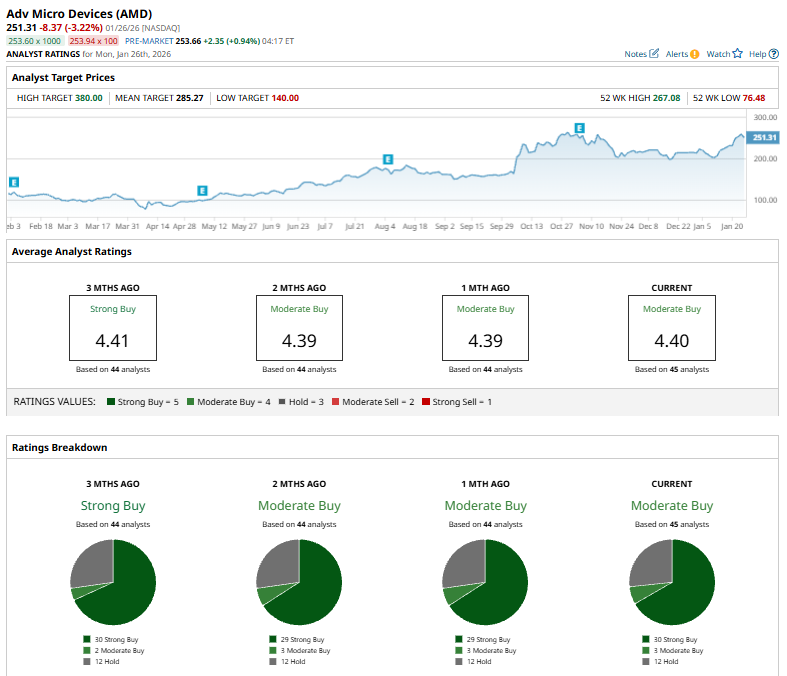

Among the 45 analysts covering AMD stock, the consensus is a “Strong Buy.” That’s based on 30 “Strong Buy” ratings, three “Moderate Buys,” and 12 “Holds.”

This configuration is bearish than three months ago when it had an overall “Strong Buy” rating.

On Jan. 27, AMD received a boost after UBS analyst Timothy Arcuri reaffirmed a “Buy” rating and raised the price target from $300 to $330, reflecting a 10% increase and signaling strong confidence in the company’s market position and future growth prospects.

AMD’s average price target of $285.27 suggests a 13.5% upside potential from the current market prices. The Street-high price target of $380 implies a premium of 51.2%.