Applied Digital Corporation (NASDAQ:APLD) will release earnings results for the first quarter, after the closing bell on Thursday, Oct. 9.

Analysts expect the Dallas, Texas-based company to report a quarterly loss at 16 cents per share, versus a year-ago loss of 15 cents per share. Applied Digital projects quarterly revenue of $45.46 million, compared to $60.70 million a year earlier, according to data from Benzinga Pro.

On Aug. 18, Applied Digital announced plans to break ground in September on a $3 billion AI data campus in Harwood, North Dakota. The site, named Polaris Forge 2, will be a 280-megawatt facility designed to scale beyond its initial capacity, with operations beginning in 2026 and full capacity expected in early 2027.

Applied Digital shares gained 4.5% to close at $27.71 on Monday.

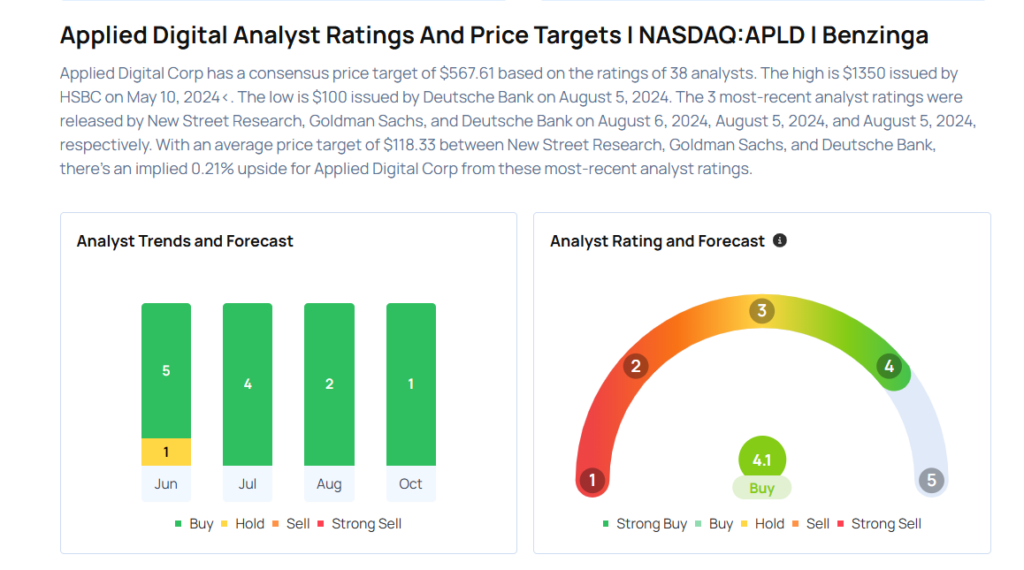

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- HC Wainwright & Co. analyst Kevin Dede maintained a Buy rating and raised the price target from $15 to $20 on Aug. 25, 2025. This analyst has an accuracy rate of 71%.

- Lake Street analyst Rob Brown maintained a Buy rating and boosted the price target from $14 to $18 on July 31, 2025. This analyst has an accuracy rate of 73%.

- Needham analyst John Todaro maintained a Buy rating and raised the price target from $12 to $16 on July 31, 2025. This analyst has an accuracy rate of 90%.

- B. Riley Securities analyst Nick Giles maintained a Buy rating and increased the price target from $8 to $15 on June 4, 2025. This analyst has an accuracy rate of 80%.

- JMP Securities analyst Greg Miller maintained a Market Outperform rating and boosted the price target from $12 to $18 on June 3, 2025. This analyst has an accuracy rate of 60%.

Considering buying APLD stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock