The long-awaited Apple Card Savings Account is here! Starting today (April 17), iPhone users can open a high-yield savings account from Goldman Sachs straight from the Wallet app and grow their Daily Cash balance with interest earned.

The savings account has no fees, no minimum deposits, and no minimum balance requirements. It offers an annual percentage yield (APY) of 4.15 percent — a rate more than 10 times the national average, Apple highlighted in a press release.

“Savings helps our users get even more value out of their favorite Apple Card benefit — Daily Cash — while providing them with an easy way to save money every day,” said Apple Pay and Apple Wallet VP Jennifer Bailey in the release. “Our goal is to build tools that help users lead healthier financial lives, and building Savings into Apple Card in Wallet enables them to spend, send, and save Daily Cash directly and seamlessly — all from one place.”

Another hotly anticipated new Apple Card offering — Apple Pay Later — rolled out last month, signaling Apple's entry into the highly competitive Buy Now Pay Later (BNPL) space.

How to open an Apple Card Savings Account

Apple Card Savings Accounts are exclusively available to Apple Card users, so you'll need to sign up for one to start saving. Check out our guide on how to apply for an Apple Card for step-by-step instructions.

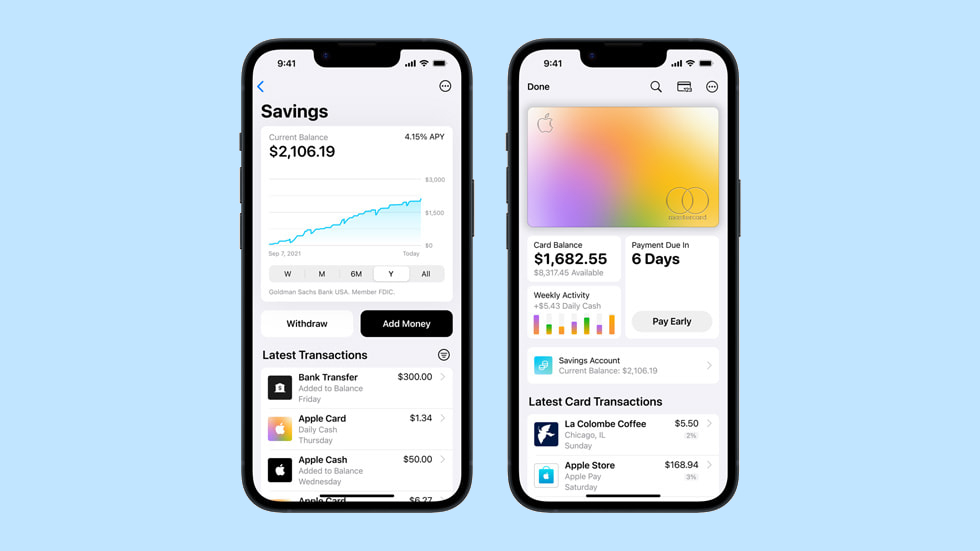

If you already have an Apple Card, you'll find the savings account integrated directly into your iPhone's Wallet app. To open one, tap on your Apple Card, then the circle with three dots in the upper-right-hand corner of the screen, and select the Daily Cash option. Scroll down and look for the Apple Card Savings Account option. Once selected, the Wallet app will walk you through the sign-up process.

It'll ask you to enter your Social Security number and other information as well as agree to the terms and conditions. Once that's done, just hit submit and your application will go to Goldman Sachs for final approval. The whole sign-up process should only take a few minutes to complete.

Once the account's set up, all Daily Cash received from that point on will be automatically deposited into your new savings account and start earning interest. Though you can change the destination for your Daily Cash at any time.

You should also see a new Savings Account interface within the Apple Card section of the Wallet app. Tap on this to track your balance, add money to your account from a linked bank account or Apple Cash balance, or withdraw funds.